The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Luxury brands mostly shook off the economic gloom of rampant inflation and collapsing consumer confidence last year — despite the deteriorating macroeconomic picture, sales grew an estimated 22 percent, according to Bain.

The picture hasn’t been as rosy for luxury’s multi-brand e-tailers, however: In August, Richemont took a €2.7 billion write-down on Yoox Net-a-Porter as it spun the e-tail group off into a joint venture at a far lower valuation than what it had paid.

And in December, Farfetch shares plummeted by a whopping 35 percent in a single day after the platform reported its first-ever year-on-year drop in sales on its marketplace. In a telling sign, multi-brand luxury e-commerce’s biggest player keeps shifting its focus to licensing activities and white-label services for brands.

“The Farfetch core [online marketplace] business is not a good business, despite Farfetch being the champion of the world at it,” analyst Luca Solca said in a note to clients.

ADVERTISEMENT

This week, news suggested that smaller rivals — whose focus on tight product curation was meant to set them apart in the sector — are facing troubles, too.

Montreal-based fashion-forward retailer Ssense confirmed it had laid off 138 employees (roughly 7 percent of its headcount), citing “a shift in consumer online shopping back to pre-pandemic levels as well as the macro-economic environment.”

London-based MatchesFashion received a £60 million ($73 million) injection of capital from its owner Apax Partners, suggesting that even after losing £24 million last year the company still needs more support to fuel a hoped-for turnaround under CEO Nick Beighton (the company’s fourth chief executive in as many years).

Even Germany’s MyTheresa — which has staked its reputation on a more cautious approach, protecting profitability by balancing the costly process of acquiring new customers with efforts to identify and retain high-spenders — has struggled to maintain investor support. Even as rising interest rates and a cloudy economic outlook drove investors away from cash-burning businesses in favour of more prudent (read: profitable) companies, shares in the New York-listed e-tailer have fallen 65 percent since its January 2021 IPO (compared to a 9 percent increase in the S&P 500).

Simply put: it’s tough out there for luxury e-tailers at every size.

To be sure, internet companies well beyond luxury e-tailers are feeling the pinch after a period of cheap debt and rapid growth. In recent weeks, layoffs have hit tech giants Meta and Google as well as fashion start-ups including StitchFix and GymShark.

But long-standing challenges for luxury‘s digital retailers such as securing inventory from A-list brands, the high costs of maintaining logistics and technology platforms, and fierce price competition due to instantaneous comparison shopping show no signs of abating. And those challenges are harder to paper over in an economy where investment capital has become more scarce and borrowing has grown more expensive.

Meanwhile, the costs of generating traffic from sources like Instagram and Google has also gone up — thwarting client acquisition — at the same time as e-tailers are facing increased competition from the brands they sell, which have ramped up their own digital efforts considerably since the pandemic. Brands have also upgraded and expanded their physical retail networks, eroding online ordering’s appeal.

ADVERTISEMENT

“On the one side, you need money to acquire the collections, then on the other you have to need money to get the traffic from Meta and Google — which costs a fortune. In most markets, this equation is impossible,” said Michel Campan, an e-commerce consultant who has worked for brands including Hermès and Christian Dior.

Pivoting to e-concessions — in which brands pay commissions for sales through virtual “shop-in-shops”, but hold stocks themselves — is one way e-tailers are evolving their approach to cope with cash shortages and competition from brands’ direct channels. While top-line revenues from commissions are lower for each sale, profitability can be higher as e-tailers dodge inventory risk.

The e-concession approach also allows e-tailers to focus their own investments on driving traffic and making their websites and apps more appealing for shoppers: in a world where nearly all brands sell directly online, multi-brand player’s ability to drive web traffic and engage consumers remains their main value-added, Campan said.

Taste can be hard to scale. But despite the challenges currently facing smaller online players, differentiating themselves through their unique fashion edit remains a key strategy, Solca says. “This can be a viable business, especially if driven with a goal to stand out on curation and fashion viewpoint.”

Further consolidation is likely following the Farfetch-YNAP tie-up last year. And yet, “this is not going to be a ‘winner takes all’ environment,” Solca said.

E-commerce sales are set to grow by double-digits annually between 2022 to 2025, according to BoF and McKinsey’s State of Fashion report. Multi-brand players still have a chance to secure their piece of that growing pie. But as e-tailers increasingly go head-to-head with trusted luxury brands, it’s unclear how big that slice will be.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

ADVERTISEMENT

Paris Fashion Week to feature Alexander McQueen comeback, Schiaparelli’s RTW runway debut. The Chambre Syndicale de la Mode Féminine released its provisional calendar for the Autumn/Winter 2023 season, which will run from Feb. 27 to March 7. Balenciaga, which has been quiet since coming under fire for ads featuring children posing with BDSM-inspired teddy bears, will go ahead with a show.

Nike sues Lululemon over alleged patent infringements. The activewear giant opened legal proceedings alleging that the Canadian sportswear brand’s Blissfeel, Chargfeel Low, Chargfeel Mid and Strongfeel sneakers infringe patents related to textile and other design elements of its footwear.

UK watchdog casts eye on Richemont deal to sell online retailer to Farfetch. Richemont, maker of Cartier jewellery and IWC watches has said it expects a €2.7 billion ($2.93 billion) write down related to the agreement in which Farfetch will initially acquire a 47.5 percent stake, in exchange for over 50 million Farfetch shares.

Ssense is the latest fashion company to reduce headcount. The Montreal-based e-commerce retailer laid off 138 employees last week, or 7 percent of its total workforce.

Rolex reseller Chrono24 cuts jobs as pre-owned watch prices fall. The company eliminated 65 jobs as it shifted the focus of its operations in the US to Miami from New York, and to Japan from Hong Kong in Asia, co-chief executive officer Tim Stracke said.

Matchesfashion secures £60 million support package from owner. Apax Partners, the private equity firm which acquired the luxury retailer in 2017, has agreed to inject £60 million ($74.2 million) into the business, a spokesperson for the company confirmed Monday.

Swatch Group raises prices for Omega SpeedMaster watches, following Rolex’s lead. The conglomerate increased the cost of the flagship Omega Speedmaster by about 7 percent in the UK and Europe, according to investment bank Jefferies.

Canada Goose cuts annual forecasts due to Covid-related disruptions in China. The Toronto, Ontario-based company cut its fiscal 2023 sales expectations to about C$1.18 billion ($886 million) to C$1.20 billion, compared with its prior forecast of C$1.2 billion to C$1.3 billion. Analysts expect an annual revenue of about C$1.24 billion, IBES data from Refinitiv showed.

Billionaire Cohen builds stake in Nordstrom, urges board shakeup. The investor would like to replace at least one director on Nordstrom’s 10-member board, according to people familiar with the matter.

Zara to start charging Spanish shoppers for returning items bought online. Customers in Spain will now have to pay €1.95 to return an order, unless they take it to a brick-and-mortar shop or third-party drop-off points where returns remain free. The fee applies for all Inditex brands, which include Pull & Bear and Massimo Dutti, according to a company spokesperson.

THE BUSINESS OF BEAUTY

Kering creates new beauty division. Former Estée Lauder executive Raffaella Cornaggia has been named CEO of the unit, which will develop beauty for the French group’s brands, including Bottega Veneta, Balenciaga and Alexander McQueen.

Sephora responds to claim its clean beauty programme is anything but. The LVMH-owned beauty retailer asked a federal judge to dismiss a lawsuit alleging its “Clean at Sephora” designation is false advertising.

Estée Lauder expects smaller fall in 2023 sales on resilient demand. Analysts expect China’s move in early December to relax Covid curbs and lift some travel restrictions to benefit luxury and beauty companies that had flagged a hit to sales in the country from its strict zero-Covid policy. The conglomerate is also seeing strong demand in skin care and fragrance.

E.l.f. Beauty raised its full year 2023 outlook. The beauty company expects sales between $541 million and $545 million, up from an earlier outlook of between $478 million and $486 million.

Highsnobiety launches beauty vertical. The publisher will bring its youth-centric POV to the beauty space with a dedicated section, launching Feb. 2.

LVMH, L’Oréal among suitors for stake in Aesop. Japanese beauty group Shiseido Co. is also studying a potential bid for an interest in Aesop, the people said, asking not to be identified discussing confidential information.

Eurazeo quietly sold stake in Pat McGrath Labs in 2021, BoF has learned. Eurazeo Brands, a division of the publicly traded Paris-based private equity, sold its stake in the beauty brand after investing $60 million in 2018 — a deal that valued the company at $1 billion.

Ariana Grande to buy beauty brand assets for $15 million. The agreement to purchase r.e.m.’s physical assets, including existing inventory, from Forma Brands is valued at roughly $15 million. The transaction needs approval from the judge overseeing the bankruptcy case, according to court documents filed on Jan. 27.

PEOPLE

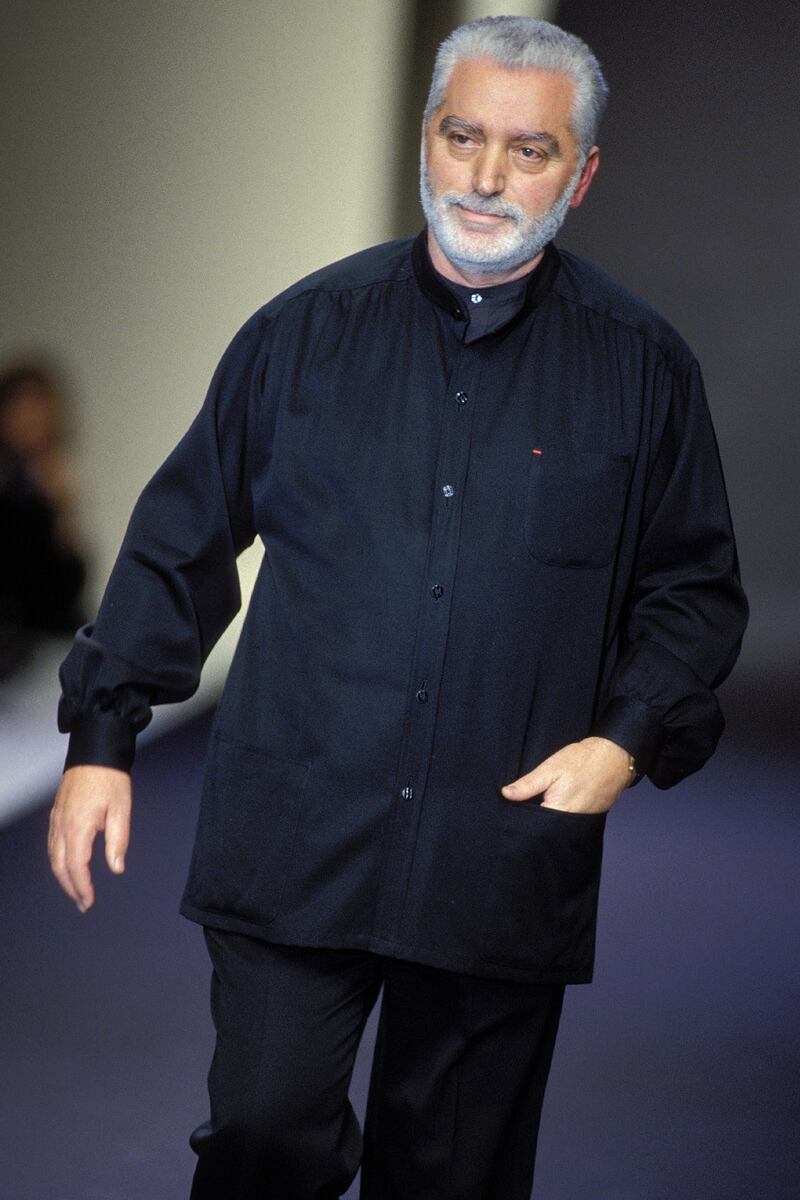

Paco Rabanne dies at 88. The Spanish designer best known for his Space-Age aesthetic, use of metallics and swift-selling fragrances had been out of the public eye since his retirement in 1999.

Creative director Ruba Abu-Nimah departs Tiffany & Co. The designer joined the brand as a jewellery outsider in March 2021, reporting to Alexandre Arnault, executive vice president of product and communications, following LVMH’s takeover in January.

Kim Kardashian’s Skims hires first chief commercial officer. The shapewear, intimates and loungewear label has recruited Robert Norton, formerly president of Moncler Americas, to the newly created role, the company confirmed in a LinkedIn post Monday.

Kohl’s names Kingsbury as permanent CEO. The executive has served as the retailer’s interim chief since December, after CEO Michelle Gass left Kohl’s for jeans maker Levi Strauss & Co.

Diesel CEO Eraldo Poletto departs. Poletto joined as CEO of North America in January 2022, then succeeded Massimo Piombini on July 1. A successor has yet to be named.

Liam Osbourne appointed managing director of Dazed Studio. Osbourne will lead commercial strategy for Dazed Studio, and work with the AnOther Magazine, Dazed, Dazed Beauty and Nowness teams. He’ll be charged with growing the team across the US and Europe.

MEDIA AND TECHNOLOGY

Meta forecasts upbeat first-quarter revenue, shares rise. The parent of Instagram and Facebook forecast revenue between $26 billion and $28.5 billion, compared with analysts’ average estimates of $27.14 billion, according to IBES data from Refinitiv. The upbeat forecast signalled a rebound in demand for digital ads after months of weak sales.

Snap forecasts first quarterly revenue decline; shares fall. Revenue is projected to drop 2 percent to 10 percent in the first quarter from a year earlier, the company said in a statement.

Amazon beats estimates for quarterly sales. The world’s biggest online retailer said it was expecting net sales of between $121 billion and $126 billion for the first quarter. Analysts were expecting $125.11 billion, according to IBES data from Refinitiv.

JD.com to shut Indonesia, Thailand shopping sites in focus shift. Alibaba Group Holding Ltd.’s biggest rival is pivoting its international business to supply chain management and warehousing; Indonesia will stop accepting orders from mid-February and all services will be stopped by the end of March, while JD Central in Thailand will cease its operations from March 3, according to statements on the businesses’ websites.

Compiled by Joan Kennedy.

The Swiss watch sector’s slide appears to be more pronounced than the wider luxury slowdown, but industry insiders and analysts urge perspective.

The LVMH-linked firm is betting its $545 million stake in the Italian shoemaker will yield the double-digit returns private equity typically seeks.

The Coach owner’s results will provide another opportunity to stick up for its acquisition of rival Capri. And the Met Gala will do its best to ignore the TikTok ban and labour strife at Conde Nast.

The former CFDA president sat down with BoF founder and editor-in-chief Imran Amed to discuss his remarkable life and career and how big business has changed the fashion industry.