The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

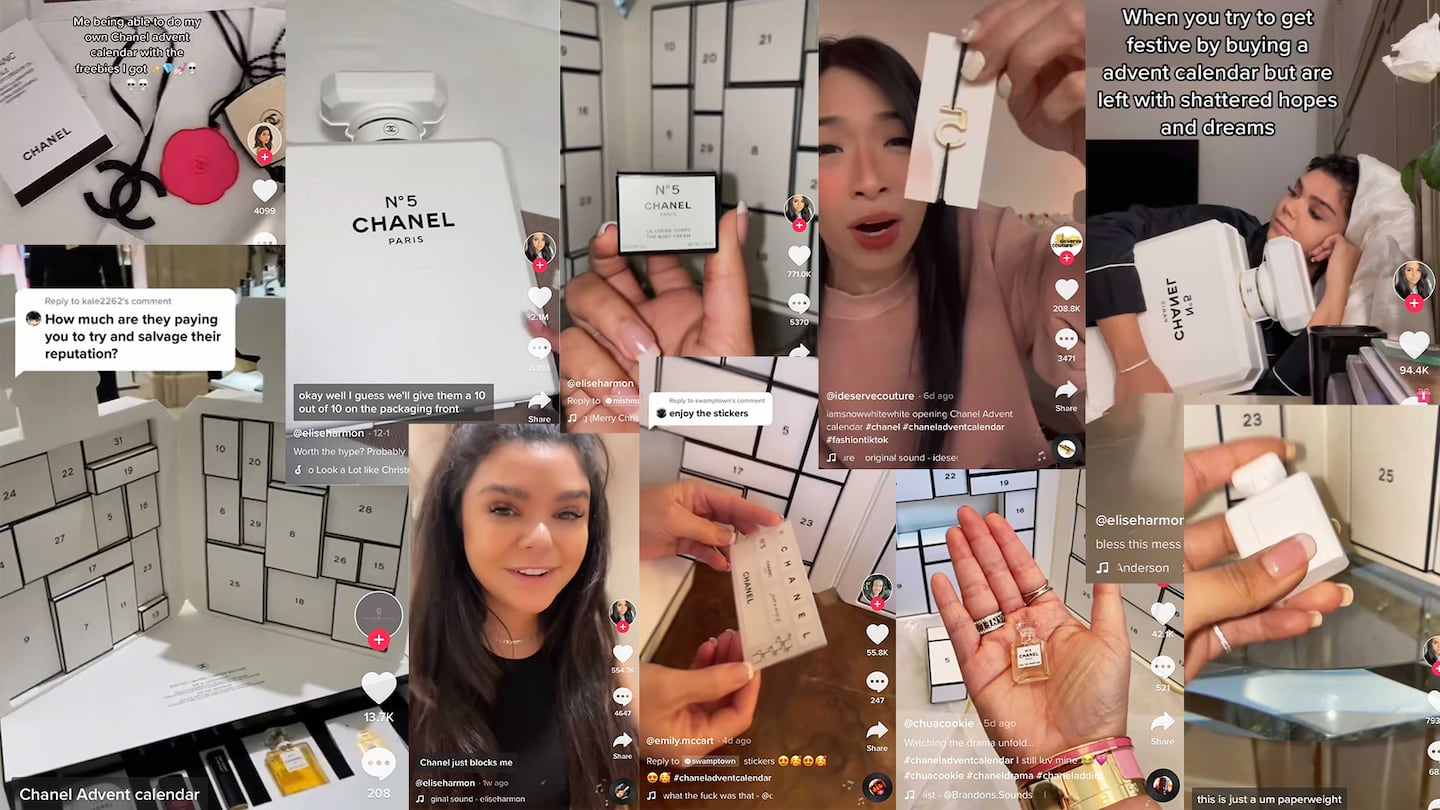

This week, Chanel was in the headlines for all the wrong reasons.

The French mega-label staged its latest Métiers d’Art showcase in Paris on Tuesday. But the hotter topic by far was TikTok influencer Elise Harmon’s series of videos railing on the company for a $825 holiday advent calendar containing what she, and many of her followers, considered underwhelming items, like a dust bag and miniaturised beauty products.

“I’m pretty sure this is enough cream for my left arm,” she said in one of the videos, pinching a teeny jar of body creme de corps between her acrylic-glazed fingers. By Friday, the posts had been viewed over 54 million times.

Chanel’s PR strategy was to play it cool, brushing off the criticism. The company’s president of fashion, Bruno Pavlovsky, called the episode a “regrettable misunderstanding,” suggesting that the real value of the calendar was not in its contents but in its “unique and remarkable” perfumed-shaped box.

ADVERTISEMENT

A misunderstanding, perhaps, but one that underscores a wider disconnect between luxury brands and the increasingly powerful TikTok.

The platform is fast-moving, featuring videos that capture user attention only for a brief period, and Chanel has a powerful brand, so the incident may soon blow over. It’s not over yet, however. The vitriol has spilled onto other platforms and users are still raging. “Maybe I can get some fashion scraps in next year’s advent calendar :),” Instagram user @henriebrooke sniffed under a recent Chanel post featuring director Sofia Coppola.

It doesn’t help that Chanel is inactive on TikTok, meaning it is missing opportunities to populate the platform with more positive messages. But traditional branded content doesn’t perform nearly as well with TikTok users as raw material. And Chanel is by no means alone in its wary approach to a platform that many luxury peers see as a crude, lowest-common denominator and ultimately challenging context for their closely managed images.

And yet, TikTok’s influence has only grown, especially with the Gen-Z customers who drive a growing portion of luxury sales. Luxury brands need to figure out how to make the platform work for them, even if they don’t have complete control.

Some engage TikTok influencers through gifting. It’s a start. However, they must go further and dream up new ways to embed positive stories about their brands within the platform, considering the very specific formats that do best, from beauty tutorials and lip-syncing bits to community “challenges” and clips focused on sounds.

The #PradaBucketChallenge, for instance, has generated over 8 billion views since its October launch. TikTok star Tinx’s “Rich Mom Starter Pack: Brentwood Edition” featured a tongue-in-cheek appearance by Gwyneth Paltrow, whose Goop brand epitomises the lifestyle the creator simultaneously embodies and mocks. The post has generated over 325,000 views, while most of Goop’s Instagram videos rack up less than 50,000.

To deliver these kinds of successes, brands need to experiment. For its recent Métiers d’Art showcase, for example, Chanel might have published clips as simple as models prepping backstage. (The #gettingready hashtag has over 560 million views.) Or, the brand could have leveraged users’ love of ASMR, posting a TikTok of a demo the brand staged at the Métiers d’Art event featuring a craftsperson from Chanel-owned atelier Lemarié cutting feathers into petals, sewing them into flowers and then arranging them in a trompe l’oeil pattern on a dress.

For decades, luxury brands have relied on consumers to drive sales of entry-level products like lipsticks and fragrance in high volumes. The halo of the runway and airbrushed advertising campaigns may have once been enough to keep luxury brands shiny in the eyes of these shoppers. Brands when perception is increasingly influenced by TikTok, luxury houses must engage or risk being left behind.

ADVERTISEMENT

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

Private equity firm L Catterton sets $7.8 billion fundraising goal. The LVMH-backed firm is pitching a buyout fund — which would fund transactions in which the firm takes a controlling stake of a business — to investors, hoping to raise $6.5 billion, The Wall Street Journal reported.

Rent the Runway falls after projecting sales below estimates. The clothing rental brand slipped in late trading after reporting a revenue projection that fell short of estimates in its first quarterly earnings since going public.

Farfetch eyes resale expansion with Luxclusif acquisition. The deal will bolster Farfetch’s suite of white label services for industry clients as the e-commerce giant aims to ‘really own the category and the opportunity.’

Nike tries to ban imports of Adidas knit shoes, accusing it of copying designs. The sportswear giant filed a complaint at the International Trade Commission in Washington on Wednesday, saying a wide range of Adidas AG Primeknit shoes copy Nike’s patented inventions for knitted fabric that reduce waste without a loss in performance.

Kim Jones debuts his pre-fall 2022 collection for Dior Men in London. The show, which took place at the Olympia Exhibition Centre, showcased Jones’ latest Dior collection, which is infused with the spirit of the Beat Generation, especially Jack Kerouac and his watershed novel “On the Road.”

London to skip January fashion week as Covid concerns loom. The British Fashion Council cited “uncertainties arising from Covid-19,″ as the reason for not hosting an official event next month. In 2022, the BFC will hold three co-ed fashion week events, from Feb. 18-22; Jun. 11-12; and Sept. 16-20. The format will continue to be a digital-physical hybrid, the BFC said.

ADVERTISEMENT

Patek Philippe and Tiffany & Co. announce the last-ever Nautilus 5711. Earlier this year, Patek Philippe president Thierry Stern announced the company was discontinuing its most sought-after watch. On Tuesday, the two brands revealed a final version of the model in Tiffany’s signature blue.

SMCP ownership battle heats up amid illegal stake transfer claim. On Wednesday, major shareholders claimed a 16 percent stake in the French fashion group was illegally transferred to an offshore account. A meeting to force a boardroom reshuffle has been called for next month.

Billionaire-backed FabIndia seeking $500 million in IPO. The clothing and furniture retailer plans to file preliminary documents for an offering of as much as $500 million, according to people familiar with the matter.

UK retailer Frasers profit jumps on strong reopening after lockdown. The British sportswear and fashion group reported a 61.7 percent rise in first-half core earnings, as the brand pursues an “elevation” strategy to take its business upmarket.

THE BUSINESS OF BEAUTY

Nestlé trims L’Oréal stake with $10 billion sale. Nestlé SA said on Tuesday it would cut its stake in L’Oréal to about 20 percent by selling shares worth €8.9 billion ($10 billion) back to the French cosmetics brand, moving to reduce the weight of the beauty giant on its books for the first time in seven years.

Pharrell Williams’ Humanrace launches in Dover Street Parfums Market. The skincare label will sell its rice powder cleanser, lotus enzyme exfoliator, humidifying cream, body bars and ceramic dishes, as well as product refills, at the Paris outpost of Dover Street Parfums Market (DSPM), which Williams calls “the kingdom of fashion.”

PEOPLE

Lanvin taps Theory executive Siddhartha Shukla as deputy general manager. France’s oldest couture house has named Siddhartha Shukla, Theory’s chief marketing officer and chief merchant, to be its new deputy general manager. Shukla will report to the brand’s chairwoman Joann Cheng and work alongside Grace Zhao, deputy general manager for Asia.

Alibaba shakes up management with CFO, commerce heads reshuffle. The Chinese e-commerce giant’s deputy chief financial officer Toby Xu is set to replace its long-standing CFO, Maggie Wu, along with leadership changes in its commerce businesses. The moves mark Alibaba’s most notable management changes since surviving a bruising antitrust investigation.

Fossil Group names senior vice president, general manager, Fossil Brand. Former Neiman Marcus executive Melissa Lowenkron will be responsible for brand strategy, product design and marketing in the newly-created position. In turn, Steve Evans, executive vice president and chief brand officer, will focus on Fossil Group’s other owned and licensed brands, which include Diesel, Emporio Armani, DKNY and Puma.

Calvin Klein taps Pete Davidson for latest marketing experiment. The American sportswear brand, best known for its logo-stamped underwear, allowed the comedian access to its Instagram account, changing its profile image to a photo of the SNL star.

MEDIA AND TECHNOLOGY

SellerX taps Sofina, BlackRock for funds at $1 billion valuation. The L Catterton-backed, Berlin-based firm, which acquires online retailers in hopes of shaping a new consumer conglomerate, raised $500 million in new debt and equity financing to buy e-commerce brands and expand its stable of businesses selling goods on Amazon. The round was led by Sofina.

Compiled by Joan Kennedy.

Editors Note: This article was updated on 11/12/2021. A previous version called SellerX an LVMH-backed firm. That is inaccurate. SellerX is backed by LVMH and Groupe Arnault’s joint-venture private equity firm, L Catterton.

Brands from Valentino to Prada and start-ups like Pulco Studios are vying to cash in on the racket sport’s aspirational aesthetic and affluent fanbase.

The fashion giant has been working with advisers to study possibilities for the Marc Jacobs brand after being approached by suitors.

A runway show at corporate headquarters underscored how the brand’s nearly decade-long quest to elevate its image — and prices — is finally paying off.

Mining company Anglo American is considering offloading its storied diamond unit. It won’t be an easy sell.