The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

It was a nostalgic Paris couture week, as the industry mourned the loss of two fashion greats, designer Manfred Thierry Mugler and journalist André Leon Talley. One created spectacle, the other documented it.

An homage to that spectacle was on display here and there, with Schiaparelli’s Daniel Roseberry and Glenn Martens, in collaboration with Jean Paul Gaultier, turning out the sorts of showpieces that hearken back to what BoF’s editor-at-large Tim Blanks called “a golden era in fashion” in his tribute to Mugler.

More often than not, though, the shows were strictly business, featuring exceptionally constructed clothes that couture clients might wear beyond a gala or wedding.

“The focus was on wonderfully made dresses that oozed savoir faire and not needless flash,” wrote BoF’s Angelo Flaccavento. “In a kind of inversion, as ready-to-wear embraces entertainment in its many shades, sometimes at the expense of the clothes, haute couture, once the realm of unbridled dreams, is getting back to clothes-making.”

ADVERTISEMENT

What does that mean for fashion?

Before the ascent of ready-to-wear in the 1960s, couture was so practical that it could easily be copied by American retailers, who made cheaper versions for their customers. But as fashion houses began selling ready-to-wear, too, couture came to represent a fantasy: the tippy top of the luxury brand pyramid as popularised by Karl Lagerfeld at Chanel and typified by John Galliano’s Dior.

Lagerfeld’s former deputy, Virginie Viard, who became his successor, doesn’t make the grand, thematic gestures for which he was so well known. Lagerfeld’s couture helped market Chanel to the masses. They could only afford a swipe of nail polish or a spray of Chanel No. 5, but these products still projected the dream.

This season, Viard turned out dresses and separates in the house’s traditional tweeds, decorated with piped seams and gemstone closures. “Clean. Nice. Pretty. No bells and whistles. very Chanel,” fashion influencer Bryanboy said on Twitter. Her peer Maria Grazia Chiuri, who has helped transform Dior into a $7 billion juggernaut, was similarly restrained.

“The idea is that you should be able to wear Dior in every moment of the day,” Chiuri told BoF’s Robert Williams in a recent interview. “Women today, they go in the office, they take a train. They don’t have the same style of life as in the past. They want to take a walk — for me that’s important because it means to be free.”

In an era when events are cancelled every time a new coronavirus variant emerges, couture clients may indeed be looking to invest more in everyday clothes. Bringing the medium back down to earth may be the best approach for the mega labels, which are increasingly using their shows as selling, not just marketing, platforms. Ready-to-wear shows are marketing spectacles targeted at customers watching at home, but it’s not about the clothes, it’s about the production around the clothes and the celebrities in the front row, which plays out on social media.

But for smaller brands that do fewer shows, they need to make every moment count. Roseberry’s approach at Schiaparelli, with his three-dimensional concepts that pop off the body, is compelling enough to entice someone to visit Bergdorf Goodman or Dover Street Market and view his ready-to-wear collection for the first time. Or, better yet, buy one of his surrealist bags, which are distinctive, covetable — and wearable.

The most exciting way forward, then, might be a vision of couture that strikes a balance between the two. At Valentino, Pierpaolo Piccioli’s designs are majestic and cinematic, paying homage to the couturiers who came before him, while being conscious of cultural currents and societal change. Today’s fashion lovers still want to be transported, but they also want to be a part of the narrative. Showing people of all shapes, ethnicities and ages in his clothes elevated the craft in a new way.

ADVERTISEMENT

Because, if we lose fashion’s dream factory, we could lose fashion altogether.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

Breaking down LVMH’s sales boom. LVMH closed 2021 with sales that grew 14 percent compared to 2019′s pre-pandemic levels, far faster than the broader luxury market. Profits more than doubled from 2020.

Thom Browne and Tom Ford to skip New York Fashion Week. Browne will debut his Autumn/Winter 2022 collection with a New York show in April, a few days before the Met Gala. Ford’s planned NYFW show was cancelled due to pandemic-induced production delays. Images from Ford’s collection will now be released at a later date.

Kim Kardashian’s Skims doubles valuation to $3.2 billion. The reality star’s underwear label raised $240 million in its latest funding round and is expecting to hit sales of $400 million.

H&M CEO Sets Target to Double Retailer’s Sales by 2030. The fast-fashion giant’s ambitious new goal comes after the company’s latest profits beat expectations, but it’s also contending with intensifying competition from upstarts like Shein. H&M is also aiming to hit its sales growth target while halving its carbon emissions.

Ferragamo’s sales grow 31 percent in 2021. The leather goods maker’s revenue for the year came in at €1.14 billion ($1.27 billion), in line with expectations, but still well below pre-pandemic levels. With many rival luxury companies already out-performing their pre-Covid numbers, Ferragamo’s latest results illustrate the challenge ahead for new chief executive Marco Gobbetti.

ADVERTISEMENT

VF Corporation falls after cutting its revenue outlook. The owner of Vans and The North Face cut its full-year revenue forecast to $11.85 billion from $12 billion previously as it contends with slowdowns in international revenue, direct-to-consumer and digital sales.

Sales of LVMH’s Hublot, Bulgari watches top pre-pandemic levels. The luxury conglomerate’s watch brands pushed sales above 2019 levels in the past year, and expect more growth this year on strong US demand, reports Reuters.

Kering to sell Girard-Perregaux and Ulysse Nardin divisions; Swiss watch exports see record year. The French luxury goods group will sell the Swiss watch manufacturing brands to the management teams that run them. Meanwhile, Swiss watch export shipments rose 31 percent, led by booming demand in the US, which overtook China as the industry’s top market for the first time in more than a decade.

Tod’s sales jump 40 percent in 2021, beating expectations. The Italian fashion group’s revenues last year totalled €883.8 million ($997 million), just below pre-pandemic levels.

REI retail workers in New York unionise. Around 115 employees from the outdoor retailer’s Soho location filed to join the Retail, Wholesale and Department Store Union (RWDSU) on Friday, according to the New York Times. The group also asked the company to recognise the union — a move that wouldn’t require them to vote.

Report: Chinese Fashion Retailer Shein Revives Plan for New York Listing in 2022. The fast-fashion retailer’s founder is considering a citizenship change to bypass tougher rules for offshore IPOs in China, two people familiar with the matter told Reuters. If the offering goes ahead, it would be the first major equity deal by a Chinese company in the US since Chinese regulators toughened oversight in July.

Kohl’s under fresh pressure as Sycamore expresses interest following Acacia’s bid. The US department store may receive a second takeover offer as private enquiry firm Sycamore Partners prepares to make a bid days after a consortium backed by activist investor firm Starboard Value proposed buying the company, sources familiar with the matter told Reuters.

Victoria’s Secret sells stake in China business for $45 million. Hong Kong-based lingerie maker Regina Miracle International Ltd. will obtain a 49 percent stake in the business. Victoria’s Secret said it hopes the local partner will be able to help boost sales.

THE BUSINESS OF BEAUTY

Glossier lays off 80 employees. Chief executive Emily Weiss wrote in a letter to employees that Glossier had “got ahead of [itself] on hiring,” and “that strategic projects that distracted [it] from the laser-focus we needed to have on our core business: scaling our beauty brand.” The layoffs come after Glossier raised $80 million in a Series E funding round over the summer.

Farfetch to acquire Violet Grey. The financial terms of the deal were not disclosed and are awaiting approval by the Los Angeles-based beauty retailers’ existing shareholders, including Japanese conglomerate Shiseido.

Reliance industries to take on Nykaa with new beauty platform. The Indian conglomerate is gearing up to launch an omnichannel beauty platform jointly developed by the company’s recent acquisitions — retail tech start-up Fynd and e-pharmacy marketplace Netmeds — according to The Economic Times.

PEOPLE

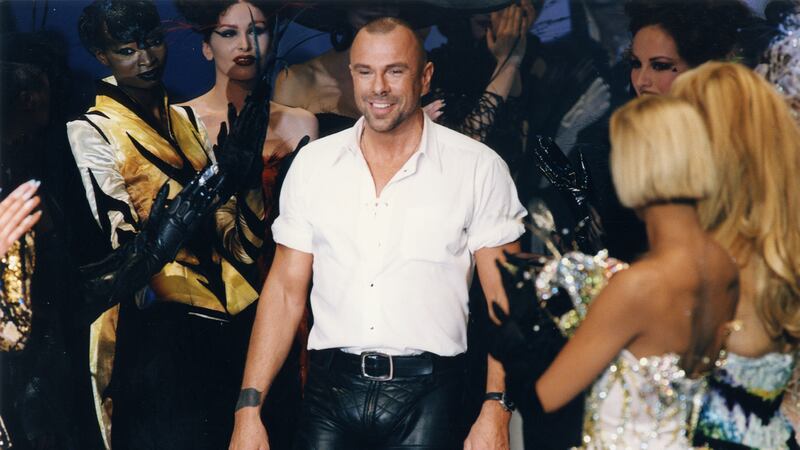

Manfred Thierry Mugler, fashion radical, has died. The pioneering designer, who was known for his metamorphic silhouettes and best-selling perfume Angel, passed away on Sunday at the age of 73.

Ras Baun Bartram succeeds Marc Goehring as 032c’s fashion director. The Danish stylist, who most recently worked with Ye, formerly known as Kanye West, on his “Heaven and Hell” music video, will join the media and fashion company, effective immediately. Goehring departs after four years leading 032c.

Hermès Beauty names creative director. Greek makeup artist Gregoris Pyrpylis will lead the development of the French luxury house’s beauty division. He will report to Agnès de Villers, president of Parfum & Beauté, and will work under the supervision of Pierre-Alexis Dumas, artistic director of Hermès.

Tatler names Sophie Pera creative director. Pera — who, at Vogue, rose to the role of associate fashion editor from assistant to editor-in-chief Anna Wintour, and went on to serve as senior fashion editor at Town & Country — will continue to lead Tatler’s fashion team in her new role. Priorly, she was Tatler’s fashion director.

Prada makes board-of-directors additions. Pamela Culpepper, co-founder of female-owned and led culture consultancy Have Her Back, and Anna Maria Rugarli, sustainability and corporate social responsibility expert, will join the Italian luxury company’s board as it looks to establish an ESG Board Committee. The appointments bring the board to a total of 11 members.

Diesel appoints chief executive, North America. Eraldo Poletto will lead the OTB-owned denim brand as it looks to scale its presence in the US and Canadian markets with new stores. Poletto has been chief executive of Tapestry-owned Stuart Weitzman since 2018 and has priorly served as managing director for Italian companies including Salvatore Ferragamo and Furla.

MEDIA AND TECHNOLOGY

L’Officiel Inc. acquired by Hong Kong’s AMTD International. The parent company of the 100-year-old French fashion and lifestyle magazine of the same name as well as a network of global divisions has been acquired by the Hong Kong-based financial service conglomerate.

China’s e-commerce hub faces Omicron flareup just before holiday. At least seven infections were detected in Hangzhou, a city near Shanghai and home to Alibaba Group Holding Ltd. and fintech giant Ant Group Co., raising concerns that cases may increase after one of the patients attended a company gathering along with several hundred people.

Compiled by Joan Kennedy.

The Swiss watch sector’s slide appears to be more pronounced than the wider luxury slowdown, but industry insiders and analysts urge perspective.

The LVMH-linked firm is betting its $545 million stake in the Italian shoemaker will yield the double-digit returns private equity typically seeks.

The Coach owner’s results will provide another opportunity to stick up for its acquisition of rival Capri. And the Met Gala will do its best to ignore the TikTok ban and labour strife at Conde Nast.

The former CFDA president sat down with BoF founder and editor-in-chief Imran Amed to discuss his remarkable life and career and how big business has changed the fashion industry.