The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

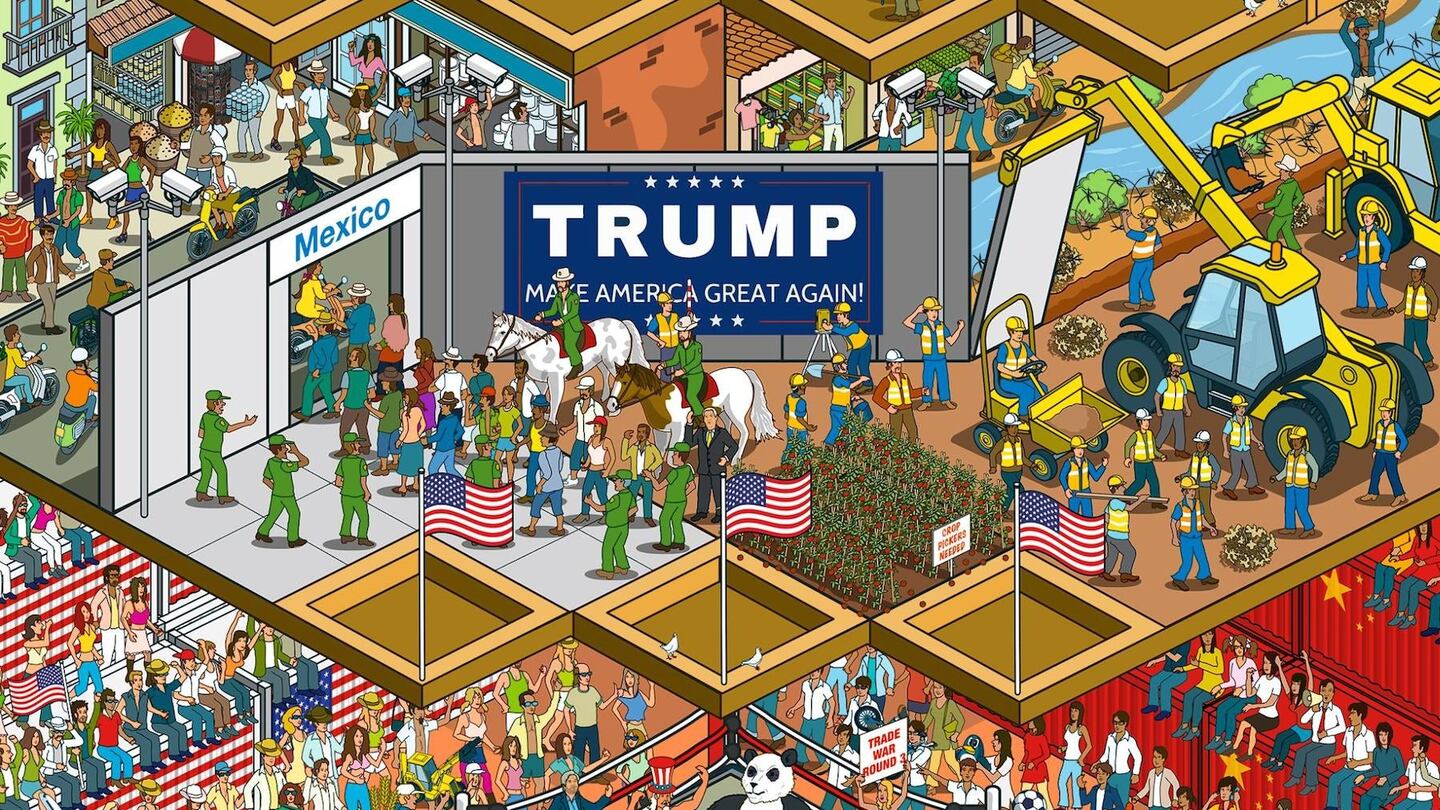

NEW YORK, United States — The early days of Donald J. Trump's presidency have been characterised by a maelstrom of angry tweets, illegal executive orders, Russian entanglements, FBI investigations, resignations, recusals, mass protests and "alternative facts." The volatility and unpredictability of the daily news cycle has many business leaders on edge.

“This is very much a case, lately, of legislation or torture by tweet,” said Rick Helfenbein, chief executive of the American Apparel and Footwear Association (AAFA), a national trade association representing apparel, footwear and their suppliers. Since President Trump’s inauguration, the organisation, whose members include L.L. Bean and Kate Spade, has been receiving daily calls from rattled executives asking for advice. “We’re in a game of Whack-A-Mole; we don’t know what’s going to pop up next. We haven’t seen anything like this in years,” Helfenbein continued. “It’s so chaotic that the story often changes multiple times during the day.”

And that’s to say nothing of the deeper effects of the actual policies being devised as part of the president’s “America First” agenda, which threatens to do serious damage to the interests of many American fashion firms.

Illustration by Rod Hunt

ADVERTISEMENT

At the top of the list of worries for fashion executives are changes to the corporate tax code. Trump has long called for a “big border tax” on imports and many suspect that he may adopt a plan first put forth in June 2016 by speaker of the house Paul Ryan, that would reduce the corporate tax rate (currently 35 percent) while introducing a 20 percent so-called “border adjustment tax” on all imports of goods and services as a way of penalising those who produce overseas. Import-reliant retailers in sectors like fashion, where 97.3 percent of apparel is manufactured abroad, argue the corporate tax cuts would not offset the impact of the “border adjustment tax” and the net impact would be nothing short of devastating, resulting in higher costs for consumers that could reach an average of $1,700 per person in the first year of the tax.

“Every economist who looks at it says that, if it works as they predict, it will not change the volume of trade either on the import side or the export side,” said Brian Dodge, senior executive vice president of public affairs of the Retail Industry Leaders Association (RILA). “We’re talking about an increase in the effective tax rate that is anywhere between two and 10 times what companies currently pay. That is huge... It’s going to pass through onto the customer, otherwise the business will cease to exist.”

“My sense is that border adjustability has become a given; that it will be part of the final tax reform plan and now the discussions are [about] how can it be designed... in a very positive way for importers,” chairman of the House Ways and Means Committee Kevin Brady, told CNBC in March. Trump and the House Republican’s failure to pass new healthcare legislation, their foremost campaign promise, in March does not bode well for future plans. Nevertheless, retailers have vowed to fight back.

We're in a game of Whack-A-Mole; we don't know what's going to pop up next.

Chief executives of the nation's largest retail companies, including Target's Brian Cornell, Gap's Art Peck and J. C. Penney's Marvin Ellison, held a meeting with Trump in February to discuss their concerns. Over 400 businesses and trade organisations have also united to launch Americans for Affordable Products, a new coalition to fight the "border adjustment tax" by lobbying lawmakers and appealing to voters. Members include Abercrombie & Fitch, American Eagle, J. Crew, Levi Strauss & Co., LVMH, Macy's, Neiman Marcus, Nike, PVH, Saks Fifth Avenue, the CFDA, the AAFA, the RILA and many others. "We believe we are in the early stages in a pretty lengthy battle on this issue and we are committed to it," said Dodge. "This issue, more so than any other issue over the last decade, has brought the industry together and retailers who have not heavily engaged in public policy in the past are doing so now."

And what if they lose the battle? What planning should companies put in place? "The only way you can plan is to diversify [manufacturing]," said Helfenbein. "But moving supply chains around is a pretty expensive proposition," explained Robert Antoshak, managing director of Olah Inc., a New York-based textile and apparel development firm that supplies US companies with denim, corduroy and piece-dyed fabrics. "Maybe [Trump] ends up just tweaking NAFTA... then I think most of the global brands and supply chains are going to remain intact and there's not going to be much movement. All the big global retailers and brands are probably not going to do much of anything until they know what the state of play is," he added, echoing several brand executives who spoke only on background. Fast Retailing founder Tadashi Yanai told the Nikkei Asian Review in March that there is "no chance" that Uniqlo will shift any manufacturing from Asia to the States.

Since the election of Trump, several new currents in US apparel manufacturing have received a boost. In New York, where the garment industry has lost 83 percent of manufacturing jobs in the last 30 years, mayor Bill de Blasio announced plans in February to contribute an additional $136 million to the creation of a “Made In New York” campus in Sunset Park, Brooklyn, which will serve as an incubator for local garment production. And in March, the New York City Economic Development Corporation, CFDA and the Garment District Alliance put $51 million toward investments in technology, business development and grants for relocation from the Garment District to Sunset Park. Nashville is also investing in apparel manufacturing. Yet momentum is weak.

Illustration by Rod Hunt

“We have several cut-and-sew manufacturing entities that have expressed an interest in looking here [since the election], but there hasn’t been a lot of what I would call serious movement in that direction,” said Van Tucker, founder of the Nashville Fashion Alliance.

ADVERTISEMENT

The largest slice of America’s apparel manufacturing is concentrated in Los Angeles, where, according to the Bureau of Labor Statistics, 40,500 people were employed in garment manufacturing in 2015 and where niche brands including Newbark, Clare V, Reformation and Creatures of the Wind produce their collections. While small-batch, vertically integrated production is not uncommon in Los Angeles, large-scale cut-and-sew factories are much harder to find.

But since Trump’s inauguration, more large retail brands have explored the possibility of setting up production in Los Angeles, said Zach Hurley, chief executive of Indie Source, a Los Angeles-based apparel manufacturer and fashion consultancy: “They are finally curious — ‘If I am forced to produce in the US, what does that actually look like? Does it put me in a position where I can run my business profitably?’”

Some players see great potential in US garment manufacturing. “How do I compete with China prices? My supplier is the sewer, it’s not a factory. I don’t subcontract,” said Dov Charney, the controversial founder of American Apparel, who is “hiring 30 people a day” in Los Angeles for his new t-shirt company. “I’m not going through this elongated complex supply chain that goes through Los Angeles and then it hits Hong Kong and then it goes over to Shenzhen but really they make everything in Vietnam,” he continued. “[When you produce overseas], by the time it lands on 7th Avenue in New York City, you’re already paying [the equivalent of] $15 an hour,” he said, referring to California’s plan to raise the minimum wage to $15 by 2022.

Yet in addition to the cost implications, the US currently lacks the modern infrastructure to support a competitive large-scale garment manufacturing sector and most believe bringing production to the country is almost impossible. “It would probably never happen, but if it did happen, it would probably take decades,” said Dodge. This would require billions and billions of dollars in new infrastructure investments — not to mention an unfettered immigrant work force.

The policies of the president's 'America First' agenda threaten to do serious damage to the interests of many American fashion firms.

On January 25, 2017, Trump signed his first executive order to aggressively enforce immigration laws by speeding up deportations, hiring thousands of new border control agents and punishing cities that do not cooperate with federal officials. White House press secretary Sean Spicer said the order was designed to take “the shackles off individuals in these agencies.” (This was followed by the highly controversial orders restricting travel from seven Muslim-majority nations, which have been blocked by federal courts).

“It is too early to see any systemic impact on the garment industry since Trump came into office. We have not yet experienced workplace raids as we did in the past. There has been a record number of deportations in recent years,” said Alexandra Suh, executive director of the Koreatown Immigrant Workers Alliance in Los Angeles, which organises both Korean and Latino workers.

Illustration by Rod Hunt

“But all this immigration talk will make it incredibly difficult if some trade barrier is put up,” said Antoshak. “I don’t know where they could get a low cost production base unless it’s coming from the immigrant [community]. It does kind of put our industry in a bit of a pickle.”

ADVERTISEMENT

Yet despite the turmoil around trade and manufacturing, some are more optimistic than others. Mario Ortelli, head of luxury goods at Sanford C. Bernstein, sees potential benefits to Trump’s proposal to reduce individual income tax on the wealthy. “Those individuals will have more discretionary spending and part of this discretionary spend will go into luxury,” said Ortelli. On the risk of the “border adjustment tax,” he added: “There are not many products made in the US that can substitute for European luxury goods.” Brands should expect American shoppers to shift their spending to adjacent markets, such as Canada and the Caribbean, and prepare those stores accordingly.

Coach chief executive Victor Luis, whose company manufactures in 18 countries around the world, mostly in Asia, told CNBC in January: "We are in a very unique position. I think, we are in a very emotional category. We have very high gross margins. We are not in a category that is a bit more restrained in passing on prices to consumers."

Trump's election in the US has only escalated the general feeling of uneasiness around the world.

Yet the emotionally driven luxury market can also be highly susceptible to the kind of uncertainty seen in today’s geopolitical landscape. European luxury brands felt the impact of decreased spending after 2015 and 2016 terrorist events in Paris and Brussels, and the ongoing Syrian refugee crisis and instability in the currency markets have also upset consumer confidence. “Luxury is a business of happiness and stability,” said Ortelli.

Trump's election in the US has only escalated the general feeling of uneasiness around the world, linked to everything from Brexit to the multi-nation dispute over strategic waterways in the South China Sea. "Fashion is not immune to these external elements," Claudia D'Arpizio, a senior partner at Bain & Company in Milan, told BoF in June 2016. "We had SARS, we had some terrorist attacks in the past, we had some economic crises, but never has the globalisation [of these crises] been so definitive."

And yet a recent report from The Economist revealed that for the first time in seven years, developed and developing countries will experience “synchronised growth spurts” in 2017. Factories are busier, spending on machinery and equipment is up and employers are adding jobs across Asia, Europe and America, while Russia and Brazil’s struggles are coming to an end. But will these positive fundamentals be enough to reassure business leaders and fashion consumers alike — in the US and around the world — as they come to grips with the fallout of a Trump presidency?

Perhaps the biggest fear amidst the chaos is the growing pile of unknowns that keep stacking up, one on top of the other. The business of fashion in America is very much a case of “wait-and-see.”

This article appears in BoF's latest special print edition: "America."

Did you know that BoF Professionals receive our print issues first? Annual BoF Professional memberships also include unlimited access to articles, exclusive analysis, invitations to networking events and the members-only app. Not a BoF Professional? Subscribe here.

The issue is also available for purchase at shop.businessoffashion.com and at select retailers around the world.

Related Articles:

[ Anna Wintour on Politics and the Fashion Business in Trump's AmericaOpens in new window ]

[ Anna Wintour on the Met Ball, the Future of Magazines and Her Own FutureOpens in new window ]

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.