The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

SHANGHAI — When Janet Wang returned to Alibaba as general manager of its Tmall Luxury Pavilion in early 2021, she found much had changed since she had left the Chinese e-commerce behemoth five years before.

In 2014, when Wang helped bring Burberry on board as the platform’s first luxury brand, the idea of selling on Tmall was still anathema to most top-end players.

Today, almost 200 brands operate stores on Tmall’s Luxury Pavilion, a dedicated space for the segment which the platform first launched in 2017.

The clambering by luxury brands to join China’s biggest e-commerce platform has been particularly heated since the beginning of 2020, when the country first entered widespread lockdowns to stem the spread of Covid-19. That year, an average of one new flagship store per week opened on Luxury Pavilion, which is now home to brands including Cartier, Gucci, Prada, Armani and Hermès.

ADVERTISEMENT

“The first outbreak accelerated the penetration of online luxury, which doubled or even tripled,” Wang explained. For brands, “it’s more than just a sales channel. It’s a vehicle that they can use [to harvest] consumer insights and then build their strategies around it.”

The platform’s broad reach and immediacy can make it a bellwether for how the interests of China’s luxury consumers are evolving: Today, Wang says, watches have overtaken handbags as the preferred luxury category among online shoppers from lower-tier cities, with even sales of million-yuan ($157,000) Vacheron Constantin timepieces becoming an increasingly regular occurrence.

In first- and second-tier cities, sales are increasingly driven by young women who use the platform to access niche designer brands that are not widely available in China. This trend has been accelerated by the opening of multi-brand giant Farfetch’s store on Luxury Pavilion 12 months ago, which brought 3,000 labels to the platform.

Owner Alibaba doesn’t routinely break out growth rates for Luxury Pavilion, but early last year Tmall told local media outlets that the unit’s quarterly sales had more than doubled year-on-year, rising 159 percent in a signal that one year into the pandemic, the relevance of online sales for luxury in China showed no signs of abating.

In 2022, online luxury platforms like Tmall’s Luxury Pavilion and its 900 million active users are once again poised to see an increase in attention, and investment, from luxury brands, Wang says. As the wave of coronavirus’ Omicron variant fades in much of the world, its belated spread in China is making physical retail and events in the country more fraught than they have been at any time since the initial wave of lockdowns and store closures over two years ago.

On Sunday evening Shanghai authorities announced the city of over 25 million would begin locking down its population (half the city is locked down for five days beginning Monday this week, the other half enters lockdown on April 1) in order to calm record high infection rates in the commercial capital.

On hold are not only Shanghai Fashion Week (which was due to begin on Mar. 25) but also brand’s events, in-store launches and activations that have become an increasingly regular fixture in the city, as global brands look to tap surging domestic demand from Chinese consumers who, since the pandemic, rarely enjoy the opportunity to travel and shop abroad.

Shanghai’s lockdown comes weeks after another first-tier city and important luxury hub in the country’s south, Shenzhen, home to 17.5 million, also effectively closed for business due to a seven-day lockdown. With the more-contagious (if less lethal) Omicron variant now getting a foothold in China, it’s a fair bet that the country’s “Covid Zero” strategy will lead to further disruptions for physical retail in the months to come.

ADVERTISEMENT

But unlike the first half of 2020, luxury brands now have two years of experience operating under pandemic conditions. As a result of this experience, as well as a more robust e-commerce infrastructure, they may see only a “modest headwind” from China’s outbreak, according to Luca Solca, head of luxury goods research at Bernstein.

“I think brands should only be concerned to a point: over the past two years, brands have perfected remote selling and digital distribution,” he said. “It will be a matter of going back to that, this time having accumulated useful experience on how to run these operations.”

History repeating?

Indeed, even as Covid-19 propelled China’s luxury industry—data from The State of Fashion 2022, a report co-published by The Business of Fashion and McKinsey & Company, showed domestic sales surging 70 to 90 percent above 2019 levels by the end of last year—growth has been uneven across both luxury brands and shopping channels.

Online sales of personal luxury goods in China grew by almost 56 percent last year, while offline sales grew 30 percent, according to consultancy Bain.

In 2021, online’s share of China’s luxury market had reached a total of about 19 percent, excluding duty-free shopping, Bain said. With duty-free penetration included, total luxury online penetration in China accounted for approximately 26 percent of total sales.

Still, brick-and-mortar remains a key channel for brand building and discovery.

This is one of the problems with the hypothesis that China’s current outbreak and resulting lockdowns will boost online luxury even further in 2022, according to Pablo Mauron, China managing director and partner at Digital Luxury Group (DLG). The absence of the luxurious world created by physical stores and events means there are fewer opportunities for brands to entice consumers in the real world, which is often a key step before they complete purchases online.

ADVERTISEMENT

Even online players, including Farfetch, have pointed to the importance of offline contact and connection to its Chinese consumers, treating its “Private Client”, top tier customers to exclusive experiences, such as a behind-the-scenes visit to Dior’s Shanghai exhibition, dinners in Chengdu and master classes in Beijing.

In a world without physical experiences, staying connected naturally becomes more of a challenge.

Luxury’s growth — both online and off — could also be thwarted by the uncertainty sparked by the current outbreak, which has seriously dented the confidence of China’s middle class.

“Generally speaking, the [Chinese consumer] confidence is low and a lot of the middle class will be financially, economically impacted by the situation,” Mauron said. “The old notions about ‘revenge buying’ aren’t relevant at the moment [as] people are just trying to make sure they can get enough food if their city goes on a wider lockdown [and] people aren’t necessarily seeing any compensation from their employers or the government [to soften] the economic impact.”

The confidence of high-net worth consumers has also been dealt a blow by the weakening of China’s property and stock markets.

For Tmall’s Luxury Pavilion, another challenge is the acceleration of consumer interest in rival Chinese e-commerce channels such as Douyin (China’s version of TikTok, known for its unbeatably addictive algorithm), which last year launched its own brand flagships. JD.com has also made major luxury sector moves over the pandemic period, notably partnering with certain LVMH brands that have long hesitated to join third-party platform players.

According to Wang, the impact of the current outbreaks will depend on their length and severity. Still, as the gap in brand building and experience between online and offline channels has narrowed in recent years, it has become easier to engage luxury consumers digitally.

“Consumers have to get what they want right away. A lot of these digital services and offerings we are seeing [in 2022] also have a very luxurious experience, so I don’t think this will cut off [the growth in online luxury shopping]. In fact, I think that brands will only invest further in online to further their connection with their customers,” she added.

Navigating a Difficult Period

The current situation in China, while difficult, is best navigated by brands staying close to their customer base and offering them the best and most luxurious experience they can, Wang said.

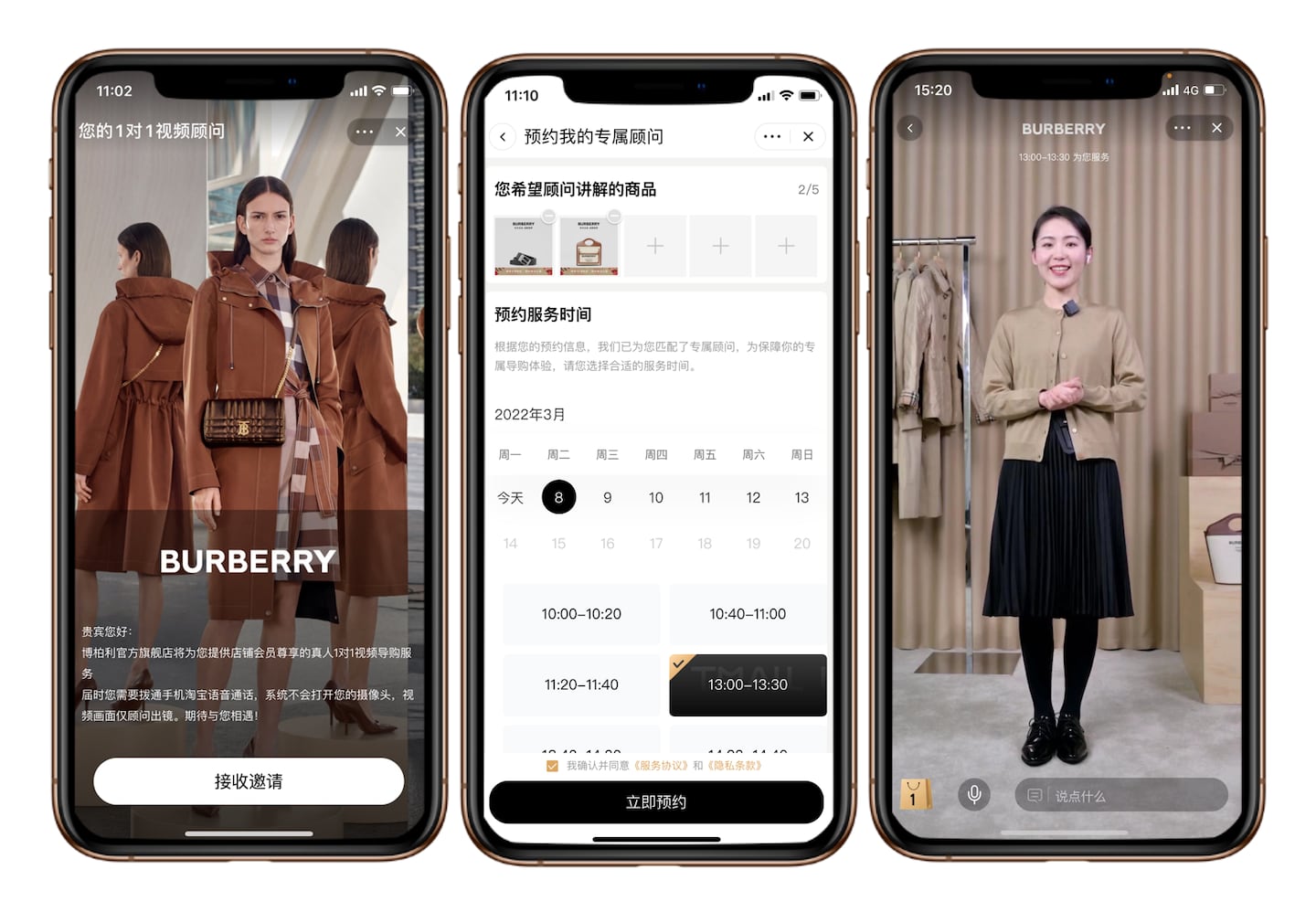

Livestreaming can help, she says, as well as one-on-one video services, which have recently been launched by several brands on Luxury Pavilion. Brands can use Tmall’s data about search history and product interest to better target individual customers during those appointments.

Brands including Cartier have also utilised 3D product rendering within their livestreams to give consumers a view of products as close to reality as possible. Next on the agenda, according to Wang, are further explorations of the metaverse and NFTs, called “digital collectibles” in China or XR: with brands experimenting with “extended reality” experiences for luxury retail.

Brands may be well-served to offer livestreams and other services late into the night, as Luxury Pavilion sees an uptick in browsing activity among younger consumers after midnight, Wang says.

While much of China rues the ways in which 2022 feels like 2020 all over again, and as key physical retail remains interrupted in major centres like Shanghai, luxury brands and the online platforms they partner are hoping history will repeat itself in another way: by providing a similar boost to luxury sales during a difficult period.

时尚与美容

FASHION & BEAUTY

Lanvin Group to List in New York Following SPAC Merger

The fashion group, which owns brands including Lanvin, Sergio Rossi, St. John Knits and Wolford, will be listed on the New York Stock Exchange following a deal to join forces with Primavera Capital Acquisition Corporation, a listed special purpose acquisition company (SPAC) and affiliate of Primavera Capital Group. Lanvin Group, which rebranded from Fosun Fashion Group last October, said the deal gives it a pro forma enterprise value of $1.5 billion, with a combined pro forma equity value of up to $1.9 billion. Total proceeds are expected to be $544 million, a war chest that will be used to accelerate organic growth via product category and retail expansion, but also to fund further acquisitions. (BoF)

科技与创新

TECH & INNOVATION

As Chinese Celebrities Run Into Trouble, Virtual Idols Fill the Gap

The visibility of virtual idols in China has risen significantly over the past 12 months, led by Ayayi, China’s first virtual influencer who made her debut on lifestyle platform Xiaohongshu, and MonoC, a virtual artist who sold her NFT artwork via Phillips for almost $25,000 last month. The market size for virtual humans was about 107.5 billion yuan ($16.9 billion) in 2021 and is expected to reach 333.5 billion yuan in 2023, according to a recent report from market research firm iiMedia. Brands and platforms, increasingly weary of the controversies, tax and legal troubles involving real-world celebrities are increasingly interested in jumping on the virtual idol bandwagon. (South China Morning Post)

消费与零售

CONSUMER & RETAIL

Luxury Retail Hit By First Stage of Shanghai Lockdown

Shanghai’s city districts are built around the Huangpu River, which dissects the east and west of the city. Districts to the east of the river, including Pudong New Area and its Lujiazui Business District, are currently closed off, with public transportation and roads connecting the city’s east and west also shut down. The other half of the city, including shopping thoroughfares on Nanjing Lu and Huaihai Lu will close for five days from Friday. Pudong is home to major malls including Shanghai IFC, usually one of the city’s busiest luxury malls, home to brands including Louis Vuitton, Cartier and Prada. Swire Properties Taikoo Li Qiantan also opened its Pudong location in September last year, quickly attracting huge crowds to stores including Balenciaga, Dior and Moncler’s biggest House of Genius store on the Chinese mainland. (BoF)

政治,经济与社会

POLITICS, ECONOMY, SOCIETY

Shipping Port Jams Reach Five-Month High

Covid-19 lockdowns have led congestion in the key Chinese ports of Shenzhen and Hong Kong to their highest level in five months, posing possible delays to goods heading to the US this summer. A queue of ships is also growing at Shanghai’s port, the world’s largest, as the city also entered a lockdown this week to counter a surge of Covid infections. Shanghai International Port Group, which manages the city’s ports, said in an online statement Monday that its ports would continue running, even as the rest of the city shuts down, maintaining 24-hour operations. (Bloomberg / CNBC)

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to our Shanghai-based Asia Correspondent casey.hall@businessoffashion.com.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.