The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

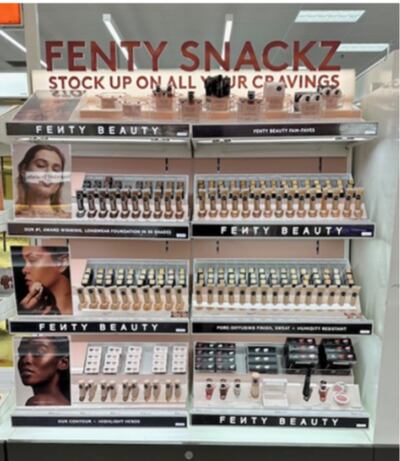

When Fenty Beauty entered Target via Ulta Beauty last month, it had the markers of a mass diffusion line: a new brand name, Fenty Snackz, and lower price points. But the products themselves were no different from Rihanna’s core Fenty Beauty assortment of Gloss Bomb Universal Lip Luminizers or Match Stix Contour Skinsticks — they were just smaller.

Once relegated to grab-and-go checkout bins, mini-sized or travel-sized beauty products are finding a more prominent position in retailers like Target, Sephora or Ulta Beauty. At Ulta Beauty locations, mini products are often dispersed throughout stores, sometimes placed next to their full-size counterparts. Rather than approach mini beauty items as last-minute impulse buys, beauty companies are increasingly trying to use mini products as a customer acquisition tool, notably price-conscious consumers shopping with value in mind.

“The price point of minis makes it a lot more accessible, and therefore simplifies the choice where it’s not a tradeoff, but it’s more like, ‘I can afford this,’” said Maria Salcedo, senior vice president of merchandising at Ulta Beauty, adding that “more brands are offering many [minis] across key franchises.”

The mini shopping craze is on the rise. According to October data from market research firm Circana, sales of minis grew by 16 percent over the last 12 months to reach $1 billion. Ulta Beauty’s e-commerce site currently lists 262 products under “travel size” for skin care and 183 for makeup. Over at Sephora, the company calls out 299 items as “mini size” in its makeup section, with more being added from holiday sets and Advent calendars. Fenty Beauty, for one, offers non-Snackz minis at Sephora, as do Charlotte Tilbury and Rare Beauty.

ADVERTISEMENT

“You’re lowering the barrier of entry,” said Anna Keller, a senior global beauty and personal care analyst at Mintel. “Minis are generally going to cost more for smaller sizes, but they help give consumers the opportunity to touch that nicer product, that more prestigious or luxe product that they’re not going to get access to.”

Value-oriented shoppers add minis to their beauty shopping list after extensive online research. In a trend similar to the online obsession with dupes, Reddit beauty groups and TikTok’s #minibeauty hashtag are full of discussions of diminutive makeup, skin care and hair care items, providing price-per-ounce breakdowns and reviews. Some consumers have even converted to a mini-exclusive buying lifestyle. One conversation thread about minis on Reddit’s “r/Makeup” community has multiple comments by users saying they almost exclusively buy minis rather than full-size products now. “I have like 2-3 products that are my holy grail go-tos that I get full sizes in. But everything else I only buy minis,” said one comment by user buttonfactoryjoe21 in the group.

This level of consumer engagement means that customers arrive in stores armed with detailed price-per-unit knowledge, especially as awareness of inflation is at an all-time high across all consumer goods categories. According to a 2022 survey by McKinsey, 65 percent of U.S. consumers said they were worried about higher prices. Consumers and influencers are even willing to call out instances where they’ve seen brands size down without pricing accordingly.

Milk Makeup, for example, was the subject of widespread discussion earlier this year when TikTok influencers and beauty Redditors discovered that its full-size blush and contour sticks had shrunk.

“These contour sticks got five times smaller and no cheaper,” said influencer Rachel Wiseman in a March 2023 TikTok video about Milk Makeup’s decision to change its container sizes from 1 oz to .21 oz, calculating that the price of the smaller item was around 500 percent more per ounce. She then expressed scepticism at the brand’s explanation of the smaller sizing — precise application and travel convenience — on its DTC site.

Beyond the deeply researched beauty enthusiast, another type of shopper that minis are attracting is one new to a beauty label or retailer. Still cost-conscious, these types of shoppers are willing to pay for small prestige products over full-size mass items.

“Think of a woman who can’t afford a Fenty lipstick pulling a mini Fenty lipstick out of her purse. [She can say,] ‘Look, I’ve got Fenty.’ It brings the cachet to a more value customer,” said Victor Casale, founder of MOB Beauty, a sustainable beauty brand that offers miniature products in paper and aluminum.

Minis also offer a way for shoppers to test and try new products without investing time and dollars into a fleeting beauty moment. This is especially important when TikTok-driven beauty trends inspire young shoppers to constantly buy the latest lip gloss or sparkly eye shadow.

ADVERTISEMENT

“We think about so many of the really fun makeup trends that have come and gone, even thinking about the Euphoria effect … Gen Alpha, Gen-Z, they’re wanting to try different things,” said Keller. “It’s not something that you’re necessarily going to use to the last drop.”

Casale agreed.

“The general consumer doesn’t hit ‘pan’ on a product or an eyeshadow or a lipstick,” said Casale, referring to the industry term used for using up a product. He also acknowledged minis’ importance for sampling, a requirement of many retailers. MOB Beauty is sold at Credo Beauty and The Detox Market.

Though smaller sized beauty items raise sustainability issues — more tiny plastic packaging is thrown away more frequently — some experts believe that customers are finishing products rather than letting them go to waste. Trial “reduces things like returns or customer complaints,” said Keller.

Even with minis’ rising presence in customers’ shopping baskets and medicine cabinets, beauty brands and retailers ultimately still see them as an upsell opportunity. According to 2022 data from Mintel, minis are preferred over in-store testers for sampling products. The ultimate goal is that once a customer tries a smaller-sized moisturiser or lipstick, they will be hooked.

“The ideal behaviour is that a guest that has not shopped at Ulta Beauty before and has not shopped Fenty, purchases a mini and then converts to a full size in Ulta Beauty,” said Salcedo.

A new breed of beauty brands is taking a page from fast fashion, winning business by offering cheap and accessible 'dupes' of it-products.

Rihanna’s Fenty Beauty range did nearly €500 million in its first full year in business, which could put her a step ahead of Kylie Jenner and her cosmetics empire.

Liz Flora is a Beauty Correspondent at Business of Fashion. She is based in Los Angeles and covers beauty and wellness.

How not to look tired? Make money.

In a rare video this week, the mega-singer responded to sceptics and gave the public a look at what her beauty founder personality might be.

Request your invitation to attend our annual gathering for leaders shaping the global beauty and wellness industry.

Excitement for its IPO is building, but in order to realise its ambitions, more acquisitions and operational expenses might be required.