The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

NEW YORK, United States — The explosion of the global luxury market over the last decade has rewarded its top players handsomely — the margins on a $1,500 T-shirt or a $170 paperclip can be quite generous. But the growth in the market raises a question about what it means for an item to be luxury: Is it exclusive? Is it truly luxe? Or is it just expensive?

Dita, an eyewear brand more than two decades old, is testing the limits of the category. In July, the company will start selling eyewear that costs anywhere from $1,800 to $4,500. That's well beyond the brand's typical $400 to $700 price tag, and several times more than the most expensive pair of shades offered by Chanel or Celine.

The company only expects to sell a few hundred pairs, on which it will “barely break even,” said Creative Director Dustin Edward Arnold. Rather, the eyewear’s out-of-this-world price is meant as a proof of concept for a new category of ultra-expensive products and services the brand has dubbed “Epiluxury.” That might include $300 lipstick or $100,000 per night hotel rooms where Dita and its partners can add value to justify the price — but likely not office supplies.

“Could an $800 dog bowl be considered luxury? Are designer dumbbells luxury? What about a $2300 ruler? Does price make it luxury?” Arnold said, later adding: “We wanted to create a segment of products to redefine what luxury is ... functional performance, engineering technology, artisan craftsmanship, timeless design, and personal exclusivity. "

ADVERTISEMENT

The company isn’t the first to hit upon the idea of charging obscene prices to the global 0.1 percent. Bugatti makes one-of-a-kind $12.5 million supercars; Richard Mille timepieces run as much as $750,000 and offer bragging rights to its owners (most recently, a colloquial flex courtesy of one Rafael Nadal); and then there is Hermès’ Birkin bag, costing anywhere between $10,000 and nearly $400,000 for a version in exotic leather, and shoppers are subject to a lengthy waiting list.

Could an $800 dog bowl be considered luxury? Are designer dumbbells luxury? What about a $2300 ruler? Does price make it luxury?

And it’s not just eye-popping price tags that luxury brands are using to court the ultra-rich; French jewelry house Boucheron invited top clients to stay overnight in a one-bedroom apartment with Eiffel Tower views between shopping trips at its reopened Place Vendôme flagship, one of a growing variety of experiences brands offer to select customers.

These brands are all competing for a lucrative sliver of the $1.3 trillion luxury market, which grew by five percent in 2018, according to Bain. Rising income inequality is swelling the ranks of ultra-high-net-worth individuals (commonly defined as anyone with at least $30 million to their name). Data analysis firm Wealth-X estimates there were 255,810 people in this category globally in 2017, up 13 percent.

Even as they invest more in experiences and customer service for their biggest customers, mainstream luxury brands haven’t added new lines of ultra-luxe products. Prices of luxury goods are on the decline, as brands strive to appear more inclusive and court millennials with limited spending power. On Net-a-Porter, for example, the maximum price for footwear has fallen dramatically over the past year, according to Edited, a data analytics platform which tracks retail prices globally.

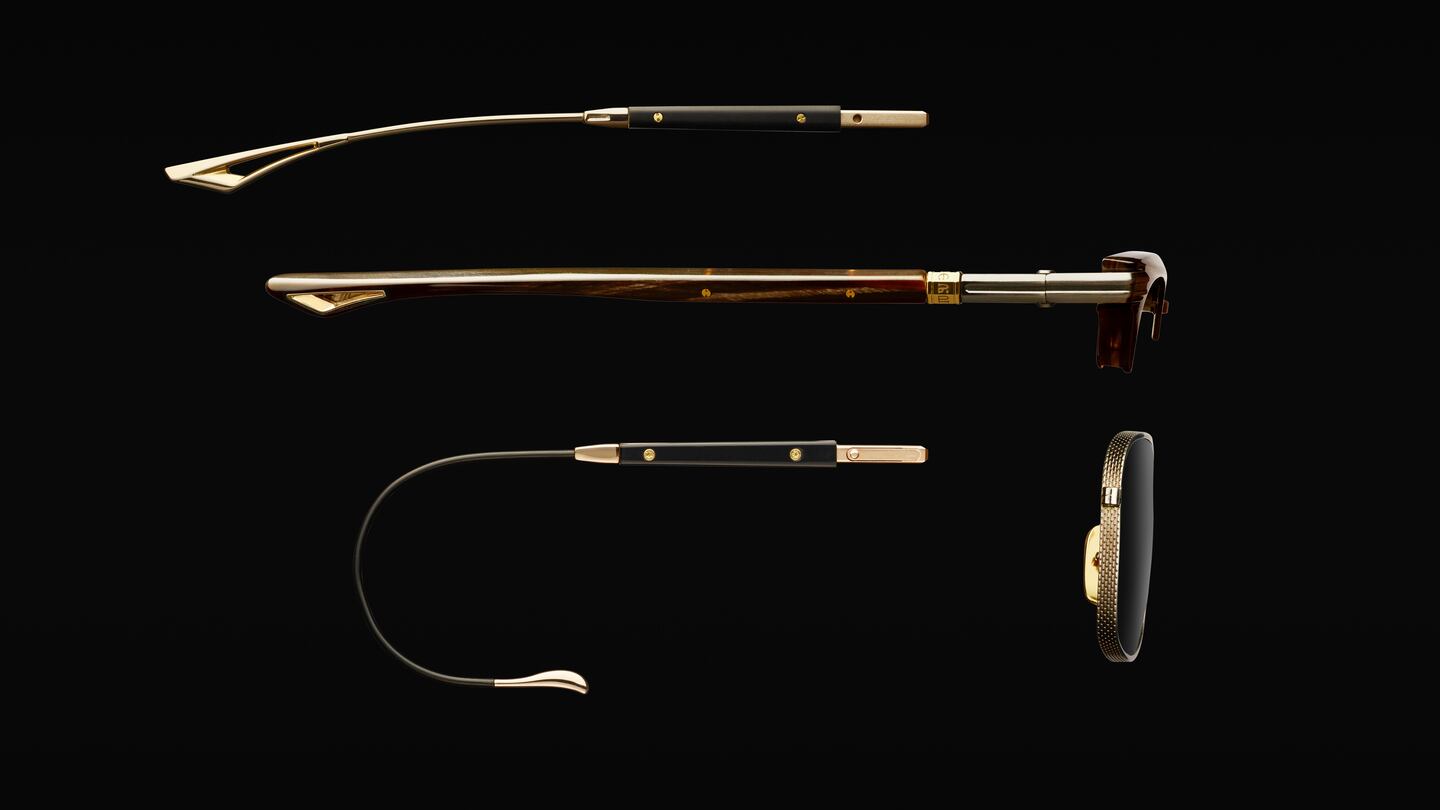

Manufacturing costs for ultra-luxe items tend to be high, involving rare and expensive materials in limited production runs. To create its $4,500 glasses, Dita had to create new machines and manufacturing processes to produce its eyewear, Arnold said, adding that “the project is not about making margins, it is about making something special no matter the cost.”

Where prices are rising is for timeless pieces, such as men’s suits, which customers view as an investment they plan to wear for the rest of their lives, said Kayla Marci, an Edited analyst. Experts say brands can justify an ultra-high price point through a combination of craftsmanship and exclusivity. Otherwise, such products amount to little more than expensive marketing gimmicks and white elephants.

“If epiluxury is going to ... meet the test of time, then those products have to go beyond pure aesthetic or [being] a work of art,” Milton Pedraza, CEO of the Luxury Institute, tells BoF. “If [it] doesn’t have anything that is truly unique and credible with consumers, then I think epiluxury is not sustainable. If it does, I’d like to see the compelling proof.”

The Vertu phone, for example, released in 2013 for a retail price of $10,000 boasted a “polished titanium case with leather accents and a ‘virtually scratch proof’ sapphire crystal screen.” But the device’s innards weren’t so different from other smartphones on the market. It bombed.

ADVERTISEMENT

And as luxury items become democratised in their availability regardless of price, the existential question of whether it qualifies as true luxury is tested. The Birkin, for example, risks losing its exclusive cache as bags become widely available in the resale market, said Elysze Held, who has for decades worked as a stylist and personal shopper for luxury clients, including celebrities and ultra-wealthy individuals.

As for Dita’s eyewear? The frames are made of sustainably-sourced horn from Asian water buffalo (harvested once the animal dies naturally, the company said), wood and beta titanium among other precious materials, temples made with 21 individual pieces and interchangeable modular components. Dita is limiting production to 200 of the flagship pieces and 500 from the core collection, to be sold online as well as through wholesale partners and some of the brand’s stores.

The second I see something on an influencer, it's just no. Ugh, no.

Held said the uber-rich think nothing of dropping $45,000 on a few items in a two-hour shopping spree, but don't always chase trends or favour the most well-known names. Even as companies like Gucci and Louis Vuitton go logo crazy, her clients increasingly prefer luxury labels that eschew conspicuous branding, including Brunello Cucinelli and Valextra. They tend to make purchases based on word of mouth; an influencer touting a product on Instagram is a turnoff.

“You’ve got 20 influencers with a bag, and do you know what that says? It says free bag,” Held said. “The second I see something on an influencer, it’s just no. Ugh, no. My clients would rather be comfortable than trendy anyway.”

Nick Fouquet, who founded his eponymous luxury millinery business in 2013, relies on customer referrals and curiosity to build his brand. Fouquet's hats, with a signature matchstick in the brim, typically range from $600 to $1,800, though a custom Montecristi-style topper could run $20,000. Clients include actress Diane Keaton, Mötley Crüe's Mickey Six and rapper Ty Dolla Sign, though Fouquet insists, "I don't think we're exclusive to people who are just super fucking rich."

“For a long time, hats were really undervalued, it was overlooked,” Fouquet says. “The truth is, I didn’t just come in and invent a really crazy high price point. These hatters in Colorado and Wyoming and Montana have been making these high-end handcrafted hats at this price point for years. I just brought it to a more high-fashion arena.”

Related Articles:

[ How Luxury Brands Are Courting the UltrarichOpens in new window ]

[ Op-Ed | How Premium Mediocre Conquered FashionOpens in new window ]

The Coach owner’s results will provide another opportunity to stick up for its acquisition of rival Capri. And the Met Gala will do its best to ignore the TikTok ban and labour strife at Conde Nast.

The former CFDA president sat down with BoF founder and editor-in-chief Imran Amed to discuss his remarkable life and career and how big business has changed the fashion industry.

Luxury brands need a broader pricing architecture that delivers meaningful value for all customers, writes Imran Amed.

Brands from Valentino to Prada and start-ups like Pulco Studios are vying to cash in on the racket sport’s aspirational aesthetic and affluent fanbase.