The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Hello BoF Professionals, your exclusive 'This Week in Fashion' briefing is ready, with members-only analysis on the key topic of the week and a digest of the week's top news.

On Wednesday, Tapestry Inc ousted Chief Executive Victor Luis, following months of poor performance at the American fashion giant. The move came weeks after the company cut its full-year earnings forecast and signalled mounting trouble at Kate Spade, the accessories label it acquired in 2017 in a deal worth $2.4 billion, adding to a portfolio anchored by Coach.

Luis, a former LVMH executive, had been with the company for 13 years, stepping into the top job more than five years ago with the ambition of transforming Coach into a multi-brand global fashion group in the mould of the European luxury conglomerates that dominate the sector.

During his tenure, he managed to reboot Coach, turning the dusty American stalwart into a modern lifestyle brand by installing British designer Stuart Vevers and shifting the label away from the heavy reliance on discounting that damaged its image, resulting in rising sales for the last seven quarters. But Luis, who led the company’s purchases of Stuart Weitzman in 2015 and Kate Spade two years later, turning Coach into Tapestry, had less success with his acquisitions.

ADVERTISEMENT

The primary problem was Kate Spade, whose colourful bags were cult hits with a generation of young American women before losing their cachet. Tapestry has been trying to turn the label around, but consumers have yet to take to the vision proposed by creative director Nicola Glass, who was hired in late 2017. Kate Spade sales declined by 6 percent in the last quarter and Tapestry expects sales to fall further at what the company’s Global Head of Investor Relations Andrea Resnick described as a “high-teens rate based on the current traffic trends we are seeing in the business.” Tapestry shares have lost about one-third of their value in 2019 and are down nearly 60 percent over the last year. Plans for future acquisitions have been put on hold.

“This idea of making Tapestry the LVMH of the USA is questionable, as the supposed mega-brand at the core seems to be fragile, and the acquired businesses still some distance from successful. Kate Spade in particular has been a big drag,” said Bernstein analyst Luca Solca. “Push is coming to shove on seeing results and they are not there.”

Creating America’s answer to LVMH, a $46 billion French behemoth that took decades to build, was never going to be easy. But a number of factors have made the task tougher for Tapestry. For a start, the group is more heavily exposed than Europe’s luxury giants to the US market, where fashion sales have suffered from declining mall traffic, faltering department stores and the rise of e-commerce. What’s more, a hollowing out of the country’s middle class has created a more polarised market, favouring value and luxury segments, while taking a toll on accessible luxury players like Tapestry, which offers price points in the $300 to $600 range.

But the mid-market isn’t dead. Fast-rising prices at luxury brands have created an even bigger gap between high and low, which has been skilfully exploited by stylish, lower-priced upstarts with savvy Instagram strategies, from Mansur Gavriel to Ganni. Key to their success, however, is a clearly defined design perspective. Indeed, when the primary battleground for fashion labels is no longer department store racks but Instagram, having a strong story is more important than ever, and simply knocking off luxury brands without a specific identity is no longer enough.

To be sure, Coach, Kate Spade and Stuart Weitzman lack the storytelling power and cultural significance of Europe’s established luxury players. (It’s also worth noting that, unlike accessible luxury label Michael Kors, which benefits from its charismatic founders, neither Stuart Weitzman nor Kate Spade have direct ties to the designers whose names are on the door).

But more than anything brand building takes time and patience, which can be in short supply at publicly traded American fashion companies with quarterly targets to hit. Europe’s luxury giants are publicly traded but family-controlled, enabling them to play a long game rooted in selective distribution, price integrity and creative risk-taking. Meanwhile, US players like Tapestry can suffer from short-term thinking, resulting in a model based on wide distribution and discounting.

It’s tempting to look at the trouble at Tapestry and mistake the weaknesses of the business model widely adopted by America’s biggest public fashion companies for a problem with American fashion itself. But this would be a mistake. Carefully managed American fashion brands have been tapping key trends, from wellness to streetwear, with terrific success. Take Supreme, for example. It’s carefully cultivated street ‘cred’ and tightly controlled product releases have given rise to an accessibly priced streetwear juggernaut that is most certainly not getting killed by Amazon or the retail apocalypse that’s ravaging malls across America.

When it comes to the world’s biggest fashion groups, it’s ironic to say the least that the streetwear aesthetic birthed in the US is driving blockbuster results — in the hands of carefully managed European brands like Alessandro Michele’s Gucci and Virgil Abloh’s Louis Vuitton.

ADVERTISEMENT

To rival Europe’s luxury giants, America’s major fashion players will need to develop a long-term mindset rooted in patient brand building — and maybe take a bet on fresh American design talent like Kerby Jean-Raymond or Emily Bode.

LVMH wasn’t built in a day.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

Mansur Gavriel SS19 Campaign | Source: Facebook

Mansur Gavriel sells majority stake to private equity firm. The New York-based label has sold a majority stake to New York-based private equity firm GF Capital Management & Advisors. The terms of the deal were not disclosed. Founders and Creative Directors Rachel Mansur and Floriana Gavriel are slated to continue with the company and will remain shareholders. Isabelle Fevrier, who most recently led the accessories business at Ralph Lauren, is joining as chief executive. President Shira Sue Carmi, who was appointed in 2017 as the company was ramping up to scale, will exit at the end of the month.

Chanel confirms postponement of Hong Kong Cruise show. Chanel's hotly-anticipated Cruise collection, due to show in Hong Kong on November 6, has been postponed to an undetermined "later and more appropriate moment," the luxury giant said in a statement. The announcement was not unexpected given the current climate in Hong Kong, where a host of major events have been cancelled in the wake of political unrest that has periodically paralysed the city for more than three months, with no end in sight. Meanwhile, however, European luxury goods stocks including Kering LVMH and Moncler rose following the news that Hong Kong Chief Executive Carrie Lam plans to formally withdraw the extradition bill that has caused the protests.

Louis Vuitton to add 1,500 jobs in France on luxury demand boom. The luxury house, which is selling more products than ever before, plans to add roughly 1,500 manufacturing jobs in France over the next three years, ramping up production to feed surging demand from China and other emerging economies. While Louis Vuitton has opened factories in Italy, Spain and the US, Chief Executive Michael Burke said it is committed to keeping the majority of its supply chain in France.

ADVERTISEMENT

Boohoo raises sales outlook and soars to £3.3 billion valuation. The British online fashion retailer is leaving rival Asos in the dust, consolidating its position as the industry's new market darling. Boohoo shares rose to a record Thursday after the company raised its annual sales outlook, pushing its market value to about £3.3 billion ($4 billion). It's the biggest company on AIM, London Stock Exchange's junior market for growth companies. Asos, which was worth £6.5 billion as recently as March 2018, now has a value of only about £2 billion.

H&M halts leather purchases from Brazil due to Amazon wildfires. The world's second-biggest fashion retailer said Thursday it had stopped purchasing leather from Brazil for the time being due to environmental concerns highlighted by Amazon wildfires. Sweden-based H&M follows VF Corp, owner of brands including Timberland, Vans and North Face, which made a similar announcement last week in response to the fires. The fires have spawned an international crisis for Brazil, with public protests and world leaders voicing concern that Jair Bolsonaro's government is doing too little to protect the world's largest tropical rainforest.

La Perla to list in Paris. The holding company that owns luxury lingerie brand La Perla will list its shares in Paris today. Chief Executive Pascal Perrier said the listing will increase the company's visibility and enhance its access to capital — though it is not planning on raising any when it first lists — paving the way for expansionary M&A down the road. Perrier has ambitions to build a portfolio of luxury brands under La Perla Fashion Holding NV, hoping to propel growth while working on a turnaround at the struggling underwear brand.

Macy's sees savings of up to $550 million. The department store chain has said it aims to save $400 million to $550 million annually in the next two to four years, as it cuts back on discounts, sending its shares up 5 percent Thursday. The 160-year-old company, which has been spending heavily on remodelling its stores and building off-price and online businesses, has relied on discounting to clear inventory, a move that has hurt its earnings. The projected savings are a result of targeted promotions and better pricing.

American Eagle shares slump after sluggish sales renew apparel pessimism. The retailer fell the most in more than two years after posting worse-than-expected same-store sales for the second quarter, signalling even its investments in denim and lingerie can't fend off a wider malaise in the struggling apparel sector. Same-store sales rose 2 percent company-wide in the most recent quarter, missing analyst estimates. Shares fell 14 percent in New York, the biggest intraday slide since May 2017, and had declined 16 percent this year through Tuesday's close.

THE BUSINESS OF BEAUTY

Source: Flickr Mckrista1976

L'Oréal has a new CEO. Stéphane Rinderknech, who first joined the company in 2001, has been appointed president and CEO of L'Oréal USA, as well as executive vice president North America. He succeeds Frédéric Rozé and will report to him in his role as executive VP. Rinderknech was previously CEO of L'Oréal China since 2016 and will take on his new responsibilities on October 1, 2019.

Tracee Ellis Ross started a beauty line. The actress and daughter of Diana Ross is readying to launch Pattern, a haircare line for curly, coily and textured hair. The line is important to Ellis Ross, who has struggled to find affordable hair-care options for her curls since childhood, and especially relevant at a time where more black women are embracing their natural hair texture. Pattern offers jojoba and argan oil serums, a shampoo and two conditioners, a shower brush, hair clip and microfibre towel, with prices ranging from $9 to $42.

PEOPLE

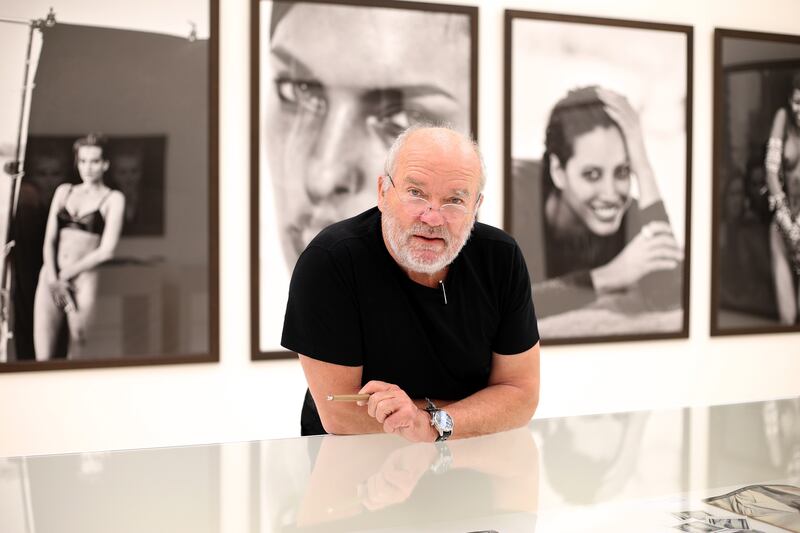

Peter Lindbergh | Photo: Gisela Schober/Getty Images

Photographer Peter Lindbergh dies at 74. Described by BoF's Tim Blanks as the most cinematic photographer of fashion's golden age, Lindbergh was known for his still photos of faces and memorably off-kilter scenarios such as Helena Christensen in the Mojave with a little Martian. He managed to dodge the "curse of commercialism," while making extraordinary, enduring images of women and left one of fashion's greatest image banks.

Thebe Magugu is the first LVMH prize recipient from Africa. The South African designer has been awarded the LVMH prize, and will receive €300,000 and a year-long mentorship. The 26-year-old, originally from Kimberley, South Africa, is known for his contemporary style and use of local suppliers. He launched his womenswear label in 2016 after studying fashion design, photography and media at the LISOF School of Fashion in Johannesburg. He has operated out of his home and had never been to Paris before this year.

Neiman Marcus CFO steps down after less than 18 months. The luxury retailer will get another chief financial officer for the second time in two years when Adam Orvos steps down next month to pursue a job with another company. Neiman Marcus is in the process of naming a successor, but Orvos will remain at the company until October 11 to help with the transition. He has been in the job less than 18 months, after joining in April 2018, when he assumed the role from Dale Stapleton, who was interim CFO since June 2017. Neiman Marcus has been fighting to boost results, with same-store sales falling 1.5 percent from a year earlier in the quarter ending April 27.

Ariana Grande files $10 million trademark lawsuit against Forever 21. The superstar singer has sued Forever 21 for $10 million, accusing the fashion retailer — and beauty company Riley Rose, started by Forever 21's billionaire founders' daughters — of piggybacking off her fame and influence to sell their wares. In a complaint filed on Monday, Grande said Forever 21 and Riley Rose misappropriated her name, image, likeness and music, including by employing a "strikingly similar" looking model, in a website and social media campaign early this year.

MEDIA AND TECHNOLOGY

Poshmark to delay IPO until 2020. The online resale marketplace for second-hand clothing has delayed plans for an initial public offering until next year to "focus on boosting sales and improving its execution," according to people familiar with the matter. Poshmark had been one of several e-commerce companies looking to go public this year amid a wave of IPOs that included two online retailers in June. The RealReal has fallen about 31 percent since then, while Revolve Group has risen about 20 percent.

Alibaba strikes $2 billion deal for NetEase-owned Kaola online mall. Alibaba Group Holding has bought Kaola for about $2 billion and invested in its music streaming service, forging a rare partnership between two of China's largest internet giants. The deal gives Alibaba the biggest Chinese online marketplace for foreign brands after its own Tmall Import and Export. Kaola will now operate independently but with a new chief executive, Alvin Liu, appointed from Tmall.

BoF Professional is your competitive advantage in a fast-changing fashion industry. Missed some BoF Professional exclusive features? Click here to browse the archive.

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.