The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

BREGANZE, Italy — Italian jeansmaker Diesel has a plan for battling Covid-19 that goes beyond social distancing guidelines and plastic barriers in front of cash registers. Last week it announced a denim fabric treatment, developed in partnership with Swedish technology firm Polygiene, that it says "physically halts 99 percent of any viral activity" within two hours of exposure to viruses, including Covid-19. Jeans featuring the technology are set to be available to purchase in the spring of next year.

As stunty as it may sound, Diesel is betting perks like virus-fighting jeans will separate it from its peers in a wide and competitive denim market as it seeks to reclaim the success of its late-1990s, early-2000s heyday, when Founder Renzo Rosso built it into a global powerhouse brand through irreverent marketing and carefully controlled denim production and innovation.

Diesel’s kicked off the rise of “designer denim” in the first decade of the century, when brands specialising in jeans priced over $200 grew in popularity as denim transitioned from a purely casual uniform to a viable alternative to formalwear and office attire. Diesel drew lines of customers for its limited edition “dirty jeans” wash treatment, a low-rise worn-in pair modelled in a campaign by Daisy Lowe.

Source: Courtesy

ADVERTISEMENT

But designer denim became a commodity almost as quickly as it became a category. Now that every direct-to-consumer brand and independent designer label offers a denim range — and leggings and sweatpants have supplanted jeans as the everyday uniform for many people — Diesel is hoping to remind consumers why it was coveted in the first place.

Diesel has been in a turnaround phase for the better part of a decade, during which Rosso stepped back to focus on his portfolio of brands under the OTB Group, including Maison Margiela and Marni, before rejoining the day-to-day operations in 2017. Diesel returned to top line growth in 2019, generating €900 million ($1 billion at current exchange) in revenue, but still down from its 2016 performance, when revenue was €960 million but the company operated at a loss.

Since Artistic Director Nicola Formichetti left in 2017 after five years at the brand, Diesel has released a string of collaborations with different designers, including Hood By Air's Shayne Oliver and A-Cold-Wall's Samuel Ross. The leadership has been in flux, too. The brand has hired two chief executives since 2017, the most recent of who arrived right at the start of the pandemic in Italy: former Balmain CEO Massimo Piombini, in his first position outside of luxury.

Piombini, who has held senior roles at Valentino, Bulgari and Gucci before Balmain, told BoF that he decided to join Diesel because it was one the first global brands that made an impression on him as a young man in Italy, and he feels it has the history and narrative needed to draw in today's customers.

“We should be the frontrunner of the new denim movement,” Piombini said. His plan involves breaking down department barriers within the organisation’s workforce to operate more effectively as a global company. But the brand will still develop localised approaches for a selection of about 10 key cities around the world.

We should be the frontrunner of the new denim movement.

Piombini wants to narrow the company’s focus onto fewer but more impactful denim styles, reduce its physical footprint of stores and invest in sustainability initiatives. The ultimate goal is to position Diesel as a fashion-driven “alternative to luxury,” offering a fashion-forward product at a higher quality and slightly higher price point, up two to three “notches,” he said.

Piombini and Diesel have a lot of challenges ahead in reclaiming its space in the trend-driven and emotional denim market. In 2019, $21.1 billion premium jeans global market grew 2.6 percent, and it is projected to contract by 18.5 percent in 2020, according to Euromonitor.

In many ways, the idea of being a “denim brand” is obsolete, putting Diesel in competition with the rest of the market between fast, mass-market fashion and luxury. It has long been squeezed by its competitors on both ends of the spectrum.

ADVERTISEMENT

“[Diesel] fell victim to that shift in jeans from being formalwear and being dressed up to being something that competes with leggings and athleisure,” said brand specialist Ana Andjelic.

Diesel’s competition today includes many more brands than the handful of denim leaders it battled against in its heyday. Niche brands from Ganni to Eckhaus Latta offer their takes on the category to their devoted customer bases. And global luxury brands have tapped the streetwear trend with more accessibly priced products, which often includes denim.

Now, “everyone has a denim brand,” said Andjelic, explaining that the new model is focused on storytelling over a cut or style, citing New York independent label Khaite’s popular offering of jeans. “Denim underpins brands, it expresses the brand values,” she said.

Diesel has always had a big story to tell, led by Rosso and his passion for denim and love of bold, tongue-in-cheek advertisements, perhaps best exemplified by the “Be Stupid” campaign of 2010.

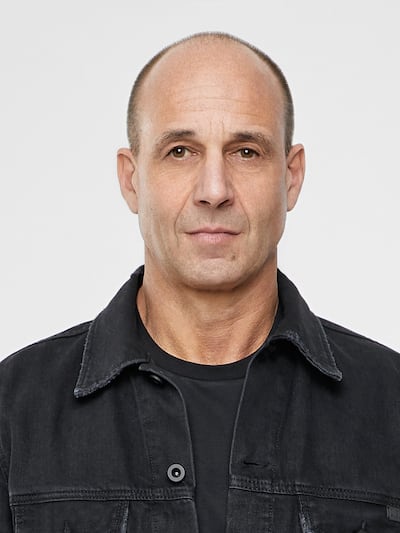

Diesel CEO Massimo Piombini | Source: Courtesy

But as clothing trends and marketing strategies evolved over the last decade, Diesel continued to “coast on a very strong brand equity,” said Andjelic. It missed out on the streetwear movement of the 2010s and the logomania that thrived along with it.

“If there were a brand that has the legitimacy to be the front runner of the streetwear brands, it was Diesel,” said Piombini. “And Diesel, in that period, lost it.”

Levi’s, which weathered its own difficult turnaround to reclaim its prior success, battled the rise of athleisure by focusing on the women’s market and key silhouettes like the 501s and 505s, effectively tapping into the return of 1990s styles. But Diesel has no equivalent signature styles to point to, though it has plenty in its archives, including the Saddle style and an angled pocket label. Its storytelling also didn’t evolve. “Those clothes may fit well, they may be great quality, but they are not relevant,” said Andjelic. These barriers will make moving upmarket even harder.

ADVERTISEMENT

Over the last decade, the brand's message became crowded by sub-lines and collaborations."It is difficult to keep a strong and relevant brand image for the consumer when you extend your offering," said Mario Ortelli, managing partner of Ortelli & Co. "Competitors do not lie waiting."

The brand has the added challenge of widespread distribution with an equally wide range of customer responses. While the US business struggled over the last decade, culminating in a Chapter 11 reorganisation bankruptcy filing in 2019, Diesel found continued success in denim-obsessed Japan, which represented 25 percent of its business as of 2017.

The coronavirus throws further complications into Diesel’s attempts to reposition itself, not only because the global fashion industry is expected to contract as much as 30 percent this year, according to McKinsey but also because consumers stuck at home won't find a compelling appeal in stiff jeans.

And for a denim brand like Diesel to succeed, it can’t reflect anxiety, said Ron Herman, the California-based retailer. He met Rosso in the early 1980s and was one of the first people to bring his jeans to the US. “His company has fun — they inspire and they attract people who want to be inspired,” said Herman. “There is a tremendous risk of losing a sense of lightness and a desire to have fun … The denim industry always reflected that it was rebellious. It reflects a certain rebellion against a suit and tie, the establishment.”

The bigger the brand, the more difficult it is to reposition it.

Ortelli said Piombini’s luxury experience will help execute a turnaround that has been a long time coming and is far from an easy task. “The bigger the brand, the more difficult it is to reposition it,” he said.

Piombini sees the same similarities between his past and current employment, particularly when it comes to navigating the relationship with Diesel’s prominent founder.

“I went from a completely managerial approach to a very family approach,” the executive said, adding that Rosso is giving him the space to work, but he values his living embodiment of the brand’s point-of-view.

“You have 43 years of DNA of the company next to you,” Piombini said. “Sometimes I have to manage some, you know, craziness. But, again, it's part of the character and it's also this craziness [that] sometimes directs you in the right direction — sometimes not, and you have to manage that. Every time you work with a founder of a company... it’s always like that.”

Piombini is finally back in the physical office in Breganze, getting to know the Diesel team in person after starting his role just before lockdowns. One of his first priorities has been a research project internally called Sunshine, to evaluate what consumers want today and how to speak to them. The findings point to underscoring Diesel’s authority in the category.

“Because, one, we have the know-how, two, we have the legitimacy, three, we have the heritage and four, we have the size,” said Piombini. “Diesel is a big company. Before Covid, it was almost a billion-dollar company, and there are not so many billion-dollar companies in the denim industry … We have the capability to become the cool and trendy player in the industry, but we have to do things in the right way.”

He described the turnaround as tackling not a product or communication problem, but a cultural one. “If you take a job at Diesel… denim should be part of your blood and you should understand that you ended up at a company that invented a certain type of denim,” he said. “All these things, today, are not happening.”

Denim will take on more prominence in the brand moving forward, from the way it is presented in stores to the product offering, in response to a greater emphasis on its other apparel categories over the last decade. Campaigns in the mid-2010s did not always feature jeans.

Ortelli said a strong strategy is to “refocus on the core” of the business and, when that is clearly defined again, “accelerate on a growth path.”

Piombini wants to edit down to about five to eight core silhouettes for men’s and women’s wear, supplemented by one or two additional evergreen styles per season that are only available for a limited time. “I think we should have our silhouettes, our own fits that should be the key pillars of the denim business.” He also plans to develop a new sneakers category for the brand. These changes will begin to be visible to customers by the end of 2021.

I think we should have our silhouettes, our own fits that should be the key pillars of the denim business.

Piombini also plans to trim down, renovate and relocate Diesel’s 450 store network. “I think we should easily do 50 percent more of the business with half of the stores,” he said, adding that he also wants to increase Diesel’s control over international territories owned by third parties through joint ventures or franchises to facilitate global strategy. He said the brand will develop localised strategies for about eight to 10 cities, including the major shopping capitals as well as cultural hotspots like Tel Aviv, Bogota and Berlin.

From a marketing perspective, Piombini plans to make sustainability a key message, connecting it to Diesel’s history of inclusivity and authenticity, words he said Rosso was using years before they became the go-to jargon. “The company and the brand is investing a lot of money in the sustainability area, not just in what you see in the front end… but also re-discussing all the supply chain,” he said. Diesel also plans to release one or two collections each year of “upcycled” products.

Positioning itself as a sustainable brand could be a smart opportunity for Diesel, but will require more effort than its peers who have already been beating that marketing message for years in order to stand out from the pack.

“They will need to work very hard to instil eco-credentials,” said Andjelic. “There is a big opportunity for them… If they really put effort in, they can come back through that angle.”

Piombini’s strategy is also meant to lay the foundation for the appointment of a creative director in the future, a conversation that he said started as soon as he joined Diesel. “One, because of my background, and two because this was a question mark for the management for many, many years,” he said. (The last creative director, Formichetti, exited Diesel three years ago.)

But Piombini says the brand isn’t ready yet. In the meantime, he plans to limit Diesel’s third-party collaborations to about three maximum per year, and extend them into multi-season relationships. “This should be a preparatory venue for a new creative director in a couple of years… when we will be ready to have the face of the brand that it is not just Mr. Rosso.”

Editor's Note: This article was updated on 21 July 2020. A previous version of this article said Renzo Rosso returned to Diesel as chief executive in 2017. While he became more involved in the brand at the point, he did not hold the title of CEO.

Related Articles:

[ Inside Diesel’s ‘Reboot’Opens in new window ]

The British musician will collaborate with the Swiss brand on a collection of training apparel, and will serve as the face of their first collection to be released in August.

Designer brands including Gucci and Anya Hindmarch have been left millions of pounds out of pocket and some customers will not get refunds after the online fashion site collapsed owing more than £210m last month.

Antitrust enforcers said Tapestry’s acquisition of Capri would raise prices on handbags and accessories in the affordable luxury sector, harming consumers.

As a push to maximise sales of its popular Samba model starts to weigh on its desirability, the German sportswear giant is betting on other retro sneaker styles to tap surging demand for the 1980s ‘Terrace’ look. But fashion cycles come and go, cautions Andrea Felsted.