The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

At the end of last week, most people across the globe received their first introduction to Silicon Valley Bank when US regulators took it over after it faced a run on deposits.

In the fashion start-up world, the financial institution was a familiar name. For decades, the Santa Clara, Calif.-based regional bank has been a favourite of venture capital firms and the companies they back. Many start-up founders and executives found themselves unable to access cash they needed to pay employees and suppliers. With the government only guaranteeing deposits up to $250,000, some companies feared they could lose the vast majority of their capital.

Fashion companies directly impacted by the collapse included publicly-traded firms like StitchFix and Etsy, the inclusive apparel brand Universal Standard and sustainable shoe label ThousandFell. The fallout was potentially much broader, as many fashion brands that didn’t bank with SVB rely on payment processing firms that did.

By Sunday, the worst-case scenario had been averted. The Federal Reserve, the Treasury Department and the Federal Deposit Insurance Corporation, a banking regulator, announced that they would protect all deposits at Silicon Valley Bank, as well as those at New York Signature Bank, another financial institution that regulators shut down due to risk. This ensured that companies would be able to make payroll even if their bank failed.

ADVERTISEMENT

In the end, the immediate business impact of the whole affair for fashion companies may be minimal, though it was a traumatic 72 hours for many.

“I’ve been running this business through Covid, the war in Ukraine, inflation, supply chain disruptions; there’s been crisis after crisis,” said Melanie Travis, founder and CEO of swimwear brand Andie Swim, which kept its capital in SVB. “This one left me speechless. I thought, ‘Oh, my God, this company just went bankrupt. We just lost everything.’”

Like many recent economic woes, SVB’s collapse can be directly linked to high inflation. As the preferred bank of start-ups receiving venture capital-funded cash infusions, SVB was able to grow quickly. (From November 2014 to November 2021, its stock price multiplied six-fold.) It invested its deposits in bonds, normally a safe investment, but as inflation, and interest rates, began to climb, they lost value. When the market caught wind of this, it triggered an old-fashion bank run.

The ripple effects are still playing out in the wider economy, and they will have implications for the fashion industry.

The inflation threat hasn’t gone anywhere — US prices rose 6 percent from a year ago in February, above the Fed’s 2 percent target. If interest rates continue to rise, it may expose problems at other banks; also this week, Credit Suisse, a giant Swiss bank, needed a cash infusion from its home country’s central bank.

But the biggest impact for fashion may be what SVB’s collapse represents: perhaps the biggest signal yet that the era of venture-backed fashion start-ups may be coming to an end.

As recently as 20 years ago, venture investors were wary of funding consumer-focussed businesses like apparel or beauty, preferring sectors like health care and technology. Social media changed that, as performance marketing there allowed companies to more quickly build a customer base and obtain more in-depth data on the customer they’re targeting.

SVB was the go-to option for many start-ups and entrepreneurs, offering access to services like venture debt financing and lines of credit that larger banks would not normally offer to small companies with unpredictable cash flow.

ADVERTISEMENT

“They made it very easy for a founder to have a turnkey access to a banking partner who grow with them as their company grew, and that was incredibly valuable,” said Jason Stoffer, partner at the venture capital firm Maveron, who estimated that half of his portfolio companies banked with Silicon Valley Bank.

In the last year, start-up valuations have plummeted, reflecting concerns that funnelling investor cash into Instagram ads would never lead to profitable growth. Inflation and interest rates played a role here too, both by suppressing consumer demand and by making it more expensive for venture capital firms to fund money-losing brands. SVB’s failure was, in that sense, more a symptom than a cause of fashion start-ups’ problems.

Stoffer said that going forward, the whole incident — and the generally unfavourable economic climate — may lead more fashion businesses to stick to bootstrapping, or self-funding their businesses. For brands that do decide to go the venture funding route, they will likely diversify their banking mix.

Chloe Songer, the founder of the retail circularity platform SuperCircle and ThousandFell, said that the company now has two accounts at two much larger banks. Travis, similarly, moved Andie’s capital over to Chase for the time being.

“I have a new bar and that is just to keep my money,” said Travis.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

Dior to show at Mumbai’s ‘Gateway of India’ monument. Dior is headed to India for its next fashion show. On March 30, creative director Maria Grazia Chiuri will present the brand’s 2023 pre-fall collection at the historic Gateway of India monument. The event will be the first time a European luxury megabrand has staged a major standalone show in the country.

ADVERTISEMENT

Zara owner Inditex’s Americas profits surge as China slips. Asia was the only region where Inditex’s profits fell as China faced Covid-19 lockdowns, while profit ballooned in the Americas, the fashion retailer’s annual report showed on Thursday.

H&M slips out of fashion as first quarter sales lag. H&M, the world’s second-biggest fashion retailer, reported on Wednesday a smaller-than-expected increase in sales in the latest sign it is struggling to compete with Zara-owner Inditex.

Cucinelli raises sales growth forecast for 2023. Italian luxury group Brunello Cucinelli on Wednesday raised its sales growth guidance for 2023 to 15 percent, up from its previous estimate of 12 percent, on the back of a strong beginning to the year and significant orders for coming seasons.

Tod’s group sees strong start to 2023. Tod’s chairman and chief executive Diego Della Valle said the Italian luxury group, which owns Tod’s, Roger Vivier, Hogan and Fay, has had a good kick-off to the year, after the company produced better-than-expected operating profits in 2022.

Mango plans US expansion after China retreat. Mango is returning to the United States — after two previous attempts failed — offering higher-priced clothes meant for special occasions and parties. It will target states where online sales are already strong.

Inditex’s Massimo Dutti chain stumbles as officewear goes casual. Zara owner Inditex SA is struggling to reverse an earnings decline at its formalwear chain Massimo Dutti as mid-range officewear is hit particularly hard by the cost-of-living crisis.

John Lewis cancels employee bonus as losses mount. John Lewis cancelled staff bonuses for the second time in three years and warned of fresh job cuts after reporting a large loss amid intense competition in the British retail market.

Kering eyewear acquires manufacturing company UNT. In a move to shore up its position in the eyewear industry, Kering announced on Monday its eyewear division had acquired the French manufacturing company Usinage & Nouvelles Technologies.

THE BUSINESS OF BEAUTY

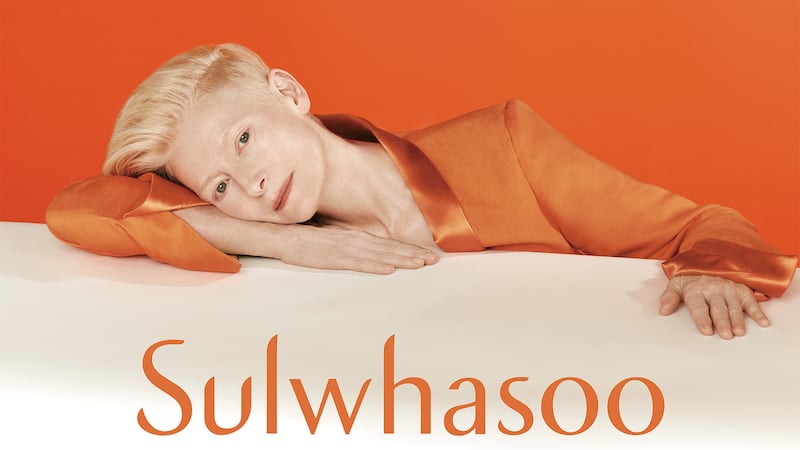

Sulwhasoo names actress Tilda Swinton as global ambassador. The actress is the latest celebrity to join the Sulwhasoo brand, with Korean pop star Rosé from the musical group Blackpink also being tapped by the line in October 2022. The two celebrities will partner on the skin care brand’s “Rebloom” campaign, which launches this month.

The Honest Company reports flat sales growth. During the fourth quarter, The Honest Company, the baby and beauty brand founded by Jessica Alba, reported its net losses had increased from $9 million the previous year to $12.6 million. The company’s losses in 2022 were $49 million compared to $38.7 million in the previous year.

PEOPLE

Amiri names new CEO. Adrian Ward-Rees joins luxury brand Amiri as its new chief executive officer, and is expected to start April 1. Ward-Rees most recently served as senior vice president at Burberry.

Burberry finds new CFO at luxury carmaker McLaren group. Burberry Group Plc has hired Kate Ferry from McLaren Group as its new chief financial officer in the latest of a series of changes at the top of the British luxury brand.

MEDIA AND TECHNOLOGY

Etsy, other e-commerce companies feel squeeze of SVB collapse. Etsy on Monday resumed payments to merchants with Silicon Valley Bank accounts after the e-commerce platform paused their payouts over the weekend following the US government shutdown of the bank last week.

Compiled by Sarah Elson.

Well, not exactly. But some surprising names made an impression on the red carpet alongside the likes of Loewe, Alaïa and Balmain.

The Swiss watch sector’s slide appears to be more pronounced than the wider luxury slowdown, but industry insiders and analysts urge perspective.

Traces of cotton from Xinjiang were found in nearly a fifth of samples from American and global retailers, highlighting the challenges of complying with a US law aimed at blocking imports that could be linked to forced labour in China.

The nature of livestream transactions makes it hard to identify and weed out counterfeits and fakes despite growth of new technologies aimed at detecting infringement.