The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

The traditional fashion calendar, in which garments for autumn are presented the preceding February and spring clothing is shown in September, was introduced by King of France Louis XIV. In the 17th century, he established France as the centre of the luxury textile industry, imposing a seasonal schedule wherein new textiles would be released twice a year, as a means of encouraging people to buy more of them. From the beginning, it was simply good marketing — people bought the latest textiles because they were new, not because they actually needed them. That practice has been rinsed to the nth degree, culminating in a gruelling schedule that now spans the world’s four traditional fashion capitals. Is this travelling circus of seasonal fashion shows still relevant in today’s digital, globalised world?

Providing a Platform

Traditional fashion shows thrive on the live gathering of the “right” people — editors, buyers, celebrities, influencers and other tastemakers — to create and transmit the cultural value that turns mere dresses into objects of desire. Consolidating fashion shows into a tight calendar across a few locations is a practical way of getting the “right” people in the right place at the right time, bundling brands together to minimise friction and maximise impact.

In particular, this helps smaller, independent brands gain visibility that would otherwise escape them. Google searches for “fashion show” peak around the Autumn/Winter ready-to-wear shows in February/March and the Spring/Summer ready-to-wear shows in October, so it is possible for lesser-known brands to piggyback on the wider hype of fashion week to get noticed.

ADVERTISEMENT

Fashion Weeks as Consumer Marketing

Earning the attention of end consumers, not just tastemakers and other industry insiders, is becoming a bigger part of the value fashion week offers. In 2018, Launchmetrics, in partnership with the CFDA, analysed the media impact of more than 400 fashion shows in New York, London, Milan and Paris and found that brands received significantly more online attention during Fashion Month than at other times of the year. Some brands were found to receive 800 percent more social media mentions during fashion weeks than they did during the rest of the year, shifting the purpose of shows away from trade events primarily targeting journalists and buyers to consumer marketing spectacles for digital viewing. Of course, influencers have played a massive role in this transformation, multiplying the sources of style authority and accelerating the transmission of information to consumers.

‘Phygital’ Fashion Weeks

The pandemic forced many brands to experiment with how they present their collections, speeding the adoption of new digital formats. Gucci, for example, abandoned the catwalk in mid-2020 in favour of short digital films, whilst also reducing the number of collections it presented and going co-ed. The first collection it presented digitally — a 12-hour livestream of a fashion shoot prep, featuring the brand’s design team as models and dubbed “Epilogue” — clocked up more than 35 million views. TikTok jumped on this trend by launching Fashion Month on its platform in September 2020, attracting contributions from Prada and Celine. And though physical fashion shows are pretty much back to their pre-pandemic norm — just look at the packed schedules for Milan and Paris — the industry is unlikely to unlearn the new tactics they learned during lockdowns as digital features have become more embedded in the experience, resulting in a “phygital” fashion week that is more valuable than ever.

Ultimately, the fashion calendar is here to stay. The combination of brand visibility and buyer concentration makes it hard for most labels to miss out. Going forward, brands may increase the entertainment factor, and possibly add new digital revenue streams in the form of NFTs.

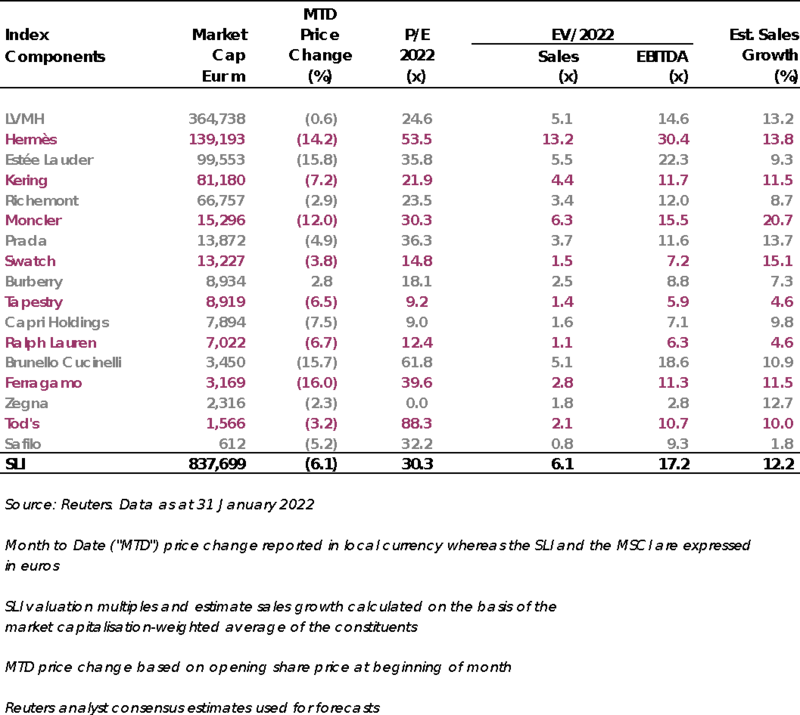

The Savigny Luxury Index (“SLI”) fell almost 7 percent in January amid fears of an escalation towards conflict between the West and Russia over Ukraine whilst the MSCI lost almost 5 percent of its value.

SLI vs. MSCI

Going up

ADVERTISEMENT

Going down

What to watch

Designer Anifa Mvuemba (Hanifa’s Pink Label Congo) launched her collection in May 2021 via an Instagram Live show with 3-D models. A virtual unknown, she gained global attention for her use of innovative technology to represent different body types and celebrate her Congolese heritage. “We know that some people may never experience a Fashion Week or Hanifa showcase, so we wanted to show up for our audience where they show up for us on a daily basis,” she told Teen Vogue after her springtime launch. Since then celebrities from Beyoncé to Zendaya have begun wearing her pieces.

Sector valuation

Pierre Mallevays is a partner and co-head of merchant banking at Stanhope Capital Group.

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.