The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

LONDON — Back in June 2007, the same year I started writing BoF, I met an enthusiastic and passionate Portuguese entrepreneur named José Neves. We had been introduced to each other by mutual friends and began exchanging ideas on how the fashion industry could transform itself into a modern, digitally savvy sector by embracing the new technologies that were changing the way we all lived, worked and, yes, shopped. I was really impressed with José's vision. He seemed to be able to see things that most industry players would not: that the same technologies that were transforming other consumer sectors would inevitably come for fashion too.

A couple of years later, as José's vision for his new company Farfetch continued to crystallise, I sat down with him for an in-depth interview where he laid out his plan to “create a world class infrastructure supported by a top-notch team, and then put all that to the service of the world’s most interesting retailers and their web sites.”

It was a simple, powerful idea that instantly made sense to me. Some of the best fashion boutiques around the world, despite having a powerful eye for curation, were not able to fund, set up and manage their own e-commerce operations to scale their businesses beyond their local markets — and Farfetch could help with that.

This, combined with the fact that Farfetch did not take on the risk of owning inventory made it a compelling business model that attracted the interest of venture capitalists who over the years pushed Farfetch to expand and grow to realise the vision of becoming the Amazon of the fashion industry, a platform upon which the whole industry could operate its e-commerce businesses. According to Crunchbase, Farfetch went on to raise more than $1.6 billion, including an IPO in 2015 which raised $885 million.

ADVERTISEMENT

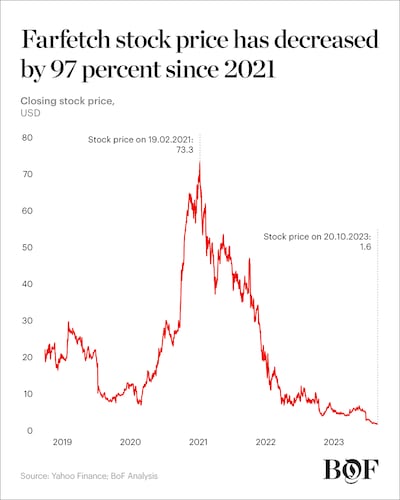

But this week, as we waited for a ruling from the European Commission on the company’s plan to acquire a 47.5 percent stake in its rival, Yoox Net-a-Porter Group, many analysts noted that Farfetch shares have lost 97 percent of their value in the last two years, a spectacular drop. Its market capitalisation has plummeted from a pandemic high of $26 billion in February 2021 to just over $600 million today.

In August, Farfetch announced that its revenue dropped 1 percent in the second quarter of 2023 from a year earlier to $572 million and downgraded its sales outlook for the full year by $500 million, to $4.4 billion.

I’ve been thinking about how things went so wrong at Farfetch, and my thoughts kept coming back to this: the fashion industry and the financial markets no longer understand the company’s increasingly complex vision and have little faith that the company, which has never consistently made a profit, can get back on track.

In 2015, the company began a spree of acquisitions, starting with Browns (meaning that Farfetch would now be taking on inventory and operating physical stores), the intellectual property from Condé Nast’s failed e-commerce venture Style.com (a brand that the company has never used), sneaker reseller Stadium Goods in 2018 (which moved Farfetch into the resale business and further into physical retail), New Guards Group in August 2019 (meaning that Farfetch now operated brands like Off-White and Palm Angels, including design, manufacturing and even more physical retail), and in 2022, Violet Grey. (The company was Farfetch’s first move into beauty and, according to a source who spoke to The Business of Beauty, is now up for sale).

In addition to these acquisitions, Farfetch now also operates white-label platform solutions for a variety of brands and retailers, including Neiman Marcus (into which it invested $200 million as part of an unusual deal), a business in China in partnership with Richemont and Alibaba and its original business which now works more than 1400 sellers in 50 countries.

The cautionary tale here for any entrepreneur taking on huge amounts of funding is the importance of maintaining focus. Over the years, as Farfetch went on its acquisition spree, it drifted further and further away from its original vision of being a technology platform for the fashion industry. As tempting as it may be to raise more money and acquire scale (and, sometimes profitability, as was the case with New Guards Group) through acquisitions, when you start stitching together so many disparate pieces you end up with a patchwork quilt that nobody understands.

Opens in new window

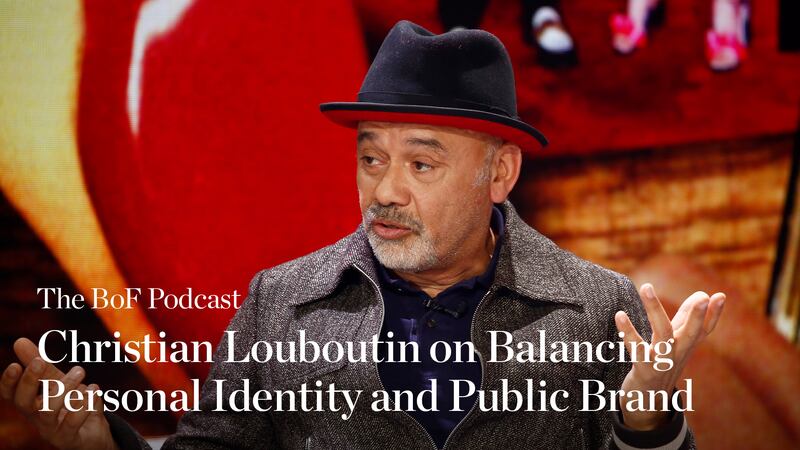

Opens in new windowChristian Louboutin’s iconic red-soled stilettos have made him one of fashion’s most recognisable names. But few know the story of the multi-faceted man behind the Christian Louboutin brand.

Louboutin spoke with writer and cultural activist Rozan Ahmed at BoF VOICES 2021 about how his identity and upbringing have shaped how he approaches business. A major factor in understanding that identity was Louboutin’s discovery later in life that he was actually the child of his French mother and her Egyptian lover.

ADVERTISEMENT

“To belong to different cultures, to different places makes you understand from the very beginning that the world has a lot of different points of view,” Louboutin said. “When you have different ethnicities, different cultures you’re not divided, you’re multiplied.”

BoF VOICES 2023 takes place from November 28 to November 30, 2023, uniting the movers, shakers and trailblazers of the fashion industry with the thought leaders, entrepreneurs and inspiring people shaping the wider world. The entire event will be livestreamed for BoF Professional All-Access members. Register now to join us.

Imran Amed, Founder, CEO and Editor-in-Chief, The Business of Fashion

P.S. Join us on 25 October at 16.00 BST / 11:00 EDT for a live Masterclass as Executive Editor of The Business of Beauty Priya Rao and E.l.f CEO Tarang Amin unpack BoF’s case study on how the upstart-turned-industry juggernaut brought its growth ambitions to life.

1. Why Farfetch’s Problems Are Fashion’s Problems: EU regulators are expected to give the go-ahead for Richemont to spin-off Yoox Net-a-Porter in a joint venture with rival Farfetch. But in the 14 months since the deal was announced, Farfetch has lost 90 percent of its market value with significant implications for the transaction and the wider fashion ecosystem.

2. How 2023 Became the Year of the Lab-Grown Diamond: Consumers are increasingly buying into the idea of lab-grown stones, altering long-held jewellery industry standards for how diamonds are sold.

Opens in new window

Opens in new window3. Can Walmart Finally Crack Fashion?: The big-box retailer is revamping its apparel offering in a bid to become a style destination, a goal it’s tried — and failed — to hit multiple times before. But between a squeezed consumer and the rise of Gen-Z, this time is different, the company says.

Opens in new window

Opens in new window4. How Indie Beauty Brands Can Still Thrive: While emerging lines of the early 2010s were able to disrupt the landscape thanks to lower barriers of entry, new-to-market labels face a tougher road ahead as they struggle to carve out their niche and raise capital in a tough economy.

ADVERTISEMENT

Opens in new window

Opens in new window5. Why This Fashion Brand Is Becoming a Nonprofit: Natalie Chanin helped pioneer the concept of locally made slow fashion in America. To secure that legacy, she’s turning her brand, Alabama Chanin, into a nonprofit.

Opens in new window

Opens in new windowTo receive this email in your inbox each Saturday, sign up to The Daily Digest newsletter for agenda-setting intelligence, analysis and advice that you won’t find anywhere else.

The British musician will collaborate with the Swiss brand on a collection of training apparel, and will serve as the face of their first collection to be released in August.

Designer brands including Gucci and Anya Hindmarch have been left millions of pounds out of pocket and some customers will not get refunds after the online fashion site collapsed owing more than £210m last month.

Antitrust enforcers said Tapestry’s acquisition of Capri would raise prices on handbags and accessories in the affordable luxury sector, harming consumers.

As a push to maximise sales of its popular Samba model starts to weigh on its desirability, the German sportswear giant is betting on other retro sneaker styles to tap surging demand for the 1980s ‘Terrace’ look. But fashion cycles come and go, cautions Andrea Felsted.