The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

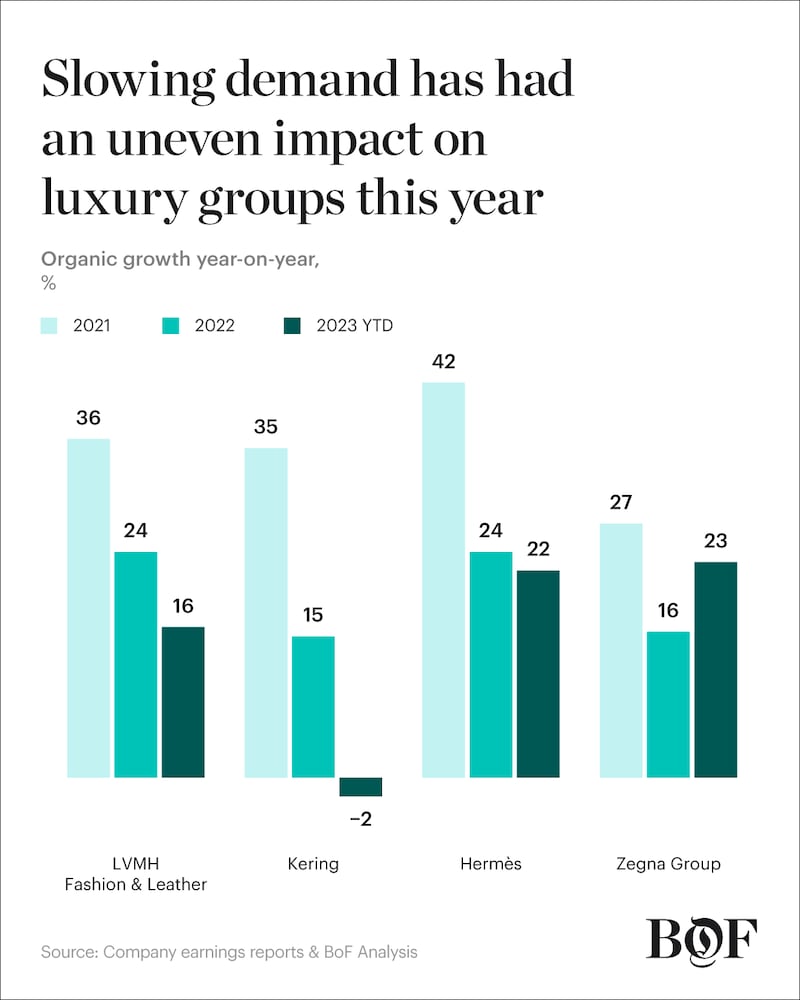

Last week, luxury sector bellwether LVMH reported third-quarter growth that was sharply down compared to the first half of the year in its key fashion and leather goods division, sending the group’s stock tumbling by more than 8 percent.

After demand for high-end items held strong during nearly two years of rising interest rates, depressed stock markets and slowing economic growth, the news that the sector’s biggest player, which owns Dior and Louis Vuitton, was now growing at less than 10 percent suggested luxury’s post-pandemic boom was ending.

This week, results luxury firms including Hermès, Kering, Zegna and Moncler confirmed the trend but painted a more polarised picture: blue chip Hermès’ continued to grow by double-digits with sales rising 16 percent in the third quarter, while Gucci and Saint Laurent owner Kering’s sales fell by 9 percent, sending shares to a five-year low.

Puffy coat-maker Moncler’s topline growth also slowed dramatically, from 24 percent in the first half to 7 percent in the third quarter, though a rapid shift away from wholesale skewed that figure. Sales in the group’s own stores rose as much as 18 percent.

ADVERTISEMENT

At Zegna Group, constant-currency growth at its namesake menswear line slowed dramatically from 18 to 6 percent. Still, strong performance at Thom Browne and adjustments to account for shifting licence agreements helped the group report another quarter of robust organic growth at 11.3 percent.

It’s clear that some luxury groups are doing much better than others. Why? Exposure to different customer segments, some of which are hit harder by the cost-of-living crisis than others, is a big part of the story. But that’s not the only thing in play. Let’s take a look at Hermès and Kering, this week’s winner and loser.

Hermès has gone from strength to strength in recent quarters, so the fact that it’s leading the pack should come as little surprise. A longstanding shortage of sought-after Birkin and Kelly bags continues to encourage customers to spend big bucks across the brand in an effort curry favour with sales associates.

To better supply those eager customers, the brand has reinforced its offer with a panoply of commercially appealing propositions across categories. While the brand still proposes more innovative items in its runway shows, its store buyers have learned to focus their merchandising on options that are ultra-relatable and ultra-recognisable (if still often logo-free): think Kelly fermoirs on shoes, fashion jewellery and mens’ bags; a fine jewellery division generously stocked with the house’s iconic anchor chain motif; and the steady expansion of its cosmetics unit.

But above all, Hermès’ core handbag offer, priced at the top of the market, appeals to customers less likely to shrink their fashion budgets in the face of macroeconomic instability. And even when top clients do pull back on spending, their annual offer of a “quota bag” from Hermès is often the last thing they cut.

Kering faces a different challenge after years of focusing on a more fashion-driven positioning that matched bold aesthetics and logo-heavy branding with prices a notch below key competitors. The group needs to adapt to two simultaneous trends: the “quiet luxury” boom that’s fuelling growth in demand for more discreet, logo-free brands like Zegna, Brunello Cucinelli and LVMH’s Loro Piana, and a macroeconomic climate in which aspirational luxury shoppers are under pressure.

For Kering, strategies for reaching wealthier shoppers — and for reassuring those less wealthy that they’re investing in a piece that won’t go out of style — are now critical.

The challenge has been well-documented at Kering’s flagship Gucci: bold designs like $650 low-top sneakers and $1,000 crossbody satchels were young luxury catnip, but the brand was slow to change up its approach after stagnating sales suggested that interest in previous designer Alessandro Michele’s kitschy vision had topped out.

ADVERTISEMENT

Under a new CEO, Jean-François Palus, and new designer, Sabato De Sarno, the brand is working to roll out a more broadly relatable fashion vision while also reinforcing its timeless, luxury credentials with expensive-looking, uncontroversial brand campaigns (Ryan Gosling with a heap of classic luggage; Paul Mescal in horsebit loafers). That plan will take time to show results.

The risks of depending too much on younger and less-wealthy luxury consumers were also apparent at Kering’s Saint Laurent, until recently one of the group’s most consistent bright spots. Retail sales fell 4 percent and overall revenue dropped 12 percent in the third-quarter on a comparable basis.

Saint Laurent designer Anthony Vaccarello’s stature as a fashion authority has steadily grown in recent years, but the prices, creativity and clout of the quilted crossbody bags that make up the brand’s commercial engine remain positioned well below the brand’s top luxury rivals: With middle-class and upper-middle class customers increasingly feeling the squeeze, luxury’s remaining spenders aren’t looking for junior Chanel.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

Hermes’ third-quarter sales defied the luxury slow down. Third quarter sales at Birkin bag maker Hermès rose briskly, at €3.37 billion ($3.60 billion) up 15.6 percent year-on-year, with the pace of growth slowing only slightly in a show of resilience of its wealthy clientele in spite of economic headwinds.

Kering lags behind luxury peers. Third quarter sales at the luxury French group fell 9 percent indicating the group’s struggle to cope with slowing demand. The drop in North America was particularly pronounced for the Gucci and Saint Laurent owner, with revenues falling 21 percent in the region.

Farfetch’s acquisition of Yoox Net-a-Porter stake gets EU approval. Under the agreement, first announced in August 2022, Richemont would sell a 47.5 percent stake in YNAP to Farfetch, with provisions for a full acquisition in the next three to five years.

ADVERTISEMENT

Moncler quarterly sales up 7 percent in line with analyst expectations. Thanks to growth in Asia and despite a decline in the Americas, total sales reached €670 million ($705 million) in the July-September period, matching an analyst consensus provided by the company.

New report details the inside story of the Adidas’ Yeezy debacle. A report from the New York Times, citing previously undisclosed internal records and information from former Adidas employees, detailed the extent to which the German sportswear giant sought to appease Ye, formally Kanye West, despite his increasingly combative behaviour.

Timberland owner VF Corp facing second activist push by Legion. Legion has amassed a stake in the Denver-based company and is urging it to divest some brands such as Timberland, the people said, asking not to be identified discussing private information. The size of Legion’s position isn’t clear.

Abercrombie and ex-CEO sued over sex-trafficking accusations. A group of once-aspiring models on Friday sued the retailer and its former chief executive Michael Jeffries, alleging that Jeffries used his position as the CEO to recruit men and invite them to castings at his homes where they were forced to take drugs and participate in sexual acts.

Rivals Temu and Shein shelve US court cases. The truce comes at a time when the global market share battle between the companies heats up. The joint declarations were filed in Chicago and Boston and did not contain details on whether settlements were made.

Puma’s reported a stronger than expected third-quarter profit margin. The German sportswear brand’s operating profit was €236.3 million ($252.3 million) for the quarter, down from €257.7 million a year earlier, but revenue beat analysts’ expectations with 6 percent growth in currency-adjusted terms, coming in at €2.31 billion.

Secondhand luxury jewellery marketplaces Worthy and Circa merge. The company created from the merger will be worth more than $100 million and the brands will continue to work under their own banners for now.

UNESCO recommends policies to strengthen the fashion industry in Africa. A report found the value of annual textile exports from the continent at $15.5 billion and said the fashion industry across Africa “is brimming with opportunities.”

Celine’s Hedi Slimane released a surprise women’s show last Friday. The show was released as a video, filmed at the Bibliothèque Nationale in Paris, and featured Summer 2024 looks steeped in his signature blend of grunge and “bon chic bon genre.”

New Paris Design Fair to launch alongside fashion week. The fair, called ”Matter and Shape” has been created by fashion editor Dan Thawley and trade-show executive Mathiew Pinet. It will run alongside Paris Fashion Week and be held in the Tuileries Garden starting February 2024.

Zara owner Intidex has joined forces with US start-up Ambercycle. Intidex will purchase “a significant” portion of recycled polyester from the company. The clothing retailer aims to have 25 percent of its fibres from “next-generation” materials by 2030.

Temu’s triumph over competitor Shein is a double-edged sword. The platform surpasses Shein in the volume of its product offerings at low-prices, however, this aggressive pricing strategy is chipping away at the company’s bottom line.

Kim Kardashian’s shapewear label Skims launched menswear this week. The brand is promoting the range of men’s products such as boxers, briefs, T-shirts, undershirts, tank tops and leggings, with a string of male sports stars including Brazilian footballer Neymar Jr. and NBA player Shai Gilgeous-Alexander.

THE BUSINESS OF BEAUTY

Unilever is selling Dollar Shave Club after 7 years of trying to grow the company. After paying for $1 billion for the shaving brand in in 2016, Dollar Shave Club has been sold to Nexus, which also owns shoemaker Toms.

L’Occitane reported net sales rose 24.9 percent to €1 billion in the first half of the fiscal year. Skin and body care label Sol de Janeiro saw the biggest gain, with sales up 174 percent to €270 million.

Unilever’s plan to restore market share underwhelms its investors. The company’s shares fell as much as 3.5 percent in London, trading near a one-year low after announcing that it would focus on investing in its top 30 brands.

Brexit blamed for £850 million drop in beauty exports. An Oxford Economics report found beauty exports from the UK to the European Union have fallen by more than £850 million ($1 billion) since the Brexit vote, as customs delays and increased costs put the brakes on orders.

Ulta Beauty to launch smart vending machines in 10 stores across the US. The US retailer has partnered with smart vending machine company SOS for a pilot programme that will allow loyalty card members to collect free beauty samples and serve as dynamic advertising space in Ulta Beauty stores.

Beyoncé announced the name of her new fragrance: Cé Noir. The scent, which has been available for pre-order in the US and Canada exclusively on the singer’s website since July, will begin shipping in November.

PEOPLE

Pitti Immagine Uomo named British designer Steven Stokey-Daley as guest designer. The Liverpool-born designer’s namesake brand, SS Daley, will stage an event at the prestigious bi-annual menswear trade show, which takes place in Italy, at Florence’s Fortezza da Basso, in January.

Puma hires A$AP Rocky as creative director of Formula 1 Partnership. The rapper is set to design a collection to be released at the Las Vegas Grand Prix in November. This marks the first of many licensing deals the rapper will have with Formula 1.

MEDIA AND TECHNOLOGY

Instagram owner Meta sued by over 30 states. The states, which include California and Massachusetts, claim that the social media sites Instagram and Facebook exploit young people for profit and feed them harmful content.

Meta earnings report reveals most profitable quarter in years. The company reported a third-quarter revenue of $34.15 billion, beating the expected $33.56 billion, up 23 percent year-over-year. Results boosted investor confidence after several volatile years for the company as it attempted to expand beyond its core social media products.

Compiled by Yola Mzizi.

The designer has always been an arch perfectionist, a quality that has been central to his success but which clashes with the demands on creative directors today, writes Imran Amed.

This week, Prada and Miu Miu reported strong sales as LVMH slowed and Kering retreated sharply. In fashion’s so-called “quiet luxury” moment, consumers may care less about whether products have logos and more about what those logos stand for.

The luxury goods maker is seeking pricing harmonisation across the globe, and adjusts prices in different markets to ensure that the company is”fair to all [its] clients everywhere,” CEO Leena Nair said.

Hermes saw Chinese buyers snap up its luxury products as the Kelly bag maker showed its resilience amid a broader slowdown in demand for the sector.