The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

The same NFT mania that has seen non-fungible tokens garner intense interest elsewhere is alive and well in China, but all is not what it seems in the country’s crypto universe.

Given their sudden ubiquity, it was little surprise to see NFTs make an appearance at the latest Singles’ Day sales event in November. Brands including Burberry, Balmain, La Perla and Coach participated in a digital art exhibition hosted by Tmall’s Luxury Pavilion. The latter also sold a limited edition NFT digital depiction of the brand’s dinosaur mascot that Judy Chang, Coach’s Greater China vice president for marketing and e-commerce, said sold out “within literally a minute.”

China’s tech giants are jostling for position in the rapidly evolving space for unique digital assets authenticated and minted using blockchain technology. JD.com has entered the race alongside Alibaba and Tencent in a bid to gain a leading position in the “digital collectible platform” market while firms like Bytedance, Baidu, Bilibili, NetEase and Xiaomi have joined the others to stake a claim in the metaverse alongside global players Meta, Alphabet, Microsoft and Apple.

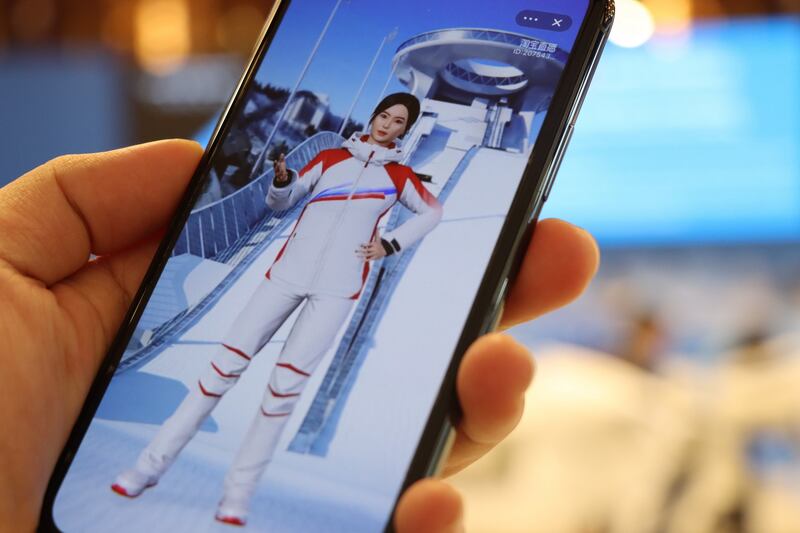

Just last week, NFTs made headline news when Tmall’s parent company Alibaba released four designs of virtual badges featuring Winter Olympics sports depicted in traditional Chinese ink-painting style. Over at Alibaba’s rival Tencent, parent company of WeChat, executives teamed up with a UNESCO world heritage site in China to digitalise the ancient wall paintings of the Mogao Caves. The money raised from the sale of the project’s NFTs was donated to help preserve the artworks.

ADVERTISEMENT

There’s China and there’s the rest of the world and I can’t see an easy bridge.

All this may sound rather run-of-the-mill in the global context of Web 3.0 competition and wave after wave of NFT activations, but there are stark differences between China’s NFT market and that of most other countries.

“There is a… wall. There’s China and there’s the rest of the world and I can’t see an easy bridge [between them],” explained Richard Hobbs, the Hong Kong-based founder of Brand New Vision (BNV). His company, which last week completed a $4 million Series A funding round led by Animoca Brands, is behind behind Bnv.me, a Web 3.0 fashion platform focused on 3D product creation, NFT sales and “future wearability.”

Having explored the possibility of cross-border NFT activations for players with a presence across Hong Kong and mainland China, Hobbs says bridging the gap between mainland China and the rest of the world is a virtually impossible task.

The government’s stance on crypto

China banned cryptocurrency mining and trading in 2021, making it part of a growing cohort of countries including Indonesia, Colombia, Nepal, Algeria, Egypt, India and Vietnam, that have banned, restricted or discouraged the use of cryptocurrencies. It was a swift turnaround from being the world’s biggest crypto miner with the most active Bitcoin trading platforms on earth just a few years earlier.

The country’s crypto crackdown, combined with the insistence of its government that the only permissible form of blockchain technology in the country is the state-sanctioned sort using semi-private networks developed by domestic tech giants such as Alibaba and Tencent, makes it incredibly difficult for ordinary Chinese people, or companies doing business in China, to be able to legitimately access globally traded NFTs without contravening rules that ban the use of cryptocurrencies.

Though there is little doubt that some people in the country continue to use crypto wallets and circumvent local regulations, they are a small percentage of China’s consuming public, Hobbs says. Due to the ban, NFT buyers currently use yuan to make a purchase, though it is likely that the further rollout of Beijing’s digital yuan will also increasingly play a role in the future.

Hobbs believes that the current market environment in China is therefore not aligned with the ethos of globally traded NFTs which “is about transparency and openness and immutability and digital asset ownership” powered by decentralised, autonomous technologies such as Bitcoin, or Ethereum.

ADVERTISEMENT

As opposed to the anonymous nature of ownership on public blockchains such as Ethereum, those developed by Chinese tech giants require real name registration accompanied by official identification documents as verification.

Even the Chinese government has recognised that allowing single companies control over independent blockchain fiefdoms is contrary to the nature of the technology. In late January, the state-sanctioned infrastructure project, BSN (blockchain-based service network) soft-launched the public BSN Decentralised Digital Certificate (BSN-DDC) Network, which is dedicated to NFT adoption in China — though it is telling that NFTs have been renamed Decentralised Digital Certificates (DDC) for the purposes of this project.

“There are some differences but the idea of recording purchase of a unique digital item [on a form of blockchain technology] is still the same, it’s just routed through the Chinese government,” explained Rand Han, founder and managing director of digital agency, Resonance China.

The biggest difference between the concept of NFTs in China and those in the West, however, lies in their intended life cycle. At present, the fact that no law exists governing the secondary market of NFT products in China means that, in essence, few are prepared to risk getting into the business of reselling these products, for fear of potential later repercussions.

Digital collectibles rather than tokens

Given the current regulatory environment and ongoing scrutiny plaguing China’s tech industry, combined with the crackdown on cryptocurrency mining and trading enacted last year, platforms in China are not allowing resale, fearing the practice will fall foul of government’s perceived intentions for the broader technological framework, even if no law currently exists to prohibit it.

According to legal specialist Qian Zhou, from Dezan Shira and Associates, a leading foreign direct investment law firm with offices throughout China: “Rather than being explicitly prohibited in China, it’s more like a cautious and voluntary decision adopted by major market players to stay away from the NFT secondary market transactions… In general, NFT is a very new thing in China and there are no very specific rules developed for it yet.”

So while the virtual badges sold on Alibaba’s platforms last week have been legally purchased, there is currently no risk-free way for the purchasers to trade or resell those badges within China. It is unclear what penalty, if any, they might incur. There has been speculation in the local media that a pilot secondary market for NFT transactions may be approved by the government and go online in the near future but, until that happens, the value of these products doesn’t lie in the amount they can potentially be resold for.

ADVERTISEMENT

Unofficial and non-state-sanctioned second-hand markets for NFTs have popped up in China in the past, and buyers have attempted to flip their digital purchases on second-hand apps such as Alibaba’s Xianyu, but they have quickly been shut down. “The government wants to clamp down on speculation,” Han said of the effectual ban on reselling NFTs in China.

Indeed, a major reason China’s government banned cryptocurrencies was its discomfort with the innate volatility of their value and the financial risks cryptocurrency trading placed on its citizens. There are some that would argue it also didn’t take kindly to the idea of a decentralised and autonomous method for its citizens to move more money offshore and beyond its control. The wild speculation in the resale value of some NFTs fits a similar risk profile.

This also explains why the preferred term for NFT in China to date has been “digital collectible”, a more neutral tone reflecting the way in which Chinese regulators wish the sector to develop, as products that people collect, rather than flip in a trading frenzy.

These and other differences mean that, for brands, the mindset that consumers tend to have when considering the acquisition of “digital collectibles” in China, isn’t the same as that of people buying NFTs elsewhere.

“It’s very different,” Coach’s Chang said. “When we launched NFTs for Coach in North America the consumers can collect it, they can resell it on the open market, so the discussion is around the resale value. For us, in China, [consumers] feel like it’s a way to define who they are, define their own persona: ‘what I collect represents who I am’… It [also] makes them feel that they are at the frontier of the digital world.”

Many of the Chinese consumers who bought Coach’s “Rexy” NFTs from Tmall last Singles’ Day used them as profile pictures on social media sites such as Weibo, WeChat and Douyin, she added, sharing with friends online what they had purchased. Comparing and admiring one another’s collections of digital assets online in a way not dissimilar to admiring a new artwork hanging in a friend’s apartment.

The reason that brands like Coach have the confidence to launch their products in China is that blockchain technologies and associated digital products (such as NFTs or at least “digital collectibles”) were included as priorities in the country’s 14th five-year plan, released last year by the government. With its explicit backing and under its watchful eye, the sector clearly has a future in China, even as it remains unclear how future regulatory moves will impact its development.

Where is the value without resale?

China market experts believe that leveraging digital collectibles as part of wider marketing and branding strategies will become more common.

“As long as the major platforms are the providers and source of such items, and the failures, scandals and scams that arise [from new technologies] are kept to a minimum… then social harmony can be maintained and the product should be allowed to live,” said Humphrey Ho, managing director at Hylink Digital.

It will be a valid part of any brand strategy in the mainland market, to have some kind of collectible on a blockchain.

Richard Hobbs also believes that developing China-specific digital collectibles remains a valuable proposition for brands, even if they are not perfectly aligned with the spirit of NFTs elsewhere.

“It will be a valid part of any brand strategy in the mainland market, to have some kind of collectible on a blockchain and use that to leverage the relationship with the consumer and events and promotions and the like. That’s going to be the key: how it’s used as more than a collectible, but in giving the consumer access to something.”

One way to do that, Hobbs suggests, is to use digital collectibles as part of a loyalty programme, giving customers who bought them first dibs on a limited edition product, or an invitation to an event with a brand’s celebrity spokesperson.

Rand Han believes that forward-thinking fashion brands using digital collectible strategies in China also have the potential to gain brand equity because successful campaigns signal modernity and demonstrate a certain cool factor. “Fashion is about the newest thing [and NFTs] are something new and novel and global,” he said.

“The novelty element, the excitement, the curiosity, the global element and wanting to be a part of that are all important to [Chinese] consumers and… the process of getting something NFT-ed is not that expensive… so it’s an inexpensive way to give your brand a second wind in 2022.”

So far, fashion brands like Coach that have started experimenting with digital collectibles in China have approached it as a new kind of incentive for customers, something akin to the traditional gift with purchase.

“A lot of it is about the buzzword right now, a lot of people are interested in it and curious about it so brands are connecting themselves to it but the function of it is like a reward for completing the consumer journey funnel,” Han said.

Though Chang agrees that the Chinese market is at an experimental stage, she is quick to add that she sees the next iteration of Coach’s strategy as more substantial than its first.

“We are thinking about the potential for collaboration with other industries [and] brands. Coach is very strong on collaboration, and we [also] have the China Cool Project with young artists so it could be working with one of them to make NFT art,” she said.

Hobbs agrees that, while it’s still unclear exactly where China’s version of NFTs goes from here, there is little doubt it is going somewhere. Its likely future relevance makes it vital that brands keep up or risk being left behind.

“What we’ve seen up until now is people dabbling, there’s not really a strategy, because it is so new,” he said. “Most people are quite naive to the possibilities of what it could represent and it’s only just now becoming clear to a lot of people that it’s more than just a pretty picture.”

Opens in new window

Opens in new windowThe Opportunity in Digital Fashion and Avatars Report — BoF Insights

BoF Insights’ guide to digital assets in fashion, which examines the rise of the metaverse and underlying technological, social and consumer shifts, plus includes a playbook for how to seize the opportunity. To explore the full report click here.

The Opportunity in Digital Fashion and Avatars is the in-depth report published by BoF Insights, a new data and analysis think tank from The Business of Fashion arming business leaders with proprietary and data-driven research to navigate the fast-changing global fashion industry.

时尚与美容

FASHION & BEAUTY

Fast Fashion Giant Shein Plans $2.3 Billion Supply Chain Hub

The Chinese fast fashion retailer plans to invest 15 billion yuan ($2.3 billion) to build a global supply chain centre in the southern Chinese port city of Guangzhou. The project will reportedly cover an area as big as three football fields, according to an official document published Tuesday by the provincial Development and Reform Commission, showing planned construction projects for 2022 in the city. (BoF)

China’s Fashion Publishers Want in on the Metaverse

Modern Media Holdings Ltd, the parent company of Modern Weekly, InStyle China, Nowness and The Art Newspaper China, has rebranded as Meta Media Holdings Ltd, according to a company statement. It signals the local media firm’s aim to become a player in the metaverse after launching AR/VR headsets, experiential AR space in its new Meta Ziwu, Met Media Lab and Meta Eye Tech departments. At the same time, Huasheng Media, the publisher of the Chinese editions of T magazine, WSJ magazine and Wallpaper has launched a digital magazine targeting the metaverse market called MO in partnership with Alimama, a marketing department of Alibaba Group, (Press Release)

L’Oréal Beats Q4 Sales Forecasts, Partly Fuelled by China Demand

Led jointly by results in mainland China and North America, the world’s largest cosmetics group’s sales rose 11.2 percent on a like-for-like basis over the last three months of 2021 to €9.09 billion ($10.40 billion), beating the €8.74 billion forecast of analysts. Online shopping grew to represent almost one-third of sales in the quarter and L’Oréal reported record sales on Alibaba’s Tmall platform during China’s Singles Day shopping festival in November. (BoF)

科技与创新

TECH & INNOVATION

Fast Fashion E-Commerce Site Linked to ByteDance Shuts Down

The fast fashion e-commerce site that was last week linked to TikTok owner, ByteDance, in Chinese media reports, has posted a notice on its homepage alerting shoppers that it ceased operations on Feb.11. The story of the Dmonstudio site, which was touted in media reports as a potential competitor to ultra-fast fashion giant Shein, remains something of a mystery. Although sources told Chinese media the site was owned by ByteDance and was overseen by the Chinese tech unicorn’s head of e-commerce, the company never confirmed its association with the site and did not respond to BoF’s requests for comment on the matter. (BoF)

The Swift Rise and Fall of a Chinese Metaverse Upstart

New metaverse app, Jelly, which promised a “virtual apartment for you and your close friends” was the most downloaded app in China last week, and reached a total of 1.85 million downloads in only three weeks since its January launch. But the app has been plagued with accusations of misusing user data and infringing on the rights of independent designers with lookalike wardrobe offerings for the game’s avatars. Developer Beijing Yidian Wangju Technology Co Ltd said on Weibo that the accusations of misusing user data were part of “malicious defamation organised by competitors.” It did not speak to the accusations of infringement against fashion brands, but removed some of the offending items of virtual clothing from the app prior to removing the app itself from app stores over the weekend. (KrAsia)

消费与零售

CONSUMER & RETAIL

Hainan’s Lunar New Year Duty-Free Sales Rise 151%

Sales at 10 surveyed duty-free malls in Hainan, a tropical island in southern China, totalled 2.13 billion yuan (almost $335 million) during the seven-day holiday, up 151 percent year-on-year, according to official figures. The number of customers reached 301,800, up 138 percent. Hainan received 5,411,300 tourists over the holiday, with total tourism retail revenue reaching 7.53 billion yuan. (BoF)

OTB Group to Double Down on China Stores

In announcing full year 2021 results last week, the luxury group founded by Renzo Rosso revealed its turnover had returned to pre-pandemic levels, reaching €1.53 billion ($1.73 billion). OTB owns brands including Diesel, Maison Margiela, Marni and Viktor&Rolf and took over Jil Sander last year. The group said it will continue to increase investments in China, where OTB now has 80 monobrand stores in 16 cities, a number it said it intends to double over the next three years. (Press Release)

政治,经济与社会

POLITICS, ECONOMY, SOCIETY

Eileen Gu’s China Choice Proves Lucrative, For Now

When the skier won Olympic gold in the big air event, sales of her red Anta ski suit surged 20-fold on Chinese e-commerce platform JD.com. At the same time, Tiffany & Co began trending on Chinese social media after she removed her Anta gloves to reveal four rings from the jeweller, which Gu endorses. But Gu’s earning power in both China and the US could be dimmed by worsening bilateral tensions. Her decision to compete for China has drawn criticism in the country of her birth, while in China Gu will need to navigate tightening oversight over celebrities, with many stars cancelled by authorities after missteps. (Reuters)

Unexpected Approval of Pfizer Drug Opens Possibility of an End to ‘Covid Zero’ in China

The conditional approval of Pfizer’s Paxlovid over the weekend marks the first foreign pharmaceutical product endorsed by China for the prevention or treatment of Covid-19. Until now the country has exclusively relied on domestically developed vaccines and therapies. According to Zeng Guang, a former chief scientist at the Chinese Center for Disease Control and Prevention who advised Beijing on Covid control, Pfizer’s drug will serve a strategic purpose, and may lay the groundwork for China’s Covid containment strategy to gradually give way to a more flexible approach. (Bloomberg)

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to our Shanghai-based Asia Correspondent casey.hall@businessoffashion.com.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.