The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

NEW YORK, United States — Louis Shapero was a casual user of the resale platform Depop before the pandemic. But with retail shut down across Europe and North America, his once-sleepy online storefront is suddenly buzzing.

The 22-year-old British university student says he’s handled dozens of sales for Stone Island sweatshirts, Van X Supreme sneakers and other streetwear items in the last three weeks, more than he logged in the previous six months. He’s doing some shopping as well on the platform, which targets Gen Z with its Instagram-like feed of used clothes and accessories.

Shapero isn’t the only Depop seller who’s red hot right now. The platform says US sales are up 150 percent from the same time last year in mid-April, and have doubled in the UK. At Poshmark, a rival resale site where sellers tend to list low-price fashion from brands like Anthropologie and Kate Spade, the third week of April was the company’s best ever in terms of sales.

Resale sites are coming out big winners as the pandemic plunges the economy into a deep recession. They will have their pick of inventory, as brands look to shift clothes that went unsold during lockdowns. Soaring unemployment is good for the secondhand market too: analysts predict the newly jobless will turn to sites like Thredup and Rebag to clean out their closets for extra cash. And consumers, stuck at home and worried about their finances, may have stopped buying new clothes, but they're still hunting for bargains online.

ADVERTISEMENT

“We aren’t going out drinking or clubbing but still have leisure time,” said Shapero. “People are now just spending money on clothes instead of going out.”

People are now just spending money on clothes instead of going out.

Shoppers aren’t quite as eager to splurge on used luxury goods, even at a discount. The RealReal, which sells $700 Louis Vuitton bags and $350 Prada pumps, saw sales plunge 40 percent the week of April 8, according to data compiled by Earnest Research, which monitors consumer spending habits. The company’s stock is down 22 percent since late February.

Some expect secondhand luxury to take off as well, particularly if a deep recession forces even wealthy consumers to watch their spending. Vestiaire Collective, a luxury reseller with a mostly European clientele, saw sales jump 20 percent in late April, and Rebag sold more handbags in late April than it did over Black Friday. At StockX, which sells sneakers that can cost thousands of dollars, sales were up 75 percent the week of April 15 compared with last year, according to Earnest, though the average price of sneakers sold decreased.

“[Resale sites] are better off than retail, and they are way better off than department stores,” said Sonia Lapinsky, a managing director in AlixPartners’ retail practice. “This crisis will completely change shopping behaviours, and when every dollar counts, resale will be far more attractive.”

New Opportunities

Before the pandemic hit, the resale market was on track to double from $24 billion in 2019 to $51 billion by 2024, according to a report from Thredup and GlobalData, a retail analytics firm.

This growth may very well accelerate. The 2008 financial crisis paved the way for “flash sale” sites like Gilt and Rue La La, where the pairing of discounts and a ticking clock proved irresistible to shoppers. Resale sites, with their ever-changing assortment, offer that same combination, said Chris Ventry, vice president of business solutions firm SSA & Company and a former Gilt Groupe executive.

Resale sites also add a feeling of community to the equation. Platforms like Poshmark and Depop allow buyers and sellers to comment on each other's listings and send direct messages (though Depop has also struggled with predatory messaging aimed at younger users). Fans have created Facebook groups to talk about their secondhand finds, while sneaker resale drama fills forums on Reddit.

ADVERTISEMENT

This crisis will completely change shopping behaviors, and when every dollar counts, resale will be far more attractive.

“These shopping platforms are social networks,” said Andrea Szasz, principal at global consulting firm Kearney. “Flash sale sites hooked consumers with scarcity and newness, but the needs of consumers today is that sense of community in the digital world.”

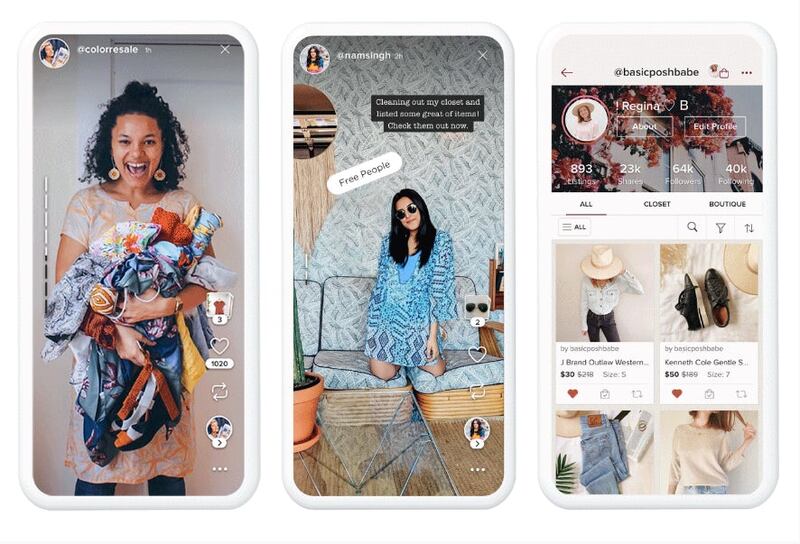

On April 29, Poshmark added a short video feature similar to Instagram Stories. The platform moved up the launch from later this year in response to the platform’s surging activity.

Poshmark's new feature, Stories. | Photo: Courtesy

In the luxury market, a recession could steer fashion back toward a more muted aesthetic, analysts say. Shoppers could end up selling the ostentatious and logo-heavy items they purchased in better times.

Sasha Skoda, head of women's merchandising at The RealReal said searches for classic jewellery, such as Cartier earrings and gold necklaces, are up 40 percent and 72 percent, respectively, over the last month, as “people gravitate toward classic investment pieces.”

Sales for investment watches like the Patek Philippe Nautilus and Rolex Daytona are up on the watch resale site Chrono24, said chief executive Tim Stracke.

Resale and the Excess Inventory Problem

Many brands offload their inventory to resale sites, whether it's luxury labels at The RealReal or Adidas dropping product on StockX. Gap, Abercrombie & Fitch, Madewell and J.C. Penney have partnered with Thredup too. Still, they often see resale as competing with new clothing in their own stores.

ADVERTISEMENT

That attitude seems to be shifting out of necessity, with entire spring collections gathering dust in warehouses and stores. Poshmark’s Chandra said his company is in discussions with large brands about creating wholesale lines that would be sold by professional Poshmark sellers.

Depop Chief Operating Officer Dominic Rose said Depop is building a wholesale platform for brands to sell on the site too. Come mid-May, brands can start selling directly to Depop sellers.

New Challenges

As masks and social distancing become ingrained habits, consumers might become warier of allowing used clothing to be shipped to their homes.

“As the crisis goes on, concerns will be about what people touched, and this could create social resistance towards used products,” said Szasz.

Depop sales are up during Covid-19. | Source: Courtesy

Peer-to-peer platforms like Poshmark have a dedicated landing page that addresses sanitary concerns during the coronavirus pandemic, pointing them to the Centers for Disease Control and Prevention’s guidance, which says it's safe to receive packages.

Consignment sites, which store and ship sellers’ items, can sanitise products directly, a potential selling point to customers. But they risk having to shut down warehouses if workers are exposed to the coronavirus. The RealReal had to close storefronts where sellers could have items appraised in person, and cited “limited warehouse operations” as a problem in the first quarter. Thredup is about a month behind in processing inventory due to low staffing at its warehouses, said chief executive James Reinhart.

Both consignment and peer-to-peer sites also need reliable shipping methods, which have become harder to secure with hundreds of millions of people shopping more online while under lockdown.

“This specific health crisis has brought vulnerabilities in the system,” said Poshmark’s Chandra. “We’re keeping an eye on logistics.”

Some resale start-ups operate at a loss, and could struggle to take advantage of the flood of merchandise hitting the market. Warehouses and appraisers are expensive, and margins on used goods are thin. StockX laid off over 100 employees earlier in April and is shifting “from a growth-focused mentality to one rooted in operational efficiency.”

“Many don’t have the working capital to make that kind of product acquisition,” Ventry said.

Resale sites also aren't the only ones offering deep discounts. Fashion brands and retailers are increasingly resorting to sales, and the deals will only get better if the economy worsens further. More brands are launching resale on their own, including Patagonia, Eileen Fisher and Nordstrom.

“The competitive advantage resale has will be less when we come out of this,” Ventry said. “If everything is on sale, customers will surely go to retail first.”

The Future of Fashion Resale Report — BoF Insights

BoF’s definitive guide to fashion resale, covering the evolution of the market, its growth and upside, consumer behaviours and recommendations for crafting a data-driven resale strategy. To explore the full report click here.

The Future of Fashion Resale is the first in-depth analysis to be published by the BoF Insights Lab, a new data and analysis unit at The Business of Fashion providing business leaders with proprietary and data-driven research to navigate the fast-changing global fashion industry.

Editor's note: This article was revised on 30 April, 2020 to reflect that searches for Cartier earrings and gold necklaces are up on The RealReal, not sales.

We’re tracking the latest on the coronavirus outbreak and its impact on the global fashion business. Visit our live blog for everything you need to know.

Related Articles:

[ Rental and Resale Were Supposed to Be the Future. Could Coronavirus Change That?Opens in new window ]

[ As a Global Recession Looms, Quiet Luxury ReturnsOpens in new window ]

[ Peer-to-Peer Rental Start-Ups Take on Rent the RunwayOpens in new window ]

The company, under siege from Arkhouse Management Co. and Brigade Capital Management, doesn’t need the activists when it can be its own, writes Andrea Felsted.

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.