The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Opens in new window

Opens in new windowAfter years of quiet and cautious growth, the secondhand market in China is finally catching fire.

The Paris-based Vestiaire Collective joins a growing number of resale companies to expand their services in the lucrative market. The company is in the process of building a tech hub in Shanghai to better service the fast-growing Asia Pacific market and China itself, which “will grow to become one of the most sophisticated markets for secondhand shopping,” said Baptiste Le Gal, Vestiaire’s APAC chief growth officer.

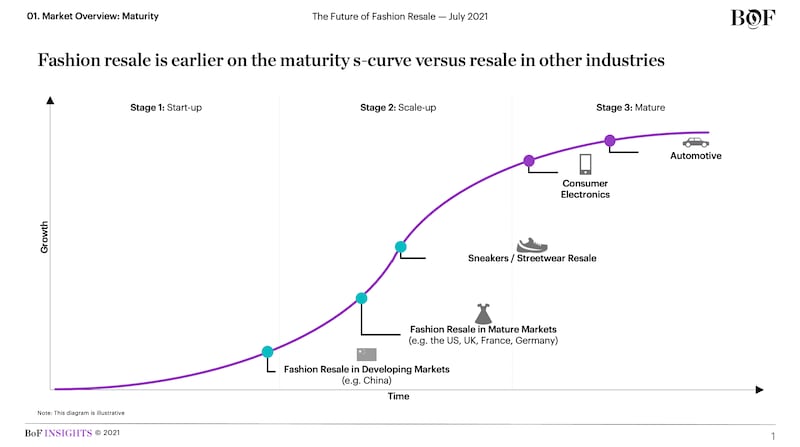

The majority of international resale platforms have yet to join the increasingly crowded and competitive resale arena in China, but opportunities are aplenty. Traditionally, Chinese consumers were wary of used clothing because of superstitions and concerns over counterfeit products. Today, these attitudes are changing, especially among young consumers who value the treasure hunt component of vintage shopping. And despite early fears that Covid-related hygiene concerns would dampen Chinese demand for secondhand luxury goods, the nascent market has grown significantly in the last two years.

The Chinese resale market, valued at 51 billion yuan ($8 billion) in 2020 by iResearch in a report released last November, will exceed 208 billion yuan ($32.8 billion) by 2025, the consulting group estimates. This growth can be largely attributed to local resale platforms like the Alibaba-owned Xianyu and luxury resellers Feiyu and Plum (known as Hongbulin to locals), which benefited from the e-commerce boom and rise of livestream shopping.

ADVERTISEMENT

For now, the market’s size, in relation to that of China’s growth-driving luxury sector as a whole, remains modest, especially when compared to the US and neighbouring Japan, which is among the most seasoned luxury resale markets. According to the iResearch report, secondhand goods make up only 5 percent of China’s luxury sector, while figures for the US and Japan stand at around 31 percent and 28 percent respectively.

For tech firms and brands in the space, this signals a major opportunity — but one fraught with serious challenges, including the ever-present issue of counterfeits in China. With one dominant player yet to emerge, how local and global resellers navigate this burgeoning landscape will shape what could become one of the biggest luxury resale markets in the world.

A Growing Secondhand Economy

China’s resale platforms saw business boom in the wake of the pandemic. In the luxury space, Shanghai-based GoShare2 (known locally as Zhi Er), which was founded in 2015, said its gross merchandise value (GMV) exceeded 1 billion yuan for the first time in 2020.

The space also welcomed a fundraising spree: Plum announced it raised “tens of millions” of dollars in a Series B round in December 2020, and other firms, including GoShare 2, Feiyu and Zhiyao, announced funding rounds in 2020 and 2021. In June alone, Feiyu raised nearly $30 million in a Series B round, while rival marketplace Ponhu raised $50 million in a Series C round.

And as one would guess, the country’s big tech players quickly followed suit. E-commerce giant JD.com launched resale in September 2021, while Alibaba invested in resale on several fronts. The juggernaut introduced a portal for Japanese resale marketplace Mercari on both Taobao and Xianyu, and launched top Japanese luxury resellers Daikokuya and Reclo on its cross-border platform Koala Haigou.

Companies like Plum, Feiyu, Zhiyao and GoShare2 are similar from Vestiaire Collective in that they generally manage everything from authentication to logistics, though photography and storage are often also part of the deal. That’s in contrast with marketplaces Xianyu (the main player in the overall C2C space) and Tencent-backed Zhuan Zhuan, which sell everything from pre-loved mobile phones to household appliances. TikTok’s local sister app, Douyin, has also just entered the space by introducing a channel devoted to selling secondhand goods.

In March 2020, Xianyu’s daily transactions hit a record high, and it saw newly registered users grow by almost 40 percent compared with the same period in 2019, according to a report published in Shanghai publication Sixth Tone.

ADVERTISEMENT

Beijing is also playing a part in the market’s growth. In July 2021, Beijing’s National Development and Reform Commission released its 14th Five Year Plan for the development of China’s circular economy, highlighting the need to promote and regulate China’s secondhand market as part of the country’s efforts in curbing carbon emissions, a Plum spokesperson told BoF.

Meet China’s Luxury Resale Shopper

According to Plum, over 80 percent of its sellers and buyers are women; millennial users dominate, though Gen-Z is gaining ground too.

“A lot of consumers who are selling or buying are among younger generations, and it’s not as if they were suddenly digitally savvy — they’ve always been,” said Iris Chan, a partner and head of client development at Digital Luxury Group. “But the opportunity in China [is in] that everyone from all generations has more comfort around the digital experience now.”

Though belt-tightening has been cited as a major driver for the wider rise of resale in the country, consumers may be more motivated by their interest in unique and scarce designer pieces, Chan added. Chelly Li, who heads the fashion business at Shanghai-based resale marketplace Deja Vu, said she noticed that as resale enters the mainstream, “niche” luxury brands like Loewe are becoming increasingly sought after on secondhand platforms.

Getting a bargain and sustainability are certainly draws, too. Bags are undoubtedly luxury resale’s leading category while jewellery and clothing lag behind, Li added.

Because China’s resale industry is still in its infancy, the lion’s share of listings Li sees are sourced from abroad, whether that’s purchases made during trips to Europe or through daigou agents. As the market grows, she expects domestic supply to further bolster circulation.

Barriers to Success

ADVERTISEMENT

The pandemic made it necessary for Vestiaire Collective to delay its China plans, according to La Gal. But it’s no secret that operations remain the main challenge for both global and native platforms.

Entering the market is complicated — especially when local players have had a head start. Le Gal’s priorities include adapting the Vestiaire Collective app to an experience tailored to Chinese users, and integrating it with China’s social media ecosystem and payment methods.

Shipping is another issue. Chinese consumers in cities and rural areas alike are accustomed to receiving orders in the nick of time — and that’s not to mention customs, taxes, and keeping up with a changing policy environment. The complexity of the market is an opportunity for native start-ups like Plum, according to the company.

There’s also the matter of authentication. In 2019, Chinese resale platform Isheyipai found that around 34 percent of luxury products it verified were authentic, and though authorities, marketplaces and a growing number of authentication services are making efforts to combat fakes, with wider adoption of e-commerce comes greater risks. According to Shanghai-based firm Daxue Consulting, some counterfeiters are even posing as authenticators online.

Vestiaire Collective plans to add more stringent measures to its existing authentication process in China, which involves pre-screening sellers and pre-authenticating items before a listing goes live, followed by authentication and quality control checks before it’s shipped to a buyer.

Today, consumers are generally more confident in the authenticity of new season goods purchased on major platforms thanks to ongoing brand partnerships with e-commerce players like Tmall, which Chan believes has indirectly boosted confidence in the resale space too. “[Shoppers] certainly have some concerns, still, but the same way I would [as someone in the US,]” said Chan.

As the Chinese resale market grows, brands too will likely want to participate as they have in the US and Europe. “Brands need to be their own saviour,” said Chan. “Authentication ultimately needs to come from the brand for that part to feel confident.”

CHINA NEWS FROM THE PAST WEEK

By Casey Hall

时尚与美容

FASHION & BEAUTY

Chinese Spokesperson for Bulgari, Bally Fined $16.6 Million for Tax Evasion

Actor Deng Lun, 31, was fined 106 million yuan ($16.6 million) for tax evasion following the discovery of irregularities in his reported income in 2019 and 2020. Before this scandal broke, Deng was a favourite spokesperson for brands including Bally, Bulgari, Roger Vivier and L’Oréal. (BoF)

Chinese Sportswear Giant Li Ning Sees Revenue Rise 56.1% in 2021

The brand reported 2021 revenue of 22.57 billion yuan ($3.55 billion) and gross profit of 11.97 billion yuan. The company’s operating cash flow also rose 136 percent year-on-year to 6.53 billion yuan, boosted by improved inventory, accelerated growth in offline retail and increased revenue from distribution channels. (BoF)

科技与创新

TECH & INNOVATION

Mytheresa Partners With JD.com in China

The German luxury e-commerce company has joined the Chinese e-commerce giant, launching an official e-boutique on its platform. The online store offers luxury brands such as Alaïa, Balmain, Roger Vivier, Versace and designer brands like Marine Serre, Lemaire and Ganni. All the products will be directly shipped from Mytheresa’s Munich headquarters with Mytheresa providing 30-day free returns and Chinese customer service. (BoF)

Tech Crackdown Comes for Douban

The Cyberspace Administration of China has sent a special task force to the offices of popular social media platform Douban in an effort to rectify “serious online chaos”. This marks yet another escalation of Beijing’s ongoing drive to control internet content and probably also the end for the relatively open and liberal discussions that the platform is known for among its 200 million users. (South China Morning Post)

消费与零售

CONSUMER & RETAIL

China’s Retails Sales Beat Estimates for First Two Months

Retail sales grew by 6.7 percent year-on-year for the January and February period, topping expectations of analysts polled by Reuters for growth of just 3 percent from a year ago. The country’s National Bureau of Statistics attributed the better-than-expected growth to consumer demand around the Lunar New Year holiday and interest in Winter Olympics-related products, as that event took place in Beijing last month. (CNBC)

政治,经济与社会

POLITICS, ECONOMY, SOCIETY

Shenzhen Lifts Lockdown, Shanghai Disney Closes as Restrictions Tighten

The southern business and tech hub re-opened for business after a week-long lockdown, while China’s most populous city further closed as it battles to contain its biggest outbreak of Covid-19 in two years. More than 35 million nucleic acid tests were administered to Shanghai residents between Wednesday and Sunday of last week, but as of Monday, more businesses and tourist sites, including Shanghai Disneyland, had closed to help prevent the spread. The Chinese mainland has been recording between 1,500 and 3,000 cases daily over the past few days, the majority of cases seen in the northeastern province of Jilin. (Associated Press)

China Suspends Expansion of Pilot Property Tax Trial

The move to halt the expansion of China’s property tax trial is seen as a way for the government to stabilise the property sector that has been suffering from a debt crisis. It also goes some way to answering questions about how far President Xi Jinping is prepared to push in order to fast-track his marquee “common prosperity” policy. The introduction of a property tax would be one of the main ways to tap the wealth of China’s richest, who have disproportionately benefited from the countries prolonged property boom. (Caixin)

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to our Shanghai-based Asia Correspondent casey.hall@businessoffashion.com.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.