The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Opens in new window

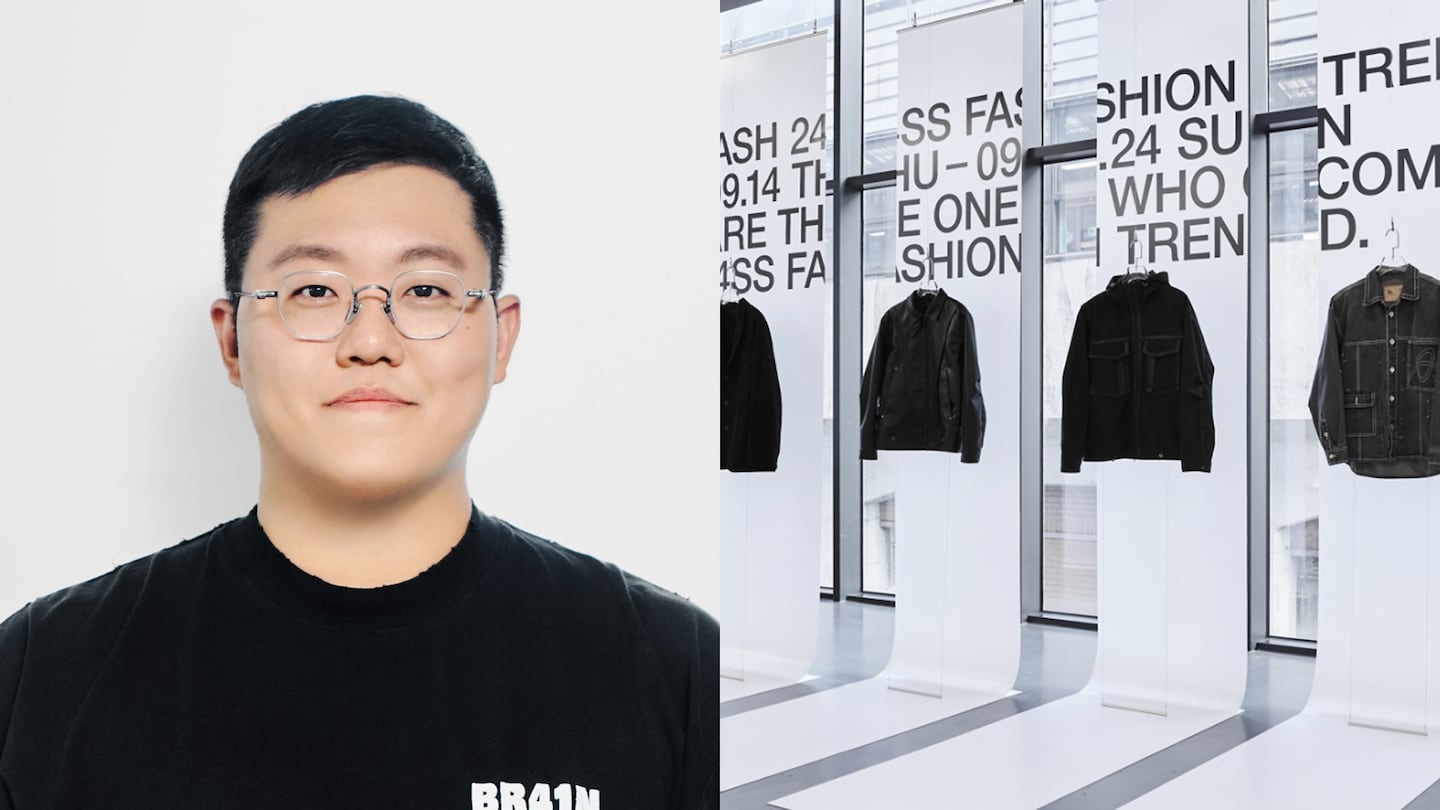

Opens in new windowHaving a global presence and recognition would have been hard to imagine only just a few years ago for Korea’s fashion industry, which is increasingly on global brands’ radars thanks in large part to fashion’s ability to benefit from the recent surge in popularity of K-films and series, according to Mun-il Han, who became CEO of the Seoul-based fashion marketplace in 2022 at the age of 33. “When I look back [in 2018 when I joined] fashion marketplace Musinsa, it usually was quite rare that a CEO or a top executive of a global brand would actually come to Seoul, and even if they did, they wouldn’t stay very long,” he recalled. “That has very much changed.”

But Musinsa wasn’t going to wait around for global recognition to make its own mark on Korea’s fashion industry. Starting out in e-commerce’s early days in 2001 as an online platform for sneaker-loving high school kids to share street fashion photos, Musinsa has grown into a fashion marketplace that it says comprises a community of 13 million, largely Gen-Z fans, with a 2023 funding round that reportedly valued the company at approximately $2.76 billion.

According to Han, Musinsa has taken a different approach than other fashion e-tailers by focusing on the sellers — that is, the 8,000 local and global brands selling their apparel and footwear on its Korean platform or via its app, including independent brands it helps fund and support by, for example, providing marketing and innovative initiatives to connect them directly with customers. One such initiative was its first-ever “Musinsa Season Preview” event, where customers could visit four offline venues in Seoul to share their thoughts alongside those of a panel of industry experts on the Spring/Summer 2024 collections from 30 local brands, which could then adjust pricing and inventory based on the feedback.

Beyond Korea, Musinsa is now present in 13 countries, selling around 800 Korean brands. Han said one of the markets where K-fashion is in increasing demand is Japan, where it set up a subsidiary in 2021 and has become the company’s largest global market.

ADVERTISEMENT

BoF: With bands like BTS, Blackpink and most recently New Jeans (the latter a Musinsa brand ambassador), K-pop’s star just seems to keep rising higher. Analysts at Bernstein recently said the K-pop industry could generate annual revenue of approximately $10 billion by 2030, or roughly double 2023′s level. How is K-fashion riding that wave?

Mun-il Han: I don’t think the global impact of K-pop is fully hitting home to us in Korea. It’s not just K-pop stars but also K-celebrities who are really gaining global exposure with the popularity of K-content or for movies and dramas. Especially fashion and luxury brands, they are leveraging K-pop stars and signing them on as their brand ambassadors. We can indirectly feel the extent to which these pop stars now have so much influence and power.

We’re still in the incipient stages, but I think when these artists or musicians share their daily lives on social media, that’s when fans really take interest. Then also when people watch K-content like movies and dramas and they see how Korean people or celebrities dress or what their lifestyle is like, people gradually start to become familiar with their lifestyle and their dress.

It’s a bit like what happened with hip-hop. People who were doing hip-hop in Korea wanted to emulate that way of life and consume the brands that were part of that. We feel that K-content is now at a similar juncture, where it’s being exported abroad. It’s taken a while for fashion to have a distinct connection with K-culture but it’s starting to happen. At Musinsa, we want to leverage that opportunity to really expand our global footprint, after having grown very rapidly by mainly focusing on the online fashion market in Korea.

BoF: Ever since Musinsa became a fully fledged fashion retail platform in the 2010s, fashion retail generally has been undergoing disruption and change. What has been Musinsa’s role in this? Does Musinsa consider itself one of the disruptors?

MH: We definitely see ourselves as a disruptor. Korea’s fashion market in the past was very much led by the department stores — you only had a handful of brands that were able to launch in department stores and that were recognised as bonified brands. Whereas with the emergence of a platform such as ours, we see many new brands emerging to create a fashion ecosystem.

Back in 2001, we started as an online community. It was a community where young people were able to freely exchange information and narratives about fashion and lifestyle that they were interested in. This was a very active community, a community where we were also able to introduce overseas street fashion brands that Koreans may not have been familiar with and introduce some local brands that were up and coming.

Right from the beginning, we had a very strong understanding of what young people wanted, what their needs were. At the same time, brands were looking for channels to sell their products and large companies also wanted to do business online but weren’t really aware of what young people like and need.

ADVERTISEMENT

BoF: In terms of that ecosystem, how does it enable Musinsa to differentiate itself in an increasingly crowded e-retailing market?

MH: If we look at this from a platform perspective, the China-based platforms are really doing well in terms of gamification. But in Korea, I don’t think we see any notable results with gamification. Rather than that, I think the biggest differentiator of our company compared to other e-commerce platforms is that we really zero in on managing the sellers.

Also, we focus more on what I would call the “essence” rather than things like gamification. What I mean by that is, people who are interested in fashion or lifestyle through our community are able to ask questions about fashion. They are able to get recommendations from other people within the community. We don’t think that algorithms alone provide the best recommendations, so we try to mix our curation with the data to come up with the best recommendation for our customers.

We’ve always had the philosophy that we focus on the seller. Because of the success of Amazon, most of the e-commerce players at that time were more focused on the buyer side. What we had in mind was something more like a content business, like Netflix and Spotify, while also focusing more on the needs of the seller, the fashion brands on our platform, the small independent brands who have a little bit more of a personality or individuality.

BoF: What does partnering with up-and-coming designers entail? Why do you want to work with these designers?

MH: The key for our business is to be able to secure good, talented new brands, and even enter agreements in which they sell with us exclusively. … We feel the right formula is to really study what their needs are as they are rising, support them to address those needs, and build a good relationship and thereby build a fashion ecosystem.

Just like Netflix invests in production companies, or like YouTube secures a lot of great creators on its platform by providing them with various tools, Musinsa partners with and invests in brands, that investment can provide everything from marketing content to interest-free loans to help fund their production plans or tools on our platform like how-to videos.

After a brand joins us, we’re able to see very quickly the type of reception it is getting, how much feedback there is [from customers on the platform], along with sales figures. So, we’re able to quickly identify if a brand is really growing or if there are any issues that need to be addressed. That’s not to say that we provide equal amounts of support to all our brands. We try to sow as many seeds as possible and then when we see there is explosive growth of a certain high-potential brand, we really try to support them so that we can grow together.

ADVERTISEMENT

BoF: In 2023, Musinsa secured $190 million of series C funding, led by investment company KKR. Given that you’ve long focused on 20-somethings in Korea, what are your plans for taking Musinsa’s ‘K-ecosystem’ to different demographics and other markets?

MH: First, we are broadening our customer base to include individuals in their late 20s and 30s, due to focus on offering an extended range such as high-end brands.

Offline and online are both important but basically 99.9 percent of our sales occur online, so we have to continue to motivate our consumers to come online to shop. But people do want to try on the clothes before they buy, and so that’s why we’re expanding our offline presence. We opened our offline flagship stores in Daegu and Seoul in late 2023. As for our private brand, Musinsa Standard, we have a store in Busan scheduled to open at the end of 2023.

Our global expansion strategy involves a gradual introduction of westernised global brands and will evolve with emerging brands too. It’s been about a year since we launched our app test cases to run alongside the platform [for non-Korean markets]. Currently it’s in phase one and we have about 800 Korean brands on that app. Phase two should happen around the end of [2024] when we believe we will be able to carry foreign brands too. These would be very westernised types of brands and that would help enhance the visibility of the Korean brands as well. Then in phase three we’re thinking it could be in Tokyo, Bangkok or Singapore or anywhere else, but to really grow the platform to incubate these other new brands.

This interview has been edited and condensed.

This article first appeared in The State of Fashion 2024, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company.

The eighth annual State of Fashion report by The Business of Fashion and McKinsey & Company reveals an industry navigating deep uncertainty. Download the full report to understand the 10 themes that will define the industry and the opportunities for growth in the year ahead.

Janet Kersnar is Executive Editor at The Business of Fashion. She is based in London and oversees long-form content, including Case Studies and Reports.

Designer brands including Gucci and Anya Hindmarch have been left millions of pounds out of pocket and some customers will not get refunds after the online fashion site collapsed owing more than £210m last month.

Antitrust enforcers said Tapestry’s acquisition of Capri would raise prices on handbags and accessories in the affordable luxury sector, harming consumers.

As a push to maximise sales of its popular Samba model starts to weigh on its desirability, the German sportswear giant is betting on other retro sneaker styles to tap surging demand for the 1980s ‘Terrace’ look. But fashion cycles come and go, cautions Andrea Felsted.

The rental platform saw its stock soar last week after predicting it would hit a key profitability metric this year. A new marketing push and more robust inventory are the key to unlocking elusive growth, CEO Jenn Hyman tells BoF.