The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Search for “the world’s most beautiful makeup” on YouTube and one brand will repeatedly appear: Chinese cosmetics label Florasis.

Known as Huaxizi in its native China, where it was founded in 2017 in the eastern city of Hangzhou (also the home of e-commerce giant Alibaba), Florasis has become increasingly visible on Western social media platforms, with videos of its intricately carved eyeshadow palettes and pictures of its laser-engraved lipsticks appearing on TikTok and Instagram and in YouTube makeup reviews from vloggers like Jeffree Star.

It’s not a coincidence: Seeding product with influential Western beauty influencers is part of the first steps the brand is has taken to sell outside of China. Last year, the brand launched a global website that ships to 40 countries worldwide, as well as joined e-commerce platforms such as Amazon Japan, and Shopee and Lazada in Southeast Asia, to reach those markets.

“I think we have achieved a bit of momentum over our social media [internationally] ... [but we] just started last year, so we are pretty new, we are like a baby in the global market,” Maggie Han, director of international business at Florasis, said.

ADVERTISEMENT

It isn’t the only C-Beauty brand with its eyes on an international prize. Perfect Diary, the Chinese direct-to-consumer unicorn has seen its innovative use of Chinese social media platforms and superior “xingjiabi” (the Chinese term for price to quality ratio) make waves in the Southeast Asian market. Less than a year after launching on Shopee, the region’s top e-commerce marketplace, Perfect Diary ranked first for beauty sales in the Vietnamese market, the cosmetics sales category for Singapore and in terms of loose powder sales in the Philippines.

Chinese fragrance brand To Summer (known as Guan Xia in Chinese) and Wendy Yu’s Yumee, a high-end cruelty-free cosmetics brand launched last year, also confirmed to BoF they are readying for international expansion, with the latter saying it’s in talks with international luxury retailers.

“I do have strong confidence that Yumee can grow internationally,” founder Wendy Yu said, though she is also cognisant of the need to grow the business domestically and to expand beyond its current product line of five SKUs to make it happen. “Of course, we need to do things step by step first,” she said.

These are brands that have risen fast and, in some cases, have found phenomenal success in their home country. (Neither Florasis nor Perfect Diary were prepared to break out international sales revenue or growth rates for their international business when asked by BoF.) But they have yet to prove whether the rest of the world, having already embraced Asian beauty brands in the K-Beauty and J-Beauty tradition, is ready to hop aboard the C-Beauty bandwagon.

“For China, there is definitely a there’s a very mixed impression externally, outside of China of what brand China means,” said Elisa Harca, co-founder and Asia chief executive of Shanghai-based digital marketing agency Red Ant. “While we know that internally brand China is something to be proud of, externally, brand China is something that’s very divisive.”

Home Market Rise

The success of brand China within China itself is a relatively recent phenomenon. Only a few years ago, China’s beauty market, which set to double from its 2019 valuation to reach $145 billion by 2025, according to Goldman Sachs, was dominated by foreign giants such as L’Oréal and Estée Lauder, as well as Japanese and Korean skin care brands.

Things changed very suddenly when, during 2018′s Singles’ Day Festival, Perfect Diary (a brand founded in Guangzhou in 2015) topped the cosmetics category on Tmall. Since then, Chinese brands have increasingly topped cosmetics and beauty sales rankings in the country.

ADVERTISEMENT

By April 2021, the total gross merchandise value (or GMV, a commonly used metric indicating value of sold goods) of Chinese beauty brands reached $2.6 billion, the first time local brands surpassed international competitors in online GMV, according to an analysis from investment bank Huachuang Securities. Brands like Florasis and Perfect Diary began topping Estée Lauder’s sales in the country. On Chinese TikTok, Douyin’s e-commerce arm, nine of the top 10 selling beauty brands were Chinese in 2021. (Foreign brands still play a major role in the market, however: By Singles’ Day 2021, L’Oréal was once again topping Tmall’s cosmetics sales rankings.)

The reasons for the rise of C-Beauty brands in China in essence boil down to the right brands coming onto the market at the right time, offering people a compelling proposition. More Chinese women, particularly younger Chinese women, began experimenting with more colour cosmetics products. And these same consumers also have less hang-ups about buying local brands than their predecessors (for whom Chinese brands denoted poor quality), and in fact, were increasingly embracing a “guochao” (or China Tide) trend that branded overtly Chinese elements in fashion, beauty and entertainment as cool.

Florasis, in particular, a brand that now sees annual GMV top 5.4 billion yuan, overtly taps into Chinese beauty history for its aesthetic and ingredients and has released collections celebrating the beauty traditions of Chinese minority cultures, riding the wave of China pride to great effect.

This rise has lured a plethora of new players into the market with Chinese beauty KOLs and celebrities launching their own brands as well as the arrival of new specialist beauty companies.

“China [has been] deeply influenced by the Western beauty but, to be honest with you, we didn’t see many brands telling our own stories, so that’s why we wanted to do something for ourselves and create a brand that more deeply explores traditional Chinese culture,” Han explained.

A Strategic Shift

Florasis is convinced that the story of Eastern beauty’s historical traditions can resonate in the West, aiming first to gain traction in less price-sensitive markets such as North America, Australia, New Zealand and Europe because of its higher price point (the majority of its most popular products are priced at around $40 to $50). Perfect Diary, meanwhile, is concentrating its expansion on Southeast Asia.

“We’re not going to lose the identity of being a Chinese brand because everything we do, from the product development, the engraving, you see there’s a lot of elements that trace back to our Chinese origin, but we also don’t need to shout out about being a Chinese brand in every single communication,” Han said.

ADVERTISEMENT

“Brand China is something that’s very divisive.”

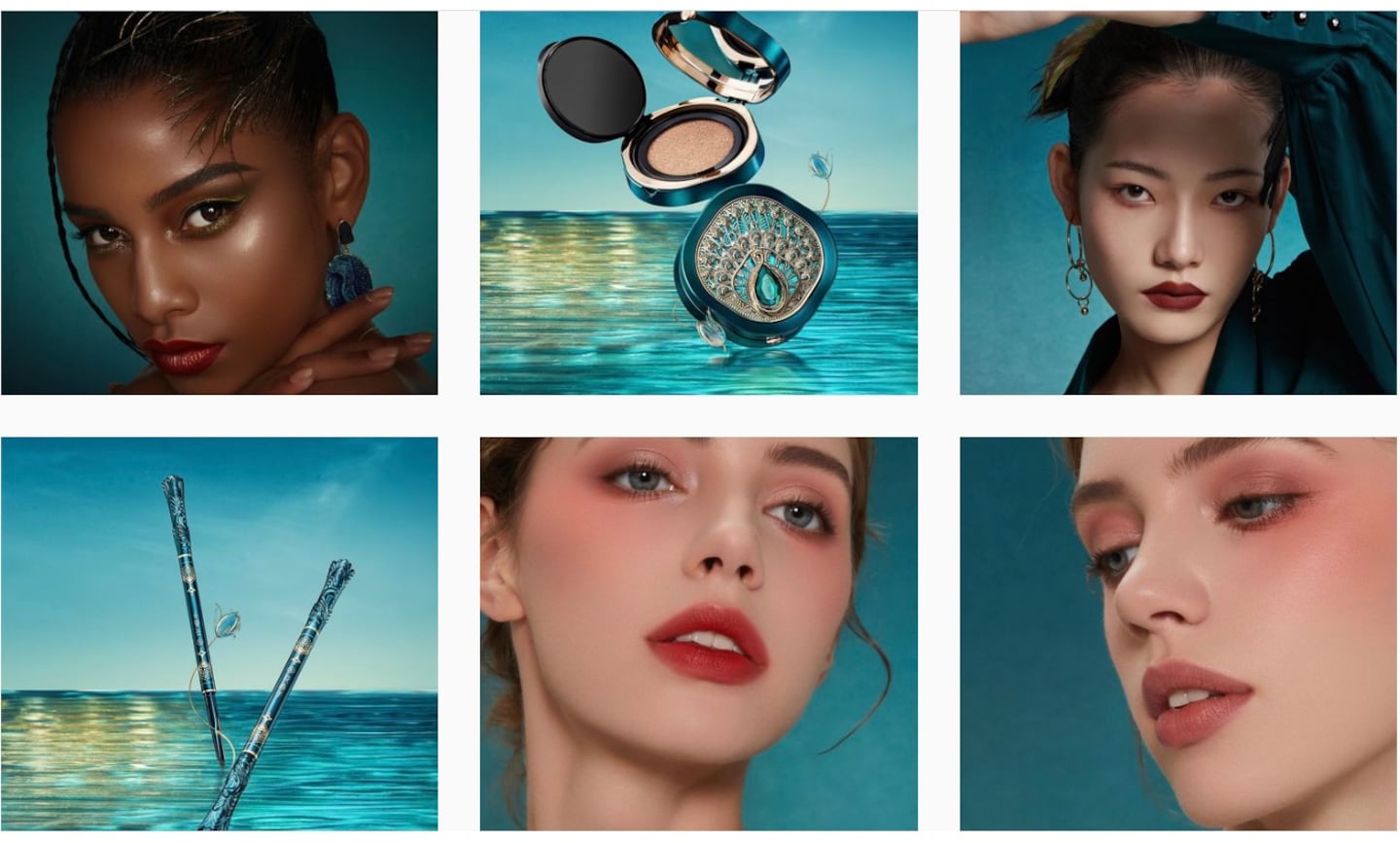

Indeed, even the brand’s Instagram account looks very different from its Chinese social media presence. Though some models it uses internationally are Chinese, the casting is far more diverse, with Black, Caucasian and Indian models also prominently featured, not only in an effort to confirm with the diversity demanded in the beauty world outside of China, but also to demonstrate that the “traditional Chinese” beauty the brand is known for can translate to a variety of ethnicities and skin types.

“Globally, people are always looking for something that is a unique take on beauty eye. The eye looks [from Florasis] are quite iconic and that’s very on trend globally, particularly for social media. These looks make them stand out from global competitors,” Harca said.

Lettie Tsang, Elle China’s beauty director, agrees, pointing out that in Japan, particularly, Chinese beauty looks, or “hualiu” have become a significant trend.

“It’s on the cover of magazines and looks very glamorous compared to the [traditional] Japanese make-up style which is very simple and natural and Florasis embodies this glamorous look,” Tsang said.

In Asia, too, C-Beauty brands have the advantage of similar preferences among consumers, she said. Perfect Diary has already proven adept at launching tweaks to its products for different countries within Asia, including releasing a greater variety of colours and launching oil control foundation in countries demanding that product line. Localised collaborations with Hello Kitty parent Sanrio have also proven popular.

In the West however, Tsang believes C-Beauty brands and fragrance brands such as To Summer are unlikely to be able to carve out more than a niche following. The market is saturated with competitors, and they will be unable to utilise native knowledge of Chinese social media platforms when faced with the alternate social media landscape of the West.

However, Harca said, C-Beauty players’ ability to work at “China pace” will be an advantage. The inability to keep up with Chinese brands has left international rivals seem flat-footed in the Chinese market in recent years.

“Chinese companies move so fast and pivot so quickly. They have a better way of testing, learning, failing fast and adjusting,” she said.

At the same time, however, brands like Florasis also seem to appreciate that they can’t expect the same kind of overnight success they achieved at home when they make the jump to selling abroad.

“This is the first time ever Chinese beauty brands are trying to compete in these established [Western] markets and we know it’s so competitive,” Han said. “We have only been established for five years, so we know there’s a long way to go but this is something we want to invest in long term.”

时尚与美容

FASHION & BEAUTY

Shanghai Fashion Week Postponed

The Autumn/Winter edition of China’s most important fashion week event was originally scheduled to be held from Mar. 25 to Apr. 1. New dates have not been announced. The postponement comes as China’s financial capital battles its most serious outbreak of Covid-19 since early 2020, dozens of new cases have been identified in Shanghai in recent days and various parts of the city have heightened restrictions. This is the second time Shanghai Fashion Week has postponed its event in recent years due to Covid-19 outbreaks. (BoF)

Yu Prize Finalists Announced

Brands including Louis Shangtao Chen, Yiran Tian and Private Policy are among the ten finalists in the running for the for the Yu Prize, which was founded by Wendy Yu in association with Shanghai Fashion Week and the Federation de la Haute Couture et de la Mode. First prize includes 1 million yuan ($158,000) prize money, in addition to a collaboration with sportswear brand Li Ning. (Press Release)

Perfect Diary Parent Yatsen Holdings Sees 2021 Revenue Rise 11.6 percent

The Guangzhou-based parent company of Perfect Diary and Eve Lom posted total net revenue of 5.84 billion yuan ($916.4 million) in 2021, a year-on-year increase of 11.6 percent. Meanwhile, the Chinese beauty group’s gross profit increased by 15.9 percent year-on-year to 3.9 billion yuan. In 2021′s final quarter, Yatsen reported a net revenue decrease of 22.1 percent year-on-year to 1.53 billion yuan. The fall was due to “soft consumer demand and intense competition in the colour cosmetics segment,” according to Huang Jinfeng, Yatsen’s founder, chairman and chief executive. (BoF)

科技与创新

TECH & INNOVATION

JD.com Posts Slowdown in Revenue Growth

The Beijing-based e-commerce giant posted a quarterly loss on the back of rising operational costs and its weakest revenue growth in 18 months. A slowdown in Chinese consumer spending has impacted its e-commerce sector, as consumers cut back on spending when it comes to non-essential categories. Last month, JD.com rival Alibaba posted its slowest year-on-year revenue growth for any quarter since its 2014 IPO. (BoF)

Weibo Sees 37 percent Profit Jump in 2021

China’s Twitter-like giant saw net profit of $428.3 million last year, the Beijing-based company said in its full-year earnings report. Revenue rose 34 percent to $2.3 billion, overwhelmingly generated by advertising and marketing. The company also warned that these business units are likely to see a slowdown this quarter as Chinese regulators increase their scrutiny of online content. (Yicai Global)

消费与零售

CONSUMER & RETAIL

Galeries Lafayette to Make Macau Debut

The store is one of six retail and lifestyle brands new to Macau that will anchor a five-star hotel and shopping precinct. The new development will be built on a site that was previously earmarked to be a casino, plans for which collapsed along with the business of previous owner, Genting Hong Kong. Hong Kong-listed Forward Fashion Holdings, which operates more than 200 self-operated stores in Greater China for brands including Stella McCartney, will manage the five-storey retail precinct. In a statement, Forward Fashion said the Galeries Lafayette store, the fourth in Greater China, will take up about 45,000-square-feet and is scheduled to open in the fourth quarter of this year. (BoF)

Swire to Open New Taikoo Li Shopping Mall in Xi’an

The real estate developer has announced its intention to open the fourth iteration of its fashion and lifestyle concept, Taikoo Li, in China’s ancient capital of Xi’an, a city in the country’s northwest. It will be the group’s seventh retail property in mainland China. The new Taikoo Li will be a retail-led project with a low density, open plan design, but will also include cultural facilities, a luxury hotel and serviced apartments. It is expected to be completed by the end of 2025 with a total gross leasable area of 269,000-square metres. (BoF)

Chanel, Hermès, Dior and Gucci Are Affluent Chinese Consumers’ Top Brands

The top ten list of favoured brands, as measure by an Agility Research survey of 2,000 affluent Chinese consumers also included Armani, Louis Vuitton, Balenciaga, Saint Lauren, Prada and Coach. (Press Release)

政治,经济与社会

POLITICS, ECONOMY, SOCIETY

Shenzhen Lockdown Raises Concerns About Manufacturing, Shipping Delays

The southern tech hub and its 17.5 million residents have entered a government-ordered lockdown that is expected to last at least a week, impacting local malls, manufacturing hubs and ports. Non-essential workers have been ordered to stay home, buses and subways are closed and non-essential stores (all except supermarkets, farmers markets and pharmacies) are shut. Express deliveries have been allowed to continue. Shenzhen is home to one of the world’s largest ports, fuelling concern the lockdown could cause further strain on global supply chains. (BoF)

China Sets 5.5 percent GDP Growth Target for 2022

China’s leaders, who met last week for their annual “Two Sessions” meeting of parliament, announced their aim to grow the country’s GDP by 5.5 percent this year. Although it’s the lowest annual target yet set by Beijing (the country began setting public GDP targets in 1994) it remains an ambitious target, particularly considering the macros economic headwinds facing the world’s second-biggest economy. Though China exceeded 6 percent growth in 2021, that growth was helped by statistical anomalies brought about by the pandemic, economists said. (Wall Street Journal)

Chinese Textile Industry Revenues Grow Over 12 percent in 2021

Both revenue and profits for firms surveyed by China’s Ministry of Industry and Information Technology recorded double-digit growth last year. Larger textile firms (classified as those with annual operating revenue of more than 20 million yuan, or $3.16 million) recorded profits of 267.7 billion yuan in 2021, up 25.4 percent year-on-year. The total operating revenue of the firms surveyed increased by 12.3 per cent year-on-year to reach 5.17 trillion yuan in 2021, according to the official data. (Fibre2Fashion)

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to our Shanghai-based Asia Correspondent casey.hall@businessoffashion.com.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.