The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

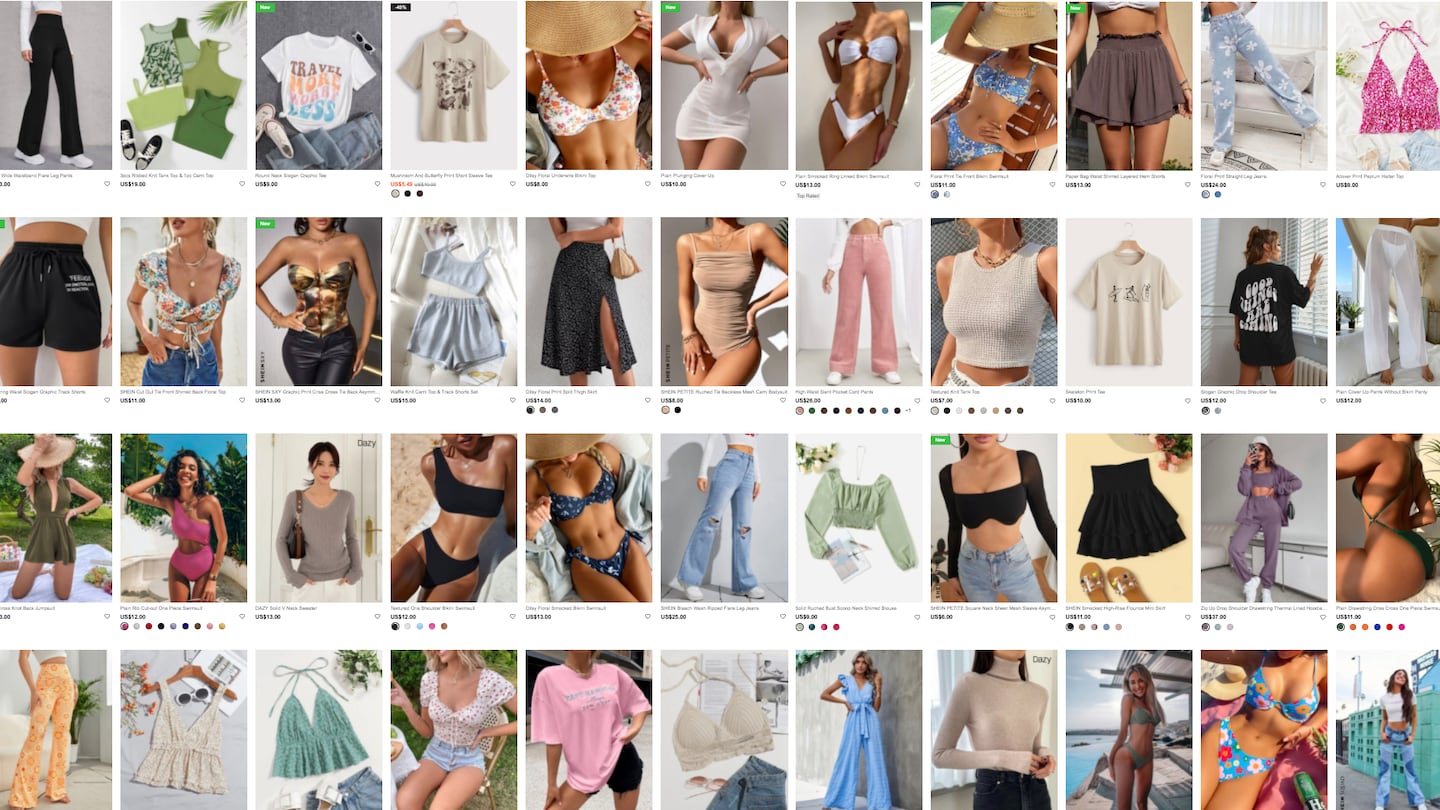

Shein’s rapid rise from anonymous fast fashion brand to the world’s biggest digital fashion retailer caught the industry by surprise. Now, in court, on Instagram or at the mall, the rest of the industry is fighting back.

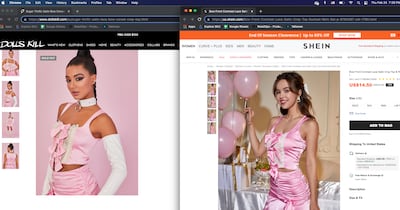

Dolls Kill, an internet retailer known for its niche, music-festival-ready style, last week became the latest brand to sue Shein for copyright infringement, alleging the Chinese company duplicated dozens of its products, down to how the models were styled in promotional photos. The seller of pleated mini dresses and mesh shirts joins Dr Martens owner Airwave International, Ralph Lauren and others in mounting legal challenges; since 2019, Shein parent Zoetop Business Co. has been the target of at least 25 lawsuits in US federal court.

“Shein respects the intellectual property rights of others,” a Shein spokesperson said in an email statement. “When legitimate complaints are raised by valid IP rights holders, Shein promptly takes action to address the situation.”

But the Shein threat goes beyond copycat clothes, said Dolls Kill chief executive Bobby Farahi. The industry hasn’t come up with an answer to the upstart’s ability to replicate trends at uncanny speed and jaw-dropping low prices. Shein’s revenue surpassed $10 billion in 2020 according to market estimates, and it ranks 12th among US apparel retailers by sales — in 2019, its rank was 47th, Euromonitor data shows. Shein now outperforms both H&M and Zara in US market share.

ADVERTISEMENT

“They’re taking market share away from everybody, from independent designers to the Walmarts and Targets of the world,” Farahi said.

Retailers that try to compete with Shein on price and speed face steep odds. Brands like Abercrombie & Fitch and Gap in the US and Next in the UK tried this, mostly unsuccessfully, when Zara and H&M were their biggest threat; now the fast fashion former disruptors find themselves on the defensive as well. Shein has additional advantages its predecessors didn’t, including a tariff loophole that allows it to avoid US import duties its competitors must pay, which some experts say is key to the company’s low prices.

From independent designers to global brands with billions of dollars in sales, companies that have successfully fended off Shein focus their efforts on their rival’s weaknesses: curation, customer service and quality.

“Anyone following the exact same recipe as Shein will likely come in second or third,” said Allen Adamson, co-founder of Metaforce, a marketing consulting firm. “But by investing in brand building, you’re not attacking them in strength, you’re attacking in areas that they’re not focused on.”

Point of View

A unique aesthetic and recognisable assortment is the best defence against Shein, said Ana Andjelic, a brand consultant and former chief brand officer of Banana Republic.

She said luxury brands like Chanel that have brand codes going back decades, or Rick Owens with his distinct aesthetic, are relatively Shein-proof. So are small labels like Telfar that have their own point of view and a community focus. Everyone else is vulnerable, particularly mall retailers that aim for middle-of-the-road tastes, she said.

“You’re either a trendsetter or you’re a fast follower,” Andjelic said. “If you’re neither, there’s no room for you.”

ADVERTISEMENT

This isn’t lost on mainstream brands. Gap’s collaboration with Kanye West, for instance, is an effort in cultivating cultural cachet, said Rick Evans, strategy director at branding firm R/GA. Shein might appropriate the designs, but they won’t have Yeezy’s or Balenciaga’s stamp of approval.

You’re either a trendsetter or you’re a fast follower.

The trick is to sustain the flow of coveted products drop after drop so it’s not a one-and-done publicity stunt that doesn’t end up generating meaningful sales or acquiring new customers.

“When you think about that cultural cachet, that’s going to get the headline, but could it get customers to stick around?” he said.

Fast fashion brands are adopting a similar approach. In the past five years, Zara has invested heavily in its own creative vision instead of merely chasing runway trends, working with high fashion photographers like Steven Meisel and Willy Vanderperre on sleek new campaigns. Already, some fast fashion consumers see Zara as being more premium than Shein.

“Even if Zara’s clothes aren’t the highest quality fabric, the care that goes into the design and the production of their clothes just shows,” said Tamara Van Lesberghe, a 26-year-old film school student and bartender, and regular shopper of Shein, Asos and Missguided.

Dolls Kill, meanwhile, has been investing more in design, quality control and storytelling around its products too as Shein continues to rise, according to Farahi. Some of its new designs are harder to replicate, such as embroidered patterns, unique trims and embellishments.

Bailey Prado, the designer behind her namesake knitwear brand, said she found more than 40 of her crochet designs imitated on Shein last summer. While her sales were largely unaffected by the incident, the experience has led her to double down on her ethos of making nearly every product by hand, made-to-order, with prices tenfold that of Shein.

“I’ve built a pretty strong aesthetic so people know it’s my work,” Prado said. “[My customers] know that everything is handmade and I show the process of it.”

ADVERTISEMENT

Connecting With Customers

Van Lesberghe purchased dozens of pieces from Shein after seeing her friends wear the brand in the summer of 2020. Some items are fantastic, she said, like swimsuits, of which she owns 20 from Shein. Others not so much: denim and sweatshirts tend to be made of very thin material, she said.

Though inexpensive, the poor quality items became a problem for Van Lesberghe because of what she described as Shein’s finicky return policy. She said she wasn’t able to return some purchases because she had thrown away the plastic bags they arrived in.

Her frustration is an opportunity for Shein’s rivals. Brands can prioritise customer service, including quickly responding to customer inquiries via direct message or email.

“Customer service is not an area of strength for Shein,” said Neri Karra, a brand consultant and a professor of entrepreneurship strategy at Oxford University.

Brick-and-mortar retail can also boost customers’ emotional connection with a brand. (Shein has opened pop-up shops in San Diego and Chicago, among other cities, but has no permanent physical stores.)

Sandra Habib, strategy director at Siegel+Gale, a branding company, points to Nike’s running clubs as an example of how stores are used as sites of building a “tribe.”

Powers of a ‘Small’ Brand

Some small brands that find themselves copied by Shein realised that embracing their scrappiness can pay off.

Like Prado, Anna Butler found a similar version of her brand’s hero product, a ruched white button-down shirt, on Shein last year. But Butler, whose brand is called Run & Follow, said she understands her customer is entirely different from that of Shein — and that she’s not in competition with the fast fashion giant even if they offer some look-alike blouses.

“Shein is not an aspirational brand; we’re not even in the same market,” Butler said. “For brands like mine, we have to be confident in our values, and my consumers find value in the fact that our pieces are made in the US and all of our products are sourced with better fabrics.”

For both Bailey Prado and Run & Follow, an unexpected positive came out of Shein’s forgery: they generated buzz on social media after speaking out about the incident. Prado said after Diet Prada shared her experience with Shein, her Instagram follower count increased by at least 10,000.

“I do feel in a way Shein ripping us off … gave us authority to people who didn’t know us,” Butler said. “It’s validating, but angering, but also validating.”

One of many fast fashion players from China trying to use the Shein playbook to chip away at Boohoo and Fashion Nova is a new brand from e-commerce giant Alibaba.

The Chinese fast fashion giant just hired a head of sustainability, and is taking other steps to remove some of the mystery in how it operates. But some of the company’s critics say the fast fashion business model can’t be reformed.

The pandemic has radically shifted the retail landscape, creating new challenges for incumbents H&M Group and Zara-owner Inditex.

Cathaleen Chen is Retail Correspondent at The Business of Fashion. She is based in New York and drives BoF’s coverage of the retail and direct-to-consumer sectors.

The company has continued to struggle with growing “at scale” and issued a warning in February that revenue may not start increasing again until the fourth quarter.

The British musician will collaborate with the Swiss brand on a collection of training apparel, and will serve as the face of their first collection to be released in August.

Designer brands including Gucci and Anya Hindmarch have been left millions of pounds out of pocket and some customers will not get refunds after the online fashion site collapsed owing more than £210m last month.

Antitrust enforcers said Tapestry’s acquisition of Capri would raise prices on handbags and accessories in the affordable luxury sector, harming consumers.