The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

NEW YORK, United States — How granular do you really have to get?

When it comes to communicating the origin of a diamond to consumers, very, according to Tiffany chief executive Alessandro Bogliolo.

In early January 2019, the American jeweller announced that it would begin sharing the region of origin of its diamonds that measure .18 carats or larger. (Each have been individually registered with a unique serial number, etched onto the stone with such a fine laser that is invisible to the naked eye.) By 2020, consumers will not only be made privy to every diamond’s starting place, but also where it went from there, with Tiffany planning to track the journey from the country where it was mined to the workshop where it was cut and polished, all the way to the shop floor.

Tiffany is doing all of this knowing that the customer isn’t directly asking for it. “Interestingly enough, people do not ask a very basic question: ‘Where was this diamond mined?’” Bogliolo told BoF in a recent interview, noting that the concern around so-called “blood diamonds” — which raised ethical questions about the diamond trade by putting a focus on stones mined in war zones and sold to finance conflict — has dissipated since the Kimberley Process Certification Scheme was put in place in 2003.

ADVERTISEMENT

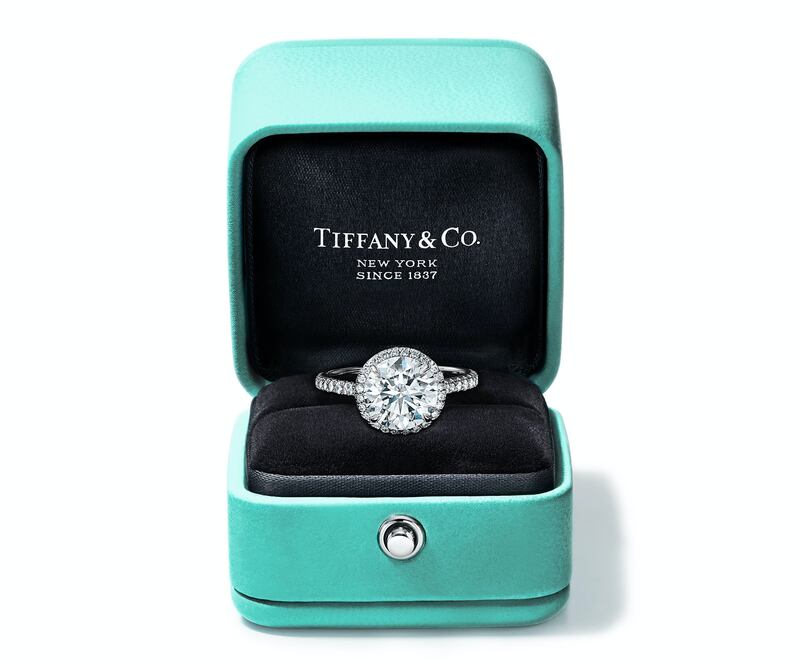

Tiffany diamond ring, labelled by origin | Source: Courtesy

In the 15-plus years since the establishment of the agreement, which aims to prevent conflict diamonds from entering the market, consumers have gained confidence in the sourcing process. However, over the years, some international advocacy groups have left the agreement, calling for more stringent regulations. And while consumers might not be as concerned as they once were about blood diamonds — there is very little non-bias data available either way — they are certainly more concerned about the social and environmental impact of their purchases. (For instance, Gen Z consumers are willing to spend 10-15 percent more on what they deem “sustainably produced” clothing, according to a 2017 study from market research firm NPD.)

Bogliolo, who joined Tiffany in October 2017, is betting that employing generosity marketing, or the act of giving the consumer more than they expect in order to create goodwill and loyalty, will pay off. "It's the role of market leaders to elevate the standards and to make people aware of what are the best practices," he said.

Whether or not his hypothesis nets out remains to be seen. During the 2018 holiday season, Tiffany fell short of market expectations, reporting flat sales in November and December blamed by a slowdown in tourism and softening local demand in the US and Europe. Sales in China, however increased by double digits, and the company reported "solid" growth in Japan and online.

Tiffany, and the fine jewellery industry at large, is facing a whole slew of roadblocks linked to changing consumer tastes (i.e. the casualisation of apparel) and cultural mores. People are marrying later, and sometimes not all, especially in the Americas, which remains Tiffany's largest market. While global sales of diamonds grew 2 percent in 2017, according to a report by Bain, that growth came from China. In China, both self-purchasing and occasion purchasing is on the rise.

People do not ask a very basic question: 'Where was this diamond mined?

Man-made diamonds have added another layer of complexity, although the synthetic version’s ability to woo the consumers in the same way is not yet proven and it’s unclear whether it will be able to filch significant market share away from mined diamonds. The effect of manmade diamonds on natural diamond demand by 2030 will be limited, according to Bain. "Given the pace of declining production costs and wholesale and retail prices, we expect lab-grown stones to become accessible to a wider consumer audience, potentially increasing demand for diamonds in general," the report read.

Instead, the right marketing will the be the key to Tiffany's success, said Paul Zimnisky, an independent diamond industry analyst. "While all those trends are playing out, the industry can shift consumer preferences toward diamonds if they effectively market," he said, noting that the residual effects of diamond miner DeBeers' long-running "A Diamond Is Forever" campaign, which it stopped promoting in the mid-2000s, have dried out. "Diamond demand is still growing, but longer-term success is going to depend on that one thing. It’s almost underplayed how significant and how important marketing is right now."

Tiffany, like many of its competitors, must balance its reputation as a traditionalist with the needs and demands of the next generation, its biggest opportunity for growth. Last year, BoF sat down with Bogliolo to discuss what it means for the company.

ADVERTISEMENT

BoF: How is Tiffany making itself relevant to Gen Z and millennials?

Alessandro Bogliolo: The way we look at it, Tiffany is actually splitting generations into baby boomers, Gen X, Y and Z. And these different generations … they have quite substantial differences and interest in the media they use, the kind of conversations they want to engage with and certain things that they are more interested in. Then, all this gets more complicated because there is also borrowing, an influence of one generation on the previous one.

A Generation Z [interest] is sustainability. The way we try to work in Tiffany is try to speak the language using media and launching initiatives and topics (personalisation, etc.) that are relevant to the different segments.

BoF: Do you think that baby boomers can relate to brand ambassadors like Elle Fanning, or are you doing different sorts of marketing initiatives to relate to different customer segments?

AB: We have done a lot of work to understand the DNA of the brand. Let me give you one example: Tiffany is not about being ostentatious, it’s about being tasteful. Spending a lot or little doesn’t matter, it can be a $20-million diamond but it would be mounted, set, advertised and communicated in a tasteful way. This is one of the facets of DNA of the brand and we have to be extremely strict on this and cannot compromise. But when it comes to the expressions of [that brand DNA], you have to be the opposite; you have to be extremely open minded.

Tasteful in the 1960s was the Givenchy black dress, tasteful today can be [Fanning’s] hoodie — but a hoodie in Tiffany blue. It’s an evolution, but it’s not disturbing the [older generation] customers and their image of the brand. You have to continue generating assets and ideas. The challenge is to keep on changing while not changing your brand DNA, especially a luxury brand. Your basics, your pillars must be clearly defined and whatever you do that is modern and different must be an expression of these unchangeable principles.

Diamond Source Initiative placard in store | Source: Courtesy

BoF: How is this strategy reflected in product?

ADVERTISEMENT

AB: We were introducing newness at a normal rate in the past, but we had become a bit conservative. The consumers were not noticing that there were new products. This limited us. It was a mistake to be over-cautious or conservative. Now, we have more distinctive designs. Distinctive doesn’t mean you need to be totally disruptive. For some brands it is to be totally disruptive, but Tiffany is not about disruption. That doesn’t mean that it has to be conservative, either.

BoF: How long do you give a collection before it becomes permanent or is rotated out or discontinued?

AB: The jewellery business model is totally different from fashion. A fashion designer entirely re-does the assortment and that’s it. At Tiffany, we keep our best-sellers, one of which dates back 130 years ago. Now, you need a certain percentage — typically between 10 and 15 percent — of newness. It is a trial-and-error kind of thing. When you launch new collections, sometimes you have immediate success ... but it may not be long-lasting. Then sometimes, it takes even one or two years, and then it becomes a huge success. Sometimes, a few SKUs of one collection are a success and the rest is not very successful. I have to say that, in jewellery, this process is much easier, because every collection is not make-or-break for the business.

BoF: What are your plans for the flagship store on Fifth Avenue in New York City?

AB: The last renovation of the flagship was in early 2000, so, after 18-20 years it is due for renovation. Since 1940, ,there have been several renovations but they have all been redecorations because the space and location has stayed exactly the same. So, the big thing now is that we are going repurpose the space — instead of using roughly one-third of the space for customers, we are going to use the entire space. That doesn't mean you will have a 10-floor store, but we will increase the retail space and the one of the areas will be devoted to VIPs, still being client-facing but towards select clientele. There will be another area for hospitality, such as big groups. This is a huge change because it means that for the first time since the 1940s we will change the way customers use that space.

BoF: Looking towards 2019, can you give us your projections about how diamond and metal trade flow may affect what you do and how you are preparing for that?

AB: There is a lot of discussion of course about tariffs. It’s something we are looking at very closely but I’m not overly worried about it. Even if there were an increase of tariffs — of course it is not something I wish — it is still something financial and therefore somehow, you can solve it.

There is no reason for being as opaque as the industry still is.

The big things will be exchange rates, but again I think the crucial thing is being global. Chinese consumers are so important now for every brand, you must be equipped on a global level. They are travelling less to the US and more to Asia, South East Asia and Japan. You must have a global presence.

The other thing is also to have a solid balance sheet. At the end of the day, it’s the best insurance that you can have against any kind of change. Then what I think is really important is to be flexible. I don’t know what is going to happen seven months from now. What I know is that we have to be very vigilant and reactive. Look at the cost of raw materials — if we look at gold, platinum, silver, it has been very stable in the last few years. The important thing is to monitor all these factors and being nimble and flexible.

BoF: Many brands are now developing digital profiles of their customers. Are customers comfortable giving away information?

AB: There are very different habits geographically. In Asia absolutely, in the West it depends on a lot. Younger generations tend to be much more open, because they are less naïve. They don’t mind giving information, they don’t mind cookies. Also, they are smarter in recognising what a brand can do with their information. The older generation are less aware of this, so they tend to be more conservative, they say no. There is still a doubt in the back of their mind. But the younger generation, they look at it in a different way: cookies enable a faster experience, and they can always block them.

BoF: As you said earlier, sustainability is a big topic of conversation for the next generation. Where do you see Tiffany going in this space?

AB: I think there are two different topics: first is corporate social responsibility and this is general to all kinds of companies. The second is sustainability, especially traceability, and that is more specific to the jewellery world. For the first one, we have chosen a strategy to focus in certain areas: conservation and the environment. So, we have initiatives and a foundation that funds projects not-for-profit. Then, we have initiatives that are client-facing where, for example, Save the Wild Elephants collection is resonating very well with customers. With that project, 100 percent of the profits from that collection go to NGOs working in Africa to protect the wilderness, and we have donated $3 million so far from the sale of these products.

Tiffany & Co blue box | Source: Courtesy

On the other hand is sustainability and traceability, because it’s true that jewellery, gemstones and metals are less transparent than fashion. In fashion, anything you buy has a tag, which might not say all the information, but it says something. When buying jewellery, the industry has been traditionally very opaque.

But Tiffany has, for almost 20 years, been a front-runner in traceability. We embarked on a vertical integration of cutting and polishing stones in order to know the origin of our stones, but we are an exception amongst all global luxury jewellers. I think that decision was in the right direction, as it puts Tiffany in a better position than other players. But I think there is still a lot to do and the entire industry has to go in that direction. There is no reason for being as opaque as the industry still is. It is better now than it was 20 years ago, but the level is still not very high. Tiffany is the highest level, and we should be more vocal about this.

BoF: Does the casualisation of culture mean the end of diamonds?

AB: No, this is a positive trend. It’s a huge benefit, especially for a jeweller like Tiffany. The fact that you don’t have to go to a function dressed up, formal, to wear jewellery, is the best news we could have, together with a growing [global] middle class. These are the two big drivers of growth.

Related Articles:

[ Tiffany's Holiday Sales Fall as Chinese Tourists Spend Less Opens in new window ]

[ Tiffany CEO: ‘Love Is Still a Hot Business’ Opens in new window ]

[ How De Beers Learned to Love Lab-Grown DiamondsOpens in new window ]

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.