The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Designer bags and small leather goods are often the most recognisable products a brand can sell. They can also serve as an indicator of the wearer’s desired social standing and values.

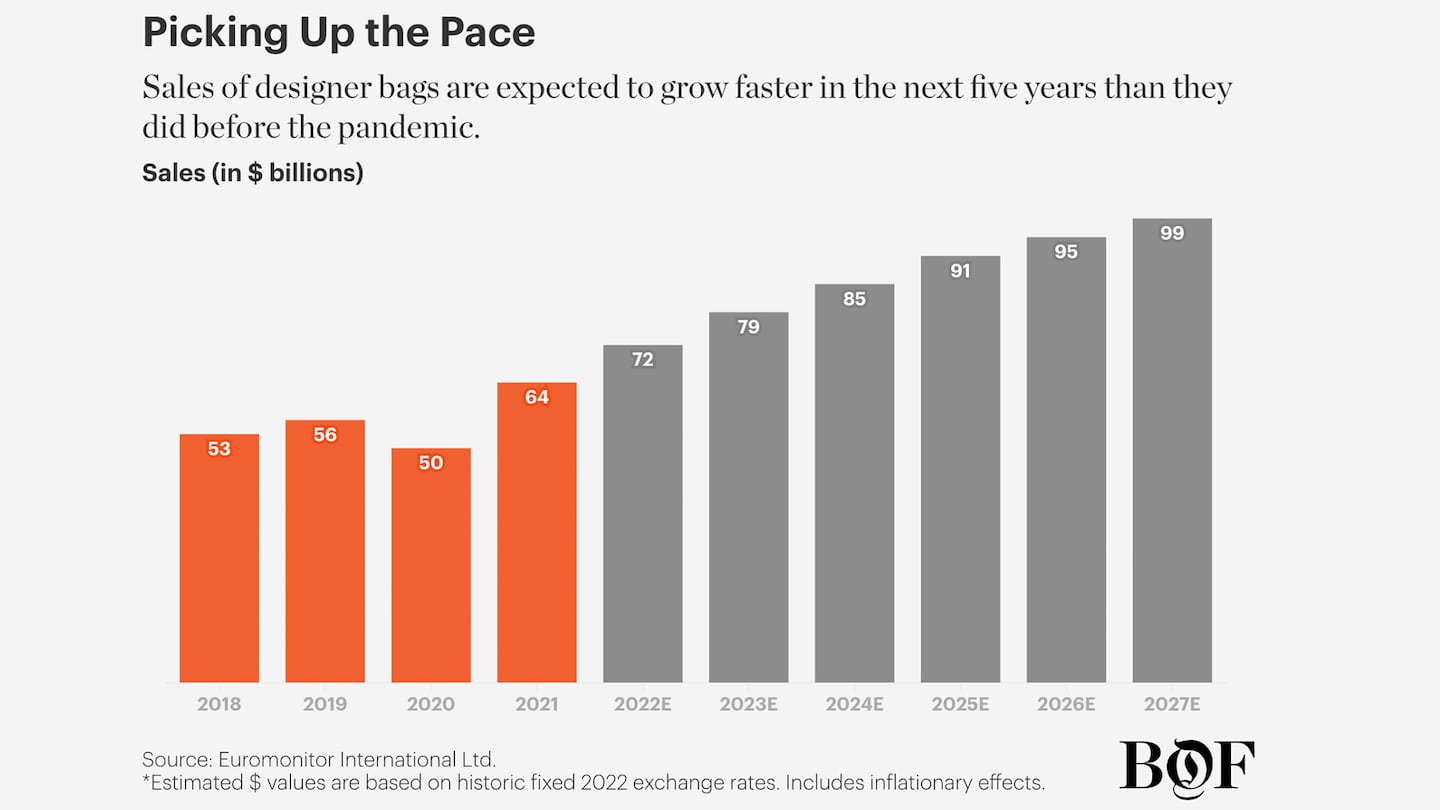

That’s only going to be more true in the coming years. According to market research firm Euromonitor International, global consumer spend in the category is set to grow from an estimated $72 billion in 2022 to $100 billion by 2027.

The US and China currently account for over half of all global sales, and those two markets will continue to drive much of the future growth. Despite lingering pandemic effects and rumbles of a potential recession, proprietary BoF Insights surveys of consumers in both markets reveal high levels of engagement in terms of purchases in the last year and intent to buy in the upcoming year.

Meanwhile, competition between brands for these customers has never been fiercer. New contemporary bag brands tout similar levels of craftsmanship to heritage brands but at significantly lower prices. Streetwear-inspired bags are coveted and rare just like more traditional luxury offerings. Brands and retailers are also catering to sustainability concerns, including integrating alternative materials.

ADVERTISEMENT

Below is a look to understand what’s at stake in this hero category.

The Opportunity

Over the next five years, the category is expected to grow even faster than it did pre-pandemic, helped by both pent-up demand from consumers and new products from designer bag brands meant to enable access at a variety of price points and functionalities. In both the US and China, designer bags are virtually ubiquitous among the wealthy and an important status symbol among much of the general population as well.

Finding the Right Mix

Luxury brands have made capturing a bigger share of this growing market a priority. Many labels generate a large share of their revenue from leather goods and have grown savvier about marketing these items both to their biggest customers and to entry-level shoppers who may be shopping with a brand for the first time. Holding onto these customers is not without its challenges; consumers are increasingly happy to rent a bag, or buy one secondhand rather than shopping new. Luxury labels are starting to engage with these markets but have yet to fully realise the pre-owned opportunity.

BoF Insights is The Business of Fashion’s data and advisory team, partnering with leading fashion and beauty clients to help them grow their brands and businesses. Get in touch at insights@businessoffashion.com to understand how BoF Insights support your company’s growth for the long term.

Read the latest BoF Insights report to get BoF’s perspective on designer bags and small leather goods, covering key competitive shifts, including what, why and how consumers buy in the US and China, the category’s biggest markets.

Fashion and leather goods revenue rose 19 percent in the second quarter, beating analyst estimates.

Hundreds of fashion companies are looking to build their own resale channels, giving rise to a new class of B2B start-ups that aim to help them navigate the nascent industry.

For the first time, brands including Stella McCartney, Balenciaga and Hermès are bringing products made of buzzy mushroom-based materials to market, a critical test for whether the next-generation fabrics could one day hit the mainstream.

Benjamin Schneider is the Senior Research Lead at the Business of Fashion (BoF). He is based in New York City as part of BoF’s Insights team, which arms fashion and luxury executives with proprietary business intelligence.

Diana Lee is the Director of Research & Analysis at The Business of Fashion. She is based in London and oversees the content strategy and roadmap for BoF Insights.

The Coach owner’s results will provide another opportunity to stick up for its acquisition of rival Capri. And the Met Gala will do its best to ignore the TikTok ban and labour strife at Conde Nast.

The former CFDA president sat down with BoF founder and editor-in-chief Imran Amed to discuss his remarkable life and career and how big business has changed the fashion industry.

Luxury brands need a broader pricing architecture that delivers meaningful value for all customers, writes Imran Amed.

Brands from Valentino to Prada and start-ups like Pulco Studios are vying to cash in on the racket sport’s aspirational aesthetic and affluent fanbase.