The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

When Glossier laid off more than 80 employees last year, mostly from its technology team, the shakeup wasn’t just about flagging sales.

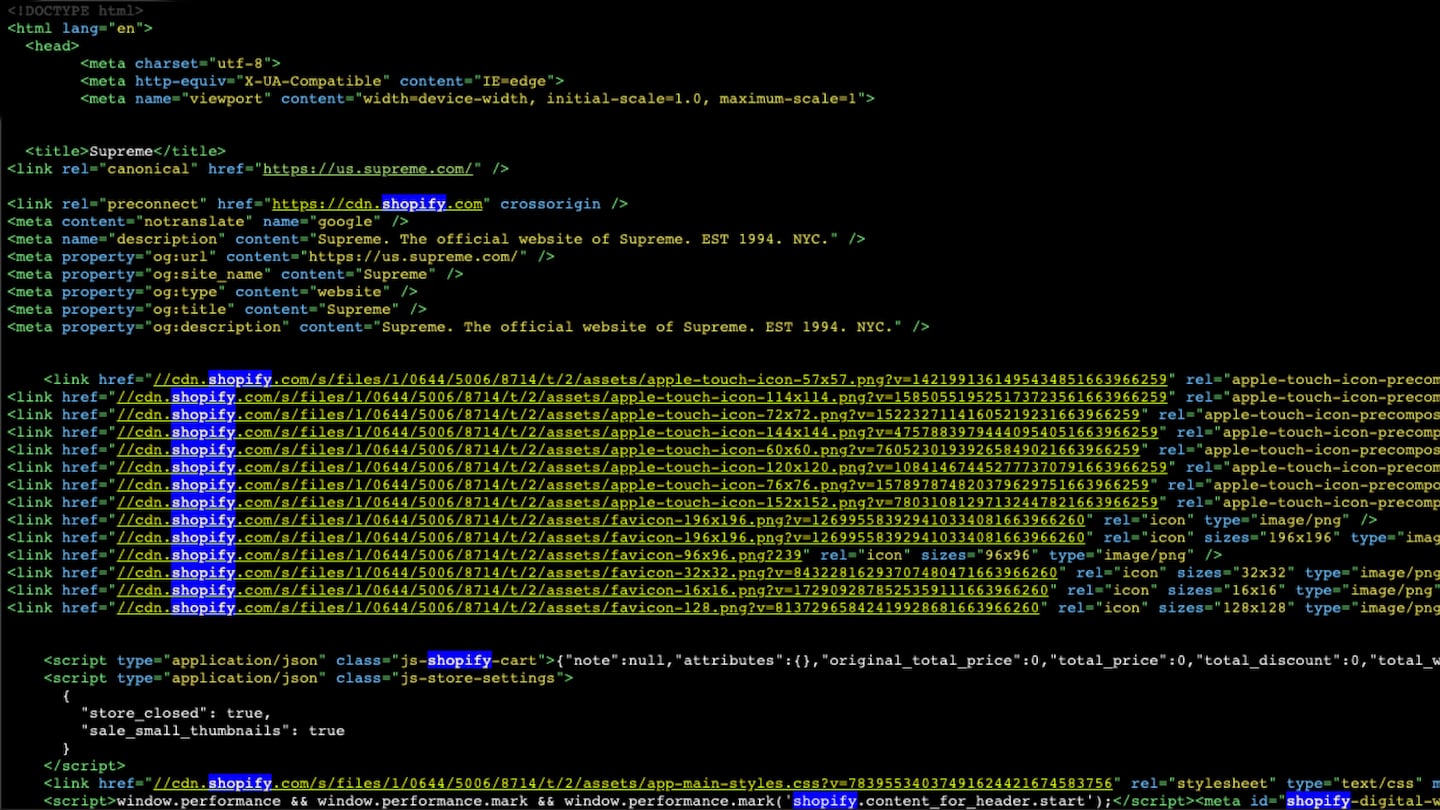

The brand that made building its own point-of-sale system part of its identity, saying it was more expensive but created a better customer experience, had decided to shift parts of its platform to external partners, according to an internal email seen by Modern Retail. It officially moved to Shopify this past October.

“Shopify is the best at what they do and working with them allows Glossier to achieve our strategic goal of bringing the brand to more people,” Kyle Leahy, Glossier’s chief executive, said in an email. She added that Shopify’s tech abilities were helping Glossier optimise its e-commerce and retail shopping experiences.

Glossier isn’t the only company seeking tech support. As online shopping has become a larger slice of retail, it’s given rise to an industry of e-commerce firms that promise brands and retailers a fast, friction-free and seamless experience for their customers across channels and countries. Along with Shopify, there’s Salesforce’s Commerce Cloud, Adobe’s Magento, Farfetch’s FPS, BigCommerce and others. Each offers different features, but all are vying for the opportunity to do the heavy lifting on the backend, allowing brands and retailers to focus on making and marketing products.

ADVERTISEMENT

For the winners, there’s a big pot of money to be had. The market for e-commerce platforms serving product-based businesses, such as fashion and beauty retailers, was worth at least $4 billion and as much as $14 billion in the US in 2021, according to an estimate from investment bank William Blair.

Fashion is a key battleground. Farfetch, which aspires to make FPS the preferred e-commerce platform of the luxury industry, expects more merchandise sales to happen through the service than on its own marketplace by 2025 and for FPS to be one of its more profitable business units. Shopify’s president, Harley Finkelstein, recently tweeted that one of his goals this year is to get fashion’s top brands on Shopify.

But running e-commerce isn’t as easy as letting businesses post product photos and adding a checkout function. With providers offering so many competing or overlapping features and services, it can be hard to stand out.

“Everybody has a buy button,” said Nikki Baird, a former retail analyst and vice president of strategy for Aptos, which makes retail management software. “What’s differentiating is what kind of brand promise are you making and how do you bring that to life?”

To draw clients, e-commerce companies keep bolting on new offerings, such as better storefront capabilities, logistics solutions and other options. Amid all the excitement over ChatGPT, Shopify just introduced a tool for AI-generated product descriptions.

But what ends up distinguishing one platform from another tends to be its flexibility and how much developer effort is required on the brand’s end, according to Ryan Foster, a director at e-commerce agency Fostr, which specialises in advising fashion and luxury brands on Shopify Plus.

“It comes down to, in my mind, that agility and how quickly you can ship functionality, and that is largely dictated by the complexity and the design of the platform,” he said.

Shopify touts its ease of use and flexibility. Salesforce is “built for scale” and can help large brands bring together customer data across regions and channels, according to Kelly Thacker, chief marketing officer of retail at Salesforce and senior vice president of Commerce Cloud. Farfetch markets FPS as a full-service operating system for luxury and works more like a partner to clients than just a technology provider.

ADVERTISEMENT

Depending on a brand’s size and specific needs, some options are a better fit than others. Several dozen of LVMH’s houses, including its most iconic brands, rely on Salesforce, while a few use Shopify, according to an LVMH representative.

3.1 Phillip Lim joined FPS in 2019 because it offered the most support of the options available, according to Justine Mohr, the brand’s chief revenue officer. It provides services such as global logistics and in-store clienteling apps but also strategic guidance.

“For a small team to run an e-commerce site, I think having an all-in-one solution like that is very attractive,” Mohr said.

The platform has more than 30 customers now, including retailers such as Harrods as well as several small and medium-sized brands like Sacai and Thom Browne. It will soon launch Ferragamo’s new site and has a pipeline of brands and retailers to be onboarded onto its platform as part of its $200 million investment in Neiman Marcus Group and recent deal with Richemont, whose brands will join FPS pending antitrust approval of the deal.

This year, Farfetch plans to push more of its services as standalone products, including its module for e-concessions, which continue to grow in importance; its logistics options; and its store-focused “connected retail” technology.

“The strategy behind having these different modules is to be able to partner with brands and retailers wherever they are in their life cycle,” said Kelly Kowal, who oversees FPS as Farfetch’s chief platform officer.

Powering e-commerce for the fashion industry isn’t simple — or cheap. The websites customers use to browse and buy fashion are the face of online shopping, and storefronts that are easy to navigate, searchable and attractive are critical. But there’s a lot that needs to happen behind the scenes to make it all work.

That can include tracking inventory across multiple distribution points and possibly stores, handling several forms of payment and managing shipping and returns. The challenges multiply when crossing international borders. There are currency exchange rates, duties, customs, localised websites with local languages and payment systems, shipping and last-mile couriers to consider. E-commerce is also constantly evolving, meaning a system that’s sufficient one day might need updating the next.

ADVERTISEMENT

“Some people really underestimate still how challenging it is to run e-commerce, especially on the operational side,” Kowal said.

Yoox Net-a-Porter ran headfirst into the costs of keeping up. Yoox provided the platform for more than 30 fashion e-commerce sites when it merged with Net-a-Porter in 2015, setting it up to become a fashion-technology giant. By 2019, however, its plans were faltering as it struggled with a “painful” migration of its technology and logistics platform that took years and hundreds of millions of euros.

Recently, analysts have questioned Farfetch’s FPS spending and ability to attract customers. On an earnings call last May, after Farfetch’s investment in Neiman Marcus Group, which will see the Neiman Marcus and Bergdorf Goodman sites migrate to FPS, a Morgan Stanley analyst asked whether it would need to continue making these investments to draw customers.

“The short answer is no,” replied José Neves, Farfetch’s founder and CEO, adding that the deal with Neiman Marcus Group was based on it being a valuable partner.

On a call in November 2021, Neves said FPS was profitable. But costs appear to keep rising.

“Farfetch’s technology spend continued to grow as the company aims to become the technology enabler of luxury industry,” Bernstein analyst Luca Solca wrote in a November 2022 research note.

Occasionally, there are retailers that do opt to go it alone.

In 2018, Kering announced it would end its deal with YNAP and bring its e-commerce in-house.

Managing e-commerce itself has advantages, it says. The company has complete control over its roadmap, from which international markets it can enter to the new features it’s able to introduce. It was also able to integrate its e-commerce with its legacy retail systems, giving it a complete picture of its customers across channels. (Brands that had large store networks before the rise of e-commerce often wound up with the two channels being siloed.)

But as Glossier discovered, this route comes with challenges, particularly as brands scale, and many choose to partner up. Recently, Shopify scored another coup and lured Supreme to its platform, getting the brand’s followers talking about its backend operations instead of its drop calendar for a moment.

Mohr of 3.1 Phillip Lim said there are different levels of consideration in choosing an e-commerce partner. First, it’s about a functional website that can sell products. Then it’s factors like global shipping and payments. Finally there’s what she called an “experiential” element.

“Are you providing the right experience on the site, and is that experience aligned with your brand and aligned with the customers you’re trying to attract?” she said.

Every platform is trying to convince fashion the answer is yes.

The Swiss luxury group is spinning off Yoox Net-a-Porter in a joint venture with fashion platform Farfetch. What does it mean for Richemont, Farfetch, YNAP and the luxury industry at large? BoF dissects the deal.

This week, Ssense said it laid off 138 workers, and MatchesFashion received a $73 million cash injection from its shareholder. From more niche players to giants like Farfetch, the pressure remains high for luxury e-tailers.

Online sales growth is slowing, returning to its pre-pandemic trajectory. As shoppers head back into the store, their new expectations around service set the stage for the next chapter of retail.

Marc Bain is Technology Correspondent at The Business of Fashion. He is based in New York and drives BoF’s coverage of technology and innovation, from start-ups to Big Tech.

The nature of livestream transactions makes it hard to identify and weed out counterfeits and fakes despite growth of new technologies aimed at detecting infringement.

The extraordinary expectations placed on the technology have set it up for the inevitable comedown. But that’s when the real work of seeing whether it can be truly transformative begins.

Successful social media acquisitions require keeping both talent and technology in place. Neither is likely to happen in a deal for the Chinese app, writes Dave Lee.

TikTok’s first time sponsoring the glitzy event comes just as the US effectively deemed the company a national security threat under its current ownership, raising complications for Condé Nast and the gala’s other organisers.