The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Hello BoF Professionals, your exclusive 'This Week in Fashion' briefing is ready, with members-only analysis on the key topic of the week and a digest of the week's top news.

Fashion platform Farfetch plans to go public on the New York Stock Exchange, according to filings made this week with the US Securities and Exchange Commission. It’s a major financial milestone for the fashion technology unicorn, whose founder and chief executive, José Neves, has long acknowledged that a public offering was the logical next step for the company.

Unlike luxury e-tail competitors that operate a traditional wholesale model, buying and pushing out merchandise to customers, Farfetch is a marketplace that connects consumers with a global network of boutiques and brands, taking a commission on sales.

Sources say Farfetch plans to IPO at a valuation greater than $5 billion, making it one of the highest-valued fashion-tech companies in the world — on par with Yoox Net-a-Porter (YNAP), which was acquired by luxury conglomerate Richemont earlier this year in a deal that valued the business at €5.3 billion, and more than Matches Fashion, which sold to private equity firm Apax for over $1 billion last September. (According to market sources, Farfetch's valuation was between $3 billion and $3.5 billion in June 2017, when the company inked a partnership with China's JD.com, which invested $397 million in the company).

ADVERTISEMENT

As for the IPO, the actual number of shares to be offered and their price remain unknown. But the company's registration statement, filed on form F-1 with US regulators, contains a trove of previously undisclosed information on the company's operations and financials, along with risk factors like whether the company would be able to generate sufficient revenue to be profitable.

BoF breaks down the most interesting revelations buried in the 250-page document.

1. Farfetch is losing a lot of money. Revenue is growing faster than costs, but not by much. In 2017, revenue hit $386 million, up from $242 million in 2016, but costs also grew significantly, resulting in a loss of $112 million last year, more than the $82 million the company lost in 2016. The company has raised a total of $701.5 million. Since 2015, Farfetch has lost a total of $255 million and losses are growing each year on an absolute basis. Losses per share have also been growing, from $2.21 in 2016 to $2.62 last year. Investors will be gauging whether the platform can truly scale revenues faster than costs — and reach profitability.

2. Losses per share may explain why Farfetch chose to list in the US. America is more receptive to loss-making companies. In Silicon Valley, which has a much higher appetite for risk than start-up ecosystems elsewhere in the world, it's much more common for investors to back loss-making companies. Yet personal styling service Stitch Fix, which went public on NASDAQ last year, made a much smaller loss of just under $1 million on sales of $977 million in its fiscal 2017, and its stock price has doubled since the company exceeded Wall Street estimates on revenue and profit.

3. Farfetch is making massive technology investments. This partly explains the scale of the losses. Technology spending by the company was $31 million in the six months ending June 30, 2018, up 178.9 percent from $11.1 million in the same period in 2017. At the end of 2017, Farfetch had 802 full-time data scientists, engineers and product employees — 35 percent of total headcount. Key learning? It takes an army to build a powerful technology platform.

4. Farfetch's marketplace business is by far its biggest. The company generates revenue from white-label solutions for brands; boutiques that sell on the Farfetch marketplace (by far the largest contributor); fulfillment services; and Browns in-store revenue. Farfetch is largely using Browns to test out its platform for brick-and-mortar technology dubbed "Augmented Retail." In-store revenue has nearly tripled since they bought the retailer in 2015, from $6.9 million that year to $15.4 million last year. But so have losses: Browns lost $3.2 million in 2015, and $8.2 million last year. And ultimately Browns remains a very small slice of the overall Farfetch pie.

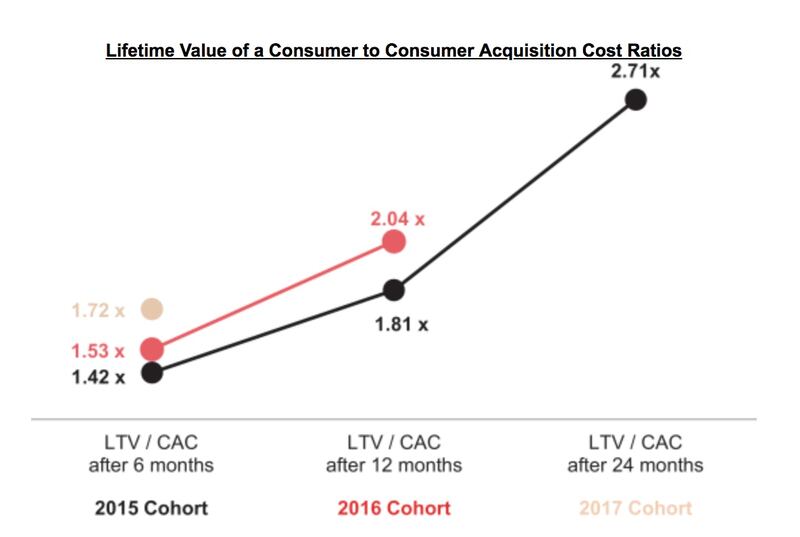

5. Farfetch is growing LTV/CAC. This is a critical ratio that investors use to assess how the lifetime value of a new customer compares to the cost of acquiring them. According to its F-1 filing, this metric is moving in the right direction for Farfetch, as the company has been able to lower customer acquisition cost and increase lifetime value. What's more, for cohorts of customers joining the platform in 2015, 2016 and 2017, the payback period on customer acquisition cost has been consistently less than six months and more recent cohorts have better LTV/CAC ratios.

Source: Farfetch's F-1 filing with the US Securities and Exchange Commission

ADVERTISEMENT

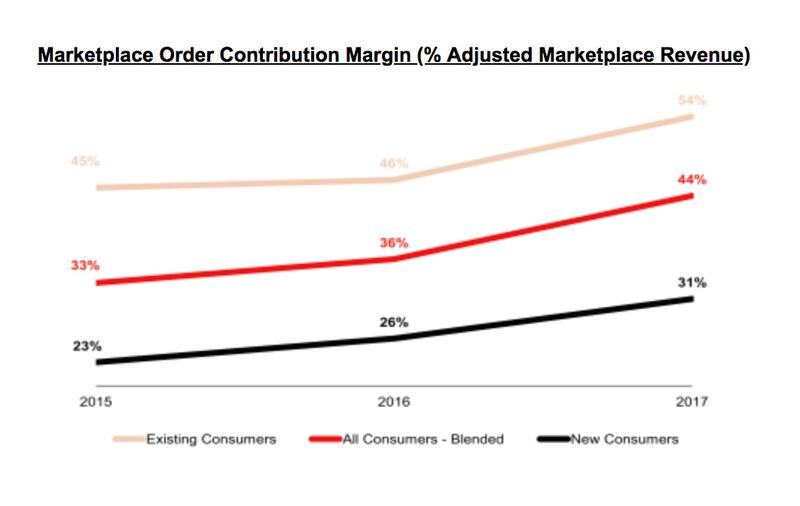

6. Marketplace order contribution margin is growing healthily. As Farfetch has increased the proportion of its business derived from existing consumers, driven by higher retention rates and order frequency, it has also seen a corresponding increase in blended order contribution margin attributable to its marketplace over time, driving overall platform order contribution margin. This would seem to bode well for profitability if the company's cost base doesn't continue to rise.

Source: Farfetch's F-1 filing with the US Securities and Exchange Commission

7. Farfetch is a truly global platform. The company expected significant growth in new customers to come from emerging markets, including China, the Middle East, Latin America and Eastern Europe. Farfetch ships to 190 countries and, already, more than 90 percent of orders are cross-border.

8. Top 1 percent of customers drive 20 percent of sales. For comparison, Net-a-Porter says 40 percent of its sales come from the top-spending 2 percent of customers. What's more, over 50 percent of Farfetch consumers are Millennials, and the company says the remainder have a "millennial mindset," meaning they embrace technology, self-expression and brand storytelling.

9. José Neves will maintain considerable control. Farfetch's a dual-class voting structure will give the Farfetch founder considerable influence over the company's decision-making and limit the power of public shareholders over corporate matters, including a change of control. Neves will hold Class B ordinary shares, entitled to 20 votes per share, while other investors will hold Class A ordinary shares, entitled to only one vote per share. This is not dissimilar to Mark Zuckerberg's control of Facebook.

10. Farfetch board members include major industry figures. The likes of Net-a-Porter founder Natalie Massenet, Condé Nast International chairman Jonathan Newhouse and JD.com founder Richard Liu sit on the Farfetch board, alongside venture investors including Danny Rimer and Frederic Court.

So, what happens next? Farfetch will take its show on the road to court institutional investors with a price range for its shares. But only when the bell rings on the New York Stock Exchange will the markets speak and Farfetch’s valuation be revealed. Stay tuned.

THE NEWS IN BRIEF

ADVERTISEMENT

BUSINESS AND THE ECONOMY

Helmut Lang Spring/Summer 2018 | Source: InDigital

Helmut Lang pivots strategy amid layoffs. The brand, controlled by Uniqlo-owner Fast Retailing, is shrinking its operations in a bid for profitability. Earlier in August the label began a series of layoffs affecting up to 40 employees. Its product range will also be whittled down, with a renewed focus on denim. While the collection will not become unisex, one design team will oversee both the men's and women's offering.

Urban Outfitters posts fourth straight quarter of sales growth. Second quarter same-store sales overall rose 13 percent in the quarter that ended July 31. All three of its brands — Anthropologie, Free People and its namesake chain — posted double-digit results that exceeded estimates, led by 17 percent growth at Free People.

TJ Maxx retains investor appeal as sales accelerate. Comparable sales at the company rose 6 percent, three times higher than analyst estimates. The discount-store chain has avoided much of the pain experienced by its competitors, and hasn't posted a drop in comparable-store sales since 2009. Its store count reached 4,194 last quarter, which ended August 4.

Target's second-quarter sales jump. Second-quarter same-store sales at Target were higher than estimates, rising 4.9 percent. Online sales rose 41 percent, up from a 32 percent rise a year ago and above the 28 percent rise in the first quarter. Revenue rose to $17.78 billion, topping the average estimate of $17.31 billion. Shares of the chain have risen more than 27 percent so far in 2018 and over 47 percent in the past 12 months.

Mulberry shares bruised by House of Fraser collapse. The luxury leather-goods maker, which operates 21 concessions in House of Fraser department stores, will set aside £3 million ($3.8 million) for costs from the department store's entry into administration (a document released by EY shows that the brand was owed £2.41 million by House of Fraser before it went into administration.) Mulberry's shares fell as much as 30 percent, the most intraday since 1998.

Tamara Mellon plots expansion. The direct-to-consumer footwear brand is opening its first brick-and-mortar store in Los Angeles after a $24 million Series B funding round, which brings the total amount of capital raised by the brand to $37 million. While the company declined to disclose financial results, it says the brand grew threefold in the first half of 2018 and has an average order value of around $700.

PEOPLE

Phillip Picardi | Source: Phil Oh

Phillip Picardi exits Condé Nast. Teen Vogue's 27-year-old chief content officer will join Out, an LGBTQ-focused magazine, as its editor-in-chief. His successor has not yet been named. Along with former Teen Vogue editor-in-chief Elaine Welteroth, Picardi transformed the struggling publication into cultural hit known for its social activism and progressive politics. He also founded the publisher's first LGBTQ media platform, THEM.

Kendall Jenner angers modelling community. In the latest issue of Love magazine, Jenner said: "Since the beginning we've been super selective about what shows I would do ... I was never one of those girls who would do like 30 shows a season or whatever the fuck those girls do." Several models including Daria Strokous, Teddy Quinlivan, Marine Deleeuw, Jac Jagaciak and Amber Witcomb have voiced their offence, noting that it was essential to many models' livelihoods to book as many runway shows as possible.

Victoria's Secret Pink CEO steps down. Denise Landman will retire at the end of this year. Amy Hauk, head of merchandising and product development at Bath & Body Works, will replace her. Shares in parent group L Brands fell as much as 5.8 percent to $30.60 in late trading. The results stoked investor fears that the company's lingerie business won't improve in the second half of the year.

Bill Cunningham's memoir revealed. The beloved fashion and society photographer, who died in 2016, left behind a written memoir, which nobody knew he had written. The memoir, titled "Fashion Climbing," a reference to his early years ascending a fashion ladder invisible and disreputable to his stern Catholic family, will be published next month.

MEDIA & TECHNOLOGY

Alibaba's revenue jumps 61 percent. Revenue at China's biggest e-commerce company climbed to 80.9 billion yuan ($11.8 billion) in the three months ended June. Net income slid 41 percent to 8.7 billion yuan, topping the 7.6 billion yuan projected after taking into account an increase in affiliate Ant Financial's valuation. Adjusted earnings per share came in at 8.04 yuan, versus the 8.19 yuan estimate.

Threads Styling raises $20 million. The London-based personal shopping firm will use the new funding — led by fashion and millennial-focused fund C Ventures, with participation from Highland Europe (which also invested in MatchesFashion) — to expand its business across the board: hiring more stylists, engineers and other staff to bolster the 90 who already work for the business.

Glamour builds on its Women of the Year Awards. The magazine is expanding its annual awards and summit into a three-day event with interactive elements accessible to consumers, part of Condé Nast's goal to find new revenue sources. The event will be the first hosted by editor-in-chief Samantha Barry, who succeeded Cindi Leive in the top role at the American women's title in January.

Amazon starts selling fashion, sportswear in Brazil. It will offer over 300,000 products ranging from Havaianas flip flops to Levi's jeans, as well as some local high-end fashion brands like Reinaldo Lourenco. The fashion brands and other articles will be delivered by the third-party vendors offering them, rather than Amazon itself.

BoF Professional is your competitive advantage in a fast-changing fashion industry. Missed some BoF Professional exclusive features? Click here to browse the archive.

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.