The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

As incoming chief executive Jonathan Akeroyd prepares to lead Burberry into the next chapter of the “brand elevation” journey it started two decades ago, he should focus less on the possible departure of designer Riccardo Tisci (my grandmother used to say: “everyone is useful, nobody is indispensable”) and more on the strategic steps Burberry must take to fulfil its upmarket ambitions.

Predecessor Marco Gobbetti is leaving Burberry with much to its credit. And yet the task he took up remains incomplete with plenty of fundamental elements still to be fixed.

Burberry’s new aesthetic is more in tune with the current streetwear zeitgeist. And yet it is not very original or deeply rooted in the brand’s heritage. Our analysis reveals several styles taken from Tisci’s former employer Givenchy. This suggests there is work to be done.

Burberry appears to have given up on its Britishness to embrace a more neutral and younger identity. Here, we don’t see a strong original take but rather a whiff of me too, a formulaic re-invention, rather than a bold one. More original and deeply rooted creative content — a modern re-interpretation of Burberry’s core DNA — could drive traction.

ADVERTISEMENT

The challenge is to distill down what it means to be British today, integrating the most vibrant, modern and globally relevant traits of the British character. Alexander McQueen has been able to overtake Burberry on Chinese social media by leveraging traits such as craftsmanship and tailoring. Let’s hope today’s un-British Burberry is only a fleeting phase in the brand’s evolution from old British to “new British.”

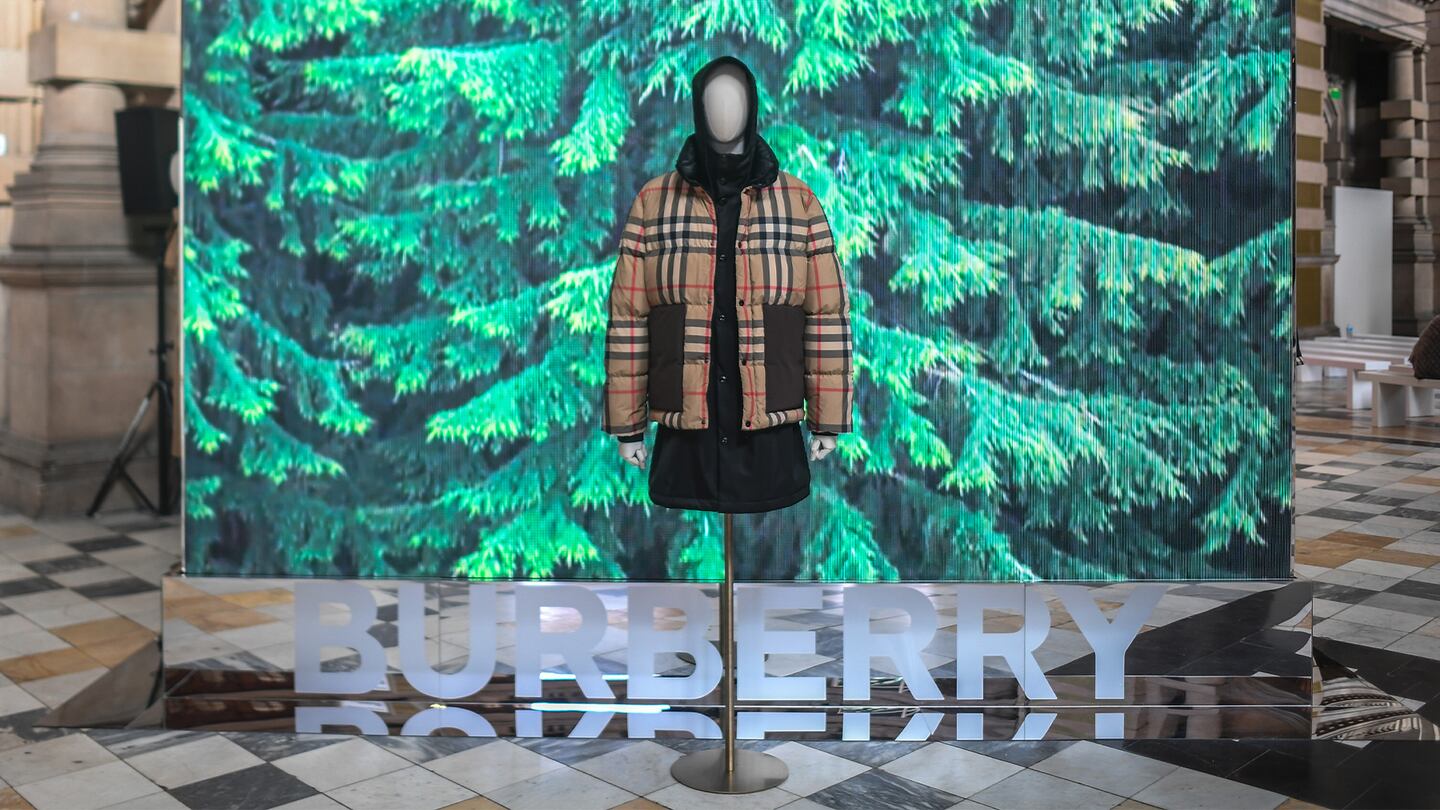

When it comes to the product mix, Burberry’s iconic trench coat has been priced to perfection and only slightly tweaked from a design viewpoint. But trench coats struggle to take centre stage in luxury’s new world. In fact, they are not the best fit with current casualisation and streetwear trends: our analysis shows that they are a distant third in the outerwear category — behind down jackets and leather jackets — in generating interest from consumers.

Burberry has succeeded in elevating its leather goods, but it is still far behind mega-brand peers like Louis Vuitton, Gucci or Prada. Burberry’s brand DNA is in rainwear, not in leather goods. It is therefore always going to be difficult for Burberry to sustainably command the same price in handbags as specialists in this category, no matter the investment in Tuscany to produce prototypes internally and gather more accurate costing information.

Burberry has eliminated in-store discounts and now has a tighter grip on full-price distribution, yet its off-price exposure is still above that of its European peers. We estimate that Burberry is dependent on off-price for approximately 30 to 40 percent of its sales and probably more than 50 percent of its profits.

Here, Burberry seems to sit halfway between the “full-price” model of European peers and the “off-price” model of American accessible luxury players. Resorting to off-price can be attractive short-term, but sets the brand on a slippery slope: the more one discounts in off-price, the less consumers will be prepared to pay full-price in flagship stores. Price discipline is critical if Burberry’s brand elevation ambitions are to be credible.

It is time for Burberry to again choose which way it’s really going: up or down. Unsurprisingly, Burberry was at some point attractive to America’s would-be luxury conglomerates, with the idea of turning it into a British Coach or Michael Kors. Going down this path would possibly generate higher cash flows and profits for a while, but would unwind all of the progress done so far and U-turn Burberry on its 20-year elevation journey.

But moving upmarket won’t come without sacrifice: elevation demands giving up on profitable but low quality business. This may be likely to weigh heavily on Burberry’s performance for a while, especially if it comes without solid consumer traction and brand momentum.

Luca Solca is head of luxury goods research at Bernstein.

Burberry Names Jonathan Akeroyd New CEO. The appointment of Versace chief Akeroyd comes four months after current Burberry CEO Marco Gobbetti announced his departure to Salvatore Ferragamo, leaving the British brand’s turnaround only partially complete.

The British brand is still lagging luxury rivals as outgoing chief executive Marco Gobbetti prepares to handover responsibility for its years-long turnaround to current Versace chief Jonathan Akeroyd.

The designer’s task at Burberry has been to create a strong new identity for the brand. His latest collection, infused by life under the ocean, highlighted just how tricky that challenge is.

The Coach owner’s results will provide another opportunity to stick up for its acquisition of rival Capri. And the Met Gala will do its best to ignore the TikTok ban and labour strife at Conde Nast.

The former CFDA president sat down with BoF founder and editor-in-chief Imran Amed to discuss his remarkable life and career and how big business has changed the fashion industry.

Luxury brands need a broader pricing architecture that delivers meaningful value for all customers, writes Imran Amed.

Brands from Valentino to Prada and start-ups like Pulco Studios are vying to cash in on the racket sport’s aspirational aesthetic and affluent fanbase.