The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

It’s no longer shocking when a global luxury brand raises prices on its most coveted bags, shoes and dresses, as Louis Vuitton did earlier this week. For years, luxury brands have been upping the numbers at a steady clip, even as more-affordable clothes and accessories have gotten cheaper.

Often, these increases are attributed to higher materials costs or clogged supply chains that can’t keep up with soaring demand. That’s not entirely spin. Labels such as Gucci, Louis Vuitton and others have bought up alligator farms and opened sprawling workshops in recent years to ensure they can create enough shoes and bags and shoes to satisfy customer demand.

But another reason a Chanel 2.55 bag costs nearly double what it did five years ago is that a healthy share of the brand’s customers are willing to pay those higher prices without blinking an eye. A soaring stock market, spiking real estate prices and new middle and upper-class consumers in developing countries created seemingly endless demand. The industry’s biggest brands have taken full advantage.

There are a growing number of signs the party could soon be over, however, even as record sales and profits give luxury brands the confidence to step up the pace of price hikes.

ADVERTISEMENT

In China, economic growth has slowed, and a troubled property market — plus last year’s crackdown on conspicuous consumption — has worried luxury brands, if not meaningfully dented sales. The S&P 500 index is down about 7 percent this year, and tech stocks that fuelled much of the gains of the last decade hit especially hard. The crypto market, which has created a new pool of luxury super-consumers, is going through one of its period busts.

But the real immediate threat is inflation. What started as a seemingly temporary, pandemic-induced spike in the cost of manufacturing and shipping goods threatens to turn into something more lasting. In the US, overall prices rose 7.5 percent in 2021, the most in 40 years. Consumer prices rose 5.5 percent in the UK, a nearly 30-year high. The US Federal Reserve plans to raise interest rates to contain rising prices, but that will cause economic pain too.

Where Chanel was an outlier with its regular price increases before, it’s now common to see consumer brands from Crocs to Nestle pass along escalating costs to consumers.

A luxury executive might brush this off — if their customers didn’t care about rising prices in 2021 or 2019, why should they now? This would be a mistake.

As we reach the end of the pandemic, consumers will once again spend a larger portion of their discretionary income on experiences, especially travel and restaurants. They’ll also feel the impact of inflation on everything, not just fashion.

In other words, consumers’ radar is up in a way it wasn’t before. The pool of shoppers willing to spend more and more to get their hands on a Louis Vuitton Neverfull bag will get smaller.

What’s more, there’s a movement among a certain set of consumers — in the US and Europe especially, but also China — to reject the highly commoditised, easy-to-access look of masstige luxury.

At some point, the market will simply no longer be able to absorb further price increases. The brands that benefit from the shift in behaviour will offer products that consumers deem of high value for the prices they pay. Hermès is one such label that exemplifies this concept, and may escape lasting damage should there be a backlash to sky-high prices. But those that rely on trend-driven items to drive growth will feel the squeeze.

ADVERTISEMENT

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

Kering sales beat estimates on Gucci turnaround, surging YSL and Balenciaga. Gucci’s sales accelerated in the fourth quarter to grow 18 percent versus 2019′s pre-pandemic levels, helping the brand to close the year with €9.73 billion ($11.1 billion) in revenue. That’s still well behind the growth rival LVMH’s fashion and leather division reported — powered by Louis Vuitton and Dior, it rose 51 percent over 2019 during the fourth quarter.

Report: France has closed its fiscal fraud investigation against Kering. Kering has resolved a dispute with French tax authorities regarding its use of a Swiss logistics centre to reduce taxes at its Saint Laurent and Balenciaga brands, paying “at least” €210 million to settle the case, according to French investigations website Mediapart.

Louis Vuitton set to raise price tags as costs climb. The move, which will affect leather goods, fashion accessories and perfumes, will make Louis Vuitton one of the first big labels to hike prices widely this year to protect margins as costs soar. This comes after hundreds of workers in Louis Vuitton’s French factories staged a walkout on Feb. 10, protesting low wages and working hours that are difficult to juggle with personal life.

US retail sales hit record high, highlighting the economy’s underlying strength. A report from the commerce department on Wednesday showed underlying strength in the economy ahead of anticipated interest rate increases from the Federal Reserve in March, although retail sales in December were much weaker than initially estimated.

Rebecca Minkoff brand sold to Sunrise Brands. The brand was sold for between $13 million and $19 million, according to WWD. Minkoff will remain in her role as chief creative officer, while her brother Uri, who has been the company’s chief executive, will step down from his position and assume an advisory role.

Sock maker Bombas to explore an initial public offering. The New York-based, certified B Corporation could be pursuing a listing as soon as this year, a person familiar with the matter told Bloomberg. Bombas’ targeted valuation couldn’t immediately be learned, and timing has not been finalised.

ADVERTISEMENT

Luxury brand turf wars boost retail rents in Tokyo. Footfall in Tokyo’s upscale shopping districts rose in the last quarter of 2021, spurring competition for prime locations between luxury firms such as LVMH and Richemont.

Hong Kong lingerie company Hop Lun up for sale. Chief executive Erik Ryd is looking to sell his $500 million business, according to the Financial Times, after his children declined to take it over. The global intimates market saw a boost during the pandemic after an initial dip in business during 2020, and Hop Lun’s sales hit $583 million in 2021.

Vietnam to keep factories open amid record Covid surge. The move reverses a policy of sweeping lockdowns last year that hobbled global supply chains for Western retailers. The government said millions of factory workers have now been vaccinated, and the Omicron variant is less severe than Delta.

THE BUSINESS OF BEAUTY

The Ordinary to debut hair care line. On Feb. 22, the brand known for its $7 serums, will introduce a new collection including shampoo and conditioner and a scalp treatment. The products highlight their inclusion of sulphate, an ingredient which has gotten a bad rap as “clean” beauty becomes mainstream.

PEOPLE

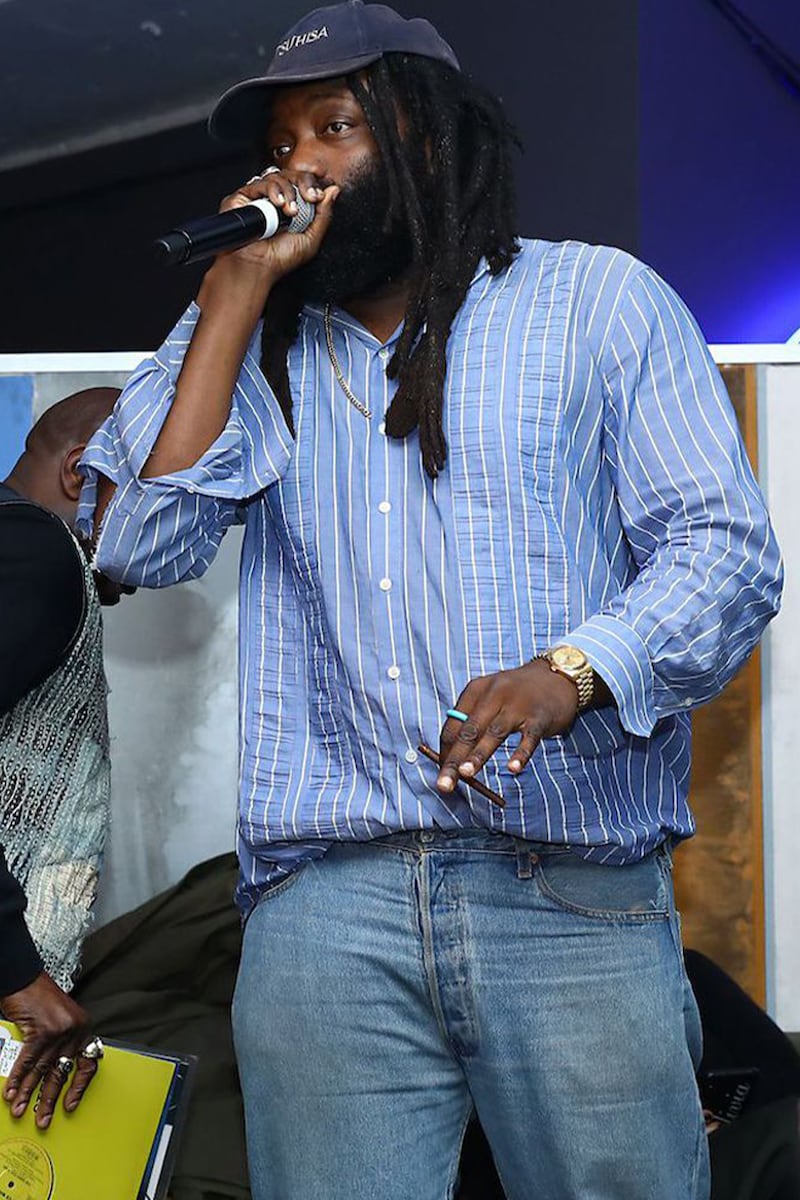

Supreme appoints Tremaine Emory creative director. The Denim Tears founder is the streetwear juggernaut’s first major creative appointment since it was acquired by VF Corp for $2.1 billion in late 2020. Emory will work closely with Supreme founder James Jebbia, who will continue to oversee all aspects of the business.

Levi’s global brand president resigns following Covid-related dispute. Jennifer Sey said she left the denim maker after more than two decades because her outspoken opposition to Covid-19 policies in schools led to a fraught work environment. Sey also said she passed up a $1 million severance package because it required a nondisclosure agreement. She shared her story in writer and editor Bari Weiss’ Substack newsletter.

Vanguards appoints Christopher Morency chief brand officer. The former editorial director at Highsnobiety will lead global brand strategy at the Nanushka, Aeron and Sunnei parent company.

Shein on Singapore hiring spree as it shifts key assets. The fast fashion retailer is aggressively expanding its Singapore office after making a Singapore firm its de facto holding company.

MEDIA AND TECHNOLOGY

Imaginary Ventures leads funding of digital ID platform Eon. It’s a bet that digital IDs, which create digital identities for physical products, will be crucial to brands as they try to take advantage of the business opportunities offered by Web3.

Amazon agrees to NYC Union Election terms, setting stage for two votes in March. The US National Labour Relations Board said Wednesday that Amazon and a group of New York workers have agreed tentatively on terms for a union election, and an organiser said the vote would take place late next month.

Shein-like site linked to TikTok owner ByteDance shuts down. The fast fashion e-commerce site, Dmonstudio, linked to ByteDance in Chinese media reports posted a notice on its homepage alerting shoppers that it ceased operations on Feb.11.

Temasek-backed Zilingo seeking $200 million in funding. The start-up, which supplies technology to apparel factories and merchants, is working with Goldman Sachs on the potential fundraising deal that could boost its valuation to over $1 billion, people familiar with the matter told Bloomberg.

Alibaba’s Koala Haigou launches luxury channel. The cross-border e-commerce platform owned by Chinese tech giant Alibaba has launched a luxury channel, offering more than 10,000 products from more than 200 brands including Dior, Louis Vuitton, Burberry, Coach and Givenchy in segments from ready-to-wear accessories, jewellery and watches.

Compiled by Joan Kennedy.

The Swiss watch sector’s slide appears to be more pronounced than the wider luxury slowdown, but industry insiders and analysts urge perspective.

The LVMH-linked firm is betting its $545 million stake in the Italian shoemaker will yield the double-digit returns private equity typically seeks.

The Coach owner’s results will provide another opportunity to stick up for its acquisition of rival Capri. And the Met Gala will do its best to ignore the TikTok ban and labour strife at Conde Nast.

The former CFDA president sat down with BoF founder and editor-in-chief Imran Amed to discuss his remarkable life and career and how big business has changed the fashion industry.