The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

NEW YORK, United States — Estée Lauder was an early supporter of Kendall Jenner, signing the reality-television star-turned-supermodel as a face of the brand in 2014. But in March 2016, the beauty industry stalwart took its relationship with Jenner a step further, harnessing her social media influence, including an Instagram following of more than 67 million, to launch the Estée Edit, a new product line aimed at Millennials and Generation Z.

The Estée Lauder Companies’ bet on the Estée Edit — which, if successful, could generate more than $60 million in its first year, according to industry estimates — is a big one, best illustrated by the whopping 52-page supplement dedicated to Jenner that was bundled with the March 2016 issue of American Vogue and sponsored entirely by the beauty conglomerate.

But while Jenner’s association with the Estée Edit and Estée Lauder certainly lends a youthful sheen to a 70-year old brand struggling to shake off its dusty reputation, the overall impact of the partnership is questionable when compared, side-by-side, to the phenomenon that is Kylie Cosmetics, the beauty line backed by Jenner’s 19-year-old sister, Kylie Jenner, who boasts more than 76 million Instagram followers.

Unlike Kendall, the younger Jenner chose to partner with Seed Beauty, an independently run company based in Oxnard, California, that also produces ColourPop Cosmetics, to build her brand. ColourPop is as well known for its secretive operations as it is for its fast fashion-inspired, social-media driven approach to selling makeup. (The company’s founders, Laura and John Nelson, did not respond to multiple interview requests from BoF.)

ADVERTISEMENT

But Kylie Cosmetics, which launched in November 2015 as a single $29.99 “Lip Kit,” has since morphed into an extensive product range. Social media metrics suggest that the brand is far more popular — or at least more relevant to consumers who are active on social media, a powerful indicator of interest — than the Estée Edit.

“In many categories, the impact of social media is vastly overrated. Beauty is not one of them,” says Kurt Jetta, Ph.D., the chief executive of consumer analytics firm TABS. “Almost half of heavy [beauty] buyers are looking at social media. It’s been pretty profound.”

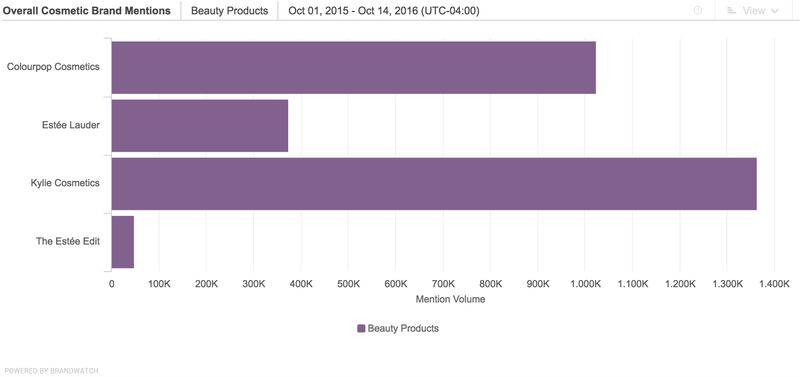

BoF enlisted social-media monitoring and analytics firm Brandwatch to track the performance of the four brands associated with the two Jenner sisters — Kylie Cosmetics, Colourpop Cosmetics, the Estée Edit and Estée Lauder — over the course of the past year. (Brandwatch gathered current data from Twitter, Facebook and Instagram, as well as news sites, blogs and forums, with historical data pulled from Twitter.) Kylie Cosmetics was mentioned more than 1.3 million times since October 2015, while Colourpop was mentioned more than 1 million times.

By comparison, Estée Lauder, the oldest brand in the group by many decades, received over 373,000 mentions, while the Estée Edit clocked just over 48,000. What’s more, this analysis doesn’t even account for specific mentions of Kylie’s Lip Kit, Kylie Cosmetics’ hero product that launched in November 2015. “Kylie Cosmetics [itself] didn’t appear to receive many mentions until February 2016, but still ended up being the most discussed brand,” explains Brandwatch data analyst Kellan Terry.

Overall cosmetic brand mentions | Source: Brandwatch

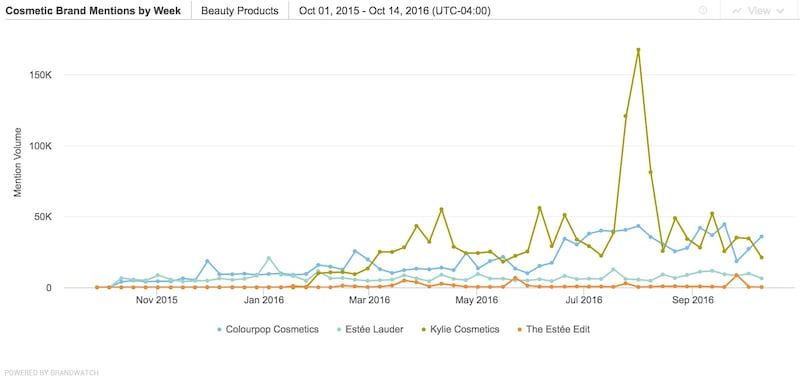

Brandwatch also broke down when the four brands were most discussed over the course of the year. For instance, Kylie Cosmetics received the largest spike in August 2016 around the launch of a limited-edition “Birthday” collection, which coincided with the younger Jenner’s 19th birthday on August 10.

Cosmetic brand mention by week | Source: Brandwatch

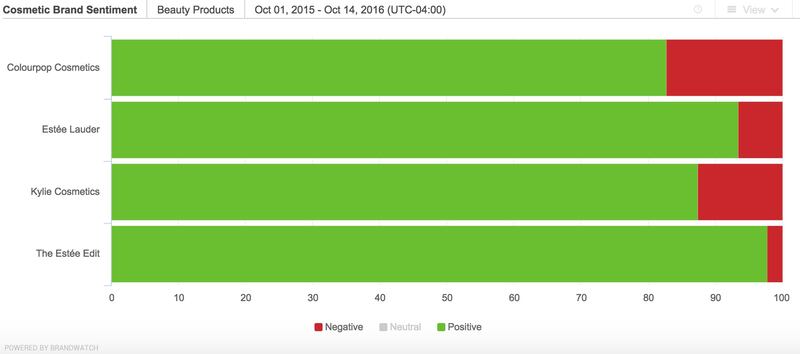

Sentiment-wise, the Estée Edit received the highest scores, with 97.7 percent of the brand’s mentions categorised as positive. However, “It’s important to note that negative mentions may not necessarily mean someone is discussing the brand negatively,” Terry cautions. “In fact, many mentions will sometimes be centred around how an individual would like to get a particular product from a brand, but can’t for whatever reason.”

ADVERTISEMENT

Cosmetic brand sentiment | Source: Brandwatch

Indeed, Colourpop and Kylie Cosmetics’ limited-edition strategy may help to explain why they garnered more negative reactions online. It also underscores vast differences between the way Seed Beauty and the Estée Lauder Companies market and distribute products. Kylie Cosmetics and Colourpop operate much like fast fashion, unleashing one product or a small bundle of product at a time — in limited quantities — in order to create a sense of singularity and urgency. (It’s no surprise that Kylie’s Lip Kit was the most talked about product among those offered by all four brands, according to Brandwatch.)

“It’s about going after just one thing; credibility in one specific area,” says Karen Grant, global beauty industry analyst at NPD Group. “Just get this lip kit and boom, you’re done.”

The rise of independent beauty incubators that will manufacture product for almost anyone with enough influence and a marketable idea has helped to democratise the industry.

It’s a strategy used by many independent beauty brands, which, over the past decade, have successfully challenged the supremacy of a handful of major beauty conglomerates — including L’Oréal, LVMH and the Estée Lauder Companies — which still control roughly 70 percent of the $60 billion US beauty market. “Even those that are not backed [by a conglomerate] are becoming top 10 brands,” notes Grant. “That was not the case in years passed, and it speaks to the power of the indie brand.”

Indeed, the rise of independent beauty incubators like Seed Beauty, Hatch Beauty and Maesa, which will manufacture product for almost anyone with enough influence and a marketable idea, has helped to democratise the industry. “Now, there’s really no barrier to entry,” Jetta says.

As Grant notes, major beauty conglomerates like the Estée Lauder Companies and L'Oreal have been smart about snapping up lines with cult followings. In 2014, the Estée Lauder Companies acquired Rodin Olio Lusso, Le Labo, Editions de Parfums Frédéric Malle and Glamglow, all independent lines that shied away from print advertising in favour of less orthodox marketing strategies. In February 2016, the company bought niche fragrance brand By Kilian, followed by the makeup label Becca Cosmetics in October.

Rival L’Oreal acquired Urban Decay, which was founded in 1996 and once owned by LVMH, in 2012 for more than $300 million. In many cases, beauty startups — such as Beautycounter, Glossier and Stowaway — have been backed by venture capitalists, suggesting that they, too, are hoping to be bought by a larger company at some point.

As seen with the Estée Edit, conglomerates are also applying the best marketing practises of indie start-ups to their own homegrown brands. “Kendall been an incredible model for Estée Lauder for over two years,” says the company’s global brand president Stephane de la Faverie. “Her ever-growing influence as a supermodel, style icon and social media sensation is helping us bring Estée Lauder to a new generation of women around the world who see her as an aspirational millennial role model.”

ADVERTISEMENT

Indeed, Lauder is so confident in the elder Jenner’s ability to draw in consumers that it has tapped her for nearly 50 digital, print and television campaigns since signing with the company two years ago. Her in-store personal appearances track particularly well on social, and like her younger sister’s sold-out lip kits, Jenner has also had luck with limited-edition products.

A custom shade created by Jenner in June 2015 for Estée Lauder’s “Pure Color Envy” lipstick line — called “Restless” — sold out almost instantly on Esteelauder.com when it was introduced. The company says that it continues to see images of the lipstick shared on social media more than a year later.

While the Estée Lauder Companies does not break out results for individual brands, it says that best-selling items from the Estée Edit include the “Pore Vanishing” stick, “Flash” illuminator and products from the “Barest” collection, all items that play into the obsession with contouring seen on social media.

But for many legacy beauty brands, efforts like these do not always generate good results. “With shoppers that are under 35, social media is more influential than print, so we’ve seen bigger brands trying to do a lot more of that,” Grant says. “But is the voice authentic to that younger consumer? It doesn’t work if you’re simply trying to emulate that strategy.”

Of course, marketing success alone does not necessarily create a winning business. Limited-edition product runs mean less inventory. Compared to Kylie Cosmetics, The Estée Edit has the advantage of being sold at Sephora and Sephora.com in North America as well as Selfridges in the UK, which offer a wide distribution network. In fact, the product’s performance at Selfridges has compelled the company to open its first freestanding store in the UK this November, which will sell both Estée Edit and Estée Lauder products.

But direct-to-consumer brands like Kylie Cosmetics typically enjoy higher margins, and they can control how much (or how little) product to release at a time. “Newness is going to be looked favourably upon,” Jetta says. “The demand is there.”

Related Articles:

[ BoF Exclusive | Estée Lauder Buys Becca CosmeticsOpens in new window ]

[ Beauty Brands Inch Away from Traditional AdvertisingOpens in new window ]

[ Emily Weiss: Blogger to Social Brand BuilderOpens in new window ]

According to an email viewed by The Business of Beauty, the company will be on hiatus while it establishes a sustainable path to return as a new company.

The surfing legend, a vocal opponent of chemical-based sun protection, is launching his own line of natural skincare products this week.

While light on obvious social stunts, the 2024 Met Gala still had its share of trending beauty moments this year.

TikTok has birthed beauty trends with very little staying power. Despite this reality, labels are increasingly using sweet treats like glazed donuts, jelly and gummy bears to sell their products to Gen-Z shoppers.