The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

As many of you are already aware, it’s a big year for The Business of Beauty. Earlier this week, we announced our plans for a daily newsletter, one that more robustly covers the global beauty and wellness industries, with our signature BoF analysis, but also creates a deeper connection with all of you.

This plan has been in the works for months — our founder and CEO Imran Amed and I first discussed ideas for this soon after our first-ever The Business of Beauty’s Global Forum over lunch in London last June. Needless to say, I’ve had a lot of time to think about what a daily newsletter could look like as well as what The Business of Beauty can uniquely say about the ever dynamic beauty and wellness industries in 2024.

A few themes kept coming up:

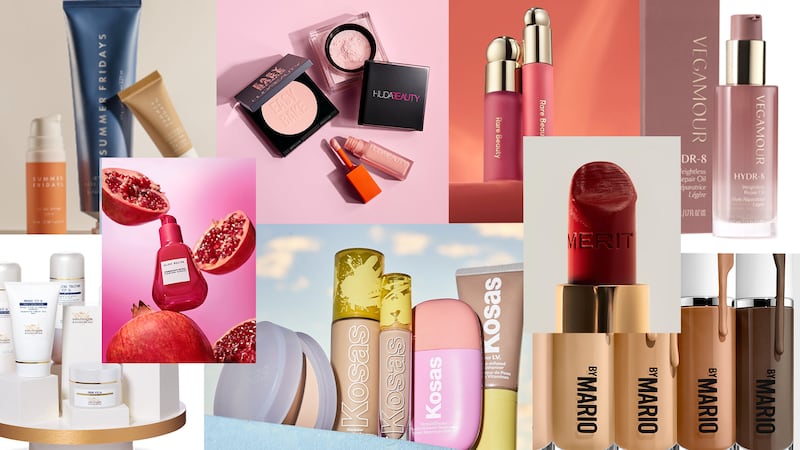

We’re not even three weeks into the new year and we’ve already seen two big beauty and wellness brands find homes — skincare label Dr. Barbara Sturm with Puig and feminine wellness line The Honey Pot with Compass Diversified. Oh, and let’s not forget that Unilever and Shiseido acquired K18 and Dr. Dennis Gross on the last working day of December. Many beauty brands held tight in 2023, worried that economic conditions and inflation would hurt their chances at a superior valuation and an A grade strategic buyer, but those fears have all but been largely forgotten this year. In a story earlier this week, I listed nine premiere assets including Summer Fridays, Kosas and Rare Beauty that are all in various stages of entertaining a sale. But I assure you more labels are coming to market, including smaller lines like Kiko Milano, Tree Hut, Pixi and Erno Laszlo, according to multiple sources. With the mega success of K18 and Dr. Dennis Gross at the end of last year, brands of all sizes are hoping to get their due.

ADVERTISEMENT

The tail end of 2023 saw some of beauty’s biggest conglomerates like L’Oréal and Unilever divest from once core or buzzy labels to conserve cash and better follow stricter company mandates. For example, L’Oréal has been laser focused on clinical skincare, while Coty is trying to transform into a luxury- or prestige-oriented firm. More than ever, conglomerates are looking for forever brands to add to their portfolios and are less likely to jump on trends like “clean” or “natural.” With conglomerates’ theses and purse strings tighter, it’s expected that many of 2024′s deals will be done with financial sponsors or unexpected buyers. There is also not a guarantee that all brands will find a desired buyer.

After the success of Rihanna’s Fenty Beauty and now Selena Gomez’s Rare Beauty, a slew of A-, B-, C- and D-list celebrities and influencers have tried their hand at building their own beauty and wellness labels. The market hasn’t been kind to these labels as Morphe’s and Amyris’ implosions last year proved. I suspect that retailers will come to rely on these labels less and talent will move on to other pet projects.

Following the rapid success of lines like Drunk Elephant, Tatcha and Glossier in the mid-2010s, a slew of other beauty labels came to market, each with their own differentiating “it” factor: “clean,” “sexual wellness,” “body care,” “patented ingredient,” etc. That continues to be the case and a new generation of brands are launching daily. But capital isn’t flowing like it once was and fast growth without profitability isn’t enough to entice investors or retailers to give them a real chance. Although beauty will continue to be a lucrative field, there are too many brands to all be successful. A rightsizing is coming.

In the late 2010s, the wellness industry was defined as a mix of supplements, CBD and whatever Goop was selling on its website. There is still some of that today, but I’m encouraged at how themes like longevity are going to affect everything from skincare to healthcare. There is a lot of opportunity for brands and retailers to realise, whether that is holistic treatments, sleep advancements or wellness-centric stores. I hope 2024 brings more innovation (and less of the same) to wellness.

We will be following all of these stories and more in the year ahead. Thank you for reading; until next time.

Here are my top picks from our insight and analysis on beauty and wellness:

1. Beauty’s Most Sought-After M&A Targets in 2024. Now that the market has stabilised, beauty brands of all shapes and sizes are eager to get their dues. The Business of Beauty identifies the top targets of the year including Kosas, Summer Fridays and Selena Gomez’s Rare Beauty.

2. There’s More to Building a Beauty Brand Than Selling Lipstick. The most inspiring fashion brands from Comme des Garçons to Balenciaga are able to satisfy customer desire and still make sales targets. The same can be done in beauty, writes Isamaya Ffrench.

ADVERTISEMENT

3. Lip Gloss Is Beauty’s Secret to Sales and Sex. Recalling the appeal of Lip Smackers balms and Lancôme’s Juicy Tubes, skincare brands like Rhode, Summer Fridays and UBeauty have the lip category cornered.

4. How Struggling Beauty Brands Can Course-Correct. A spate of shutterings, bankruptcies and layoffs are rocking the beauty industry. Going back to basics by not overcommitting to executive hires and over-the-top marketing campaigns may be the route out, experts say.

5. The Business of Beauty Haul of Fame: The Stunt Beauty Boom. Black blush and peel-off lip liners are just the beginning.

Now that the market has stabilised, beauty brands of all shapes and sizes are eager to get their dues. The Business of Beauty identifies the top targets of the year including Kosas, Summer Fridays and Selena Gomez’s Rare Beauty.

The Business of Beauty is doubling down on our commitment to rigorous coverage of the global beauty and wellness space, with more content and events.

Priya Rao is Executive Editor at The Business of Beauty at BoF. She is based in New York and oversees BoF’s beauty and wellness coverage.

How not to look tired? Make money.

In a rare video this week, the mega-singer responded to sceptics and gave the public a look at what her beauty founder personality might be.

Request your invitation to attend our annual gathering for leaders shaping the global beauty and wellness industry.

Excitement for its IPO is building, but in order to realise its ambitions, more acquisitions and operational expenses might be required.