The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

American consumers are flexing their spending power — and fashion brands are taking notice.

In its earnings call this week, Zara parent Inditex said the United States had become its largest market outside of its native Spain. Last month, Kering credited North America as well as Asia for strong sales at Balenciaga and Alexander McQueen (not coincidentally, McQueen debuted its Autumn/Winter 2022 collection in New York earlier this week, including a runway show in Brooklyn and associated events for top customers). Last autumn, LVMH pointed to “strong revenue growth” in the US as a highlight of 2021.

The US is hardly overlooked — it’s still the world’s largest consumer market, after all. But for much of the last decade, many fashion brands have focused on Chinese consumers for growth. That made sense: China is the world’s biggest market for luxury fashion, making up about one-third of global sales, according to consultancy Bain & Company.

But the events of the last two years have changed the outlook for both countries.

ADVERTISEMENT

China’s 2022 GDP growth target of 5.5 percent is its lowest in over three decades, and some economists say it might prove overly ambitious if the country’s unstable property market or strict Covid lockdown measures curb consumption. A government campaign against wealth inequality last year sent shudders through the luxury sector.

Recently, China has locked down entire regions to contain its worst Covid outbreak since the start of the pandemic. Shanghai’s shopping districts are eerily deserted, though the faithful were still lining up outside the Chanel store during a recent visit by a BoF correspondent.

The tilt back toward America looks set to continue, at least in the short term. But the US isn’t without its problems, including inflation at a four-decade high. But its economy has bounced back from the pandemic faster than many expected. Stimulus checks sent to most Americans also drove a surge in spending on fashion last year, creating a broader pool of potential customers for luxury brands.

Brands are staging more high-profile events in the US – in addition to McQueen, Gucci, Bottega Veneta and Louis Vuitton were among the labels to hold shows in American cities in the last six months alone. Louis Vuitton will also stage its cruise show in California this May.

They’re also opening more US stores, including outside the traditional American fashion hubs of New York and Los Angeles. Miami and Austin have seen an influx of wealthy tech workers, while cities like Charleston, Nashville and Atlanta have seen their median incomes rise. These cities have already seen store openings from brands like Gucci, Hermès and Chanel. In February, Kering chief executive François-Henri Pinault name checked the latter two as cities where Kering is eyeing expansion, while Prada has said it’s planning to soon target Austin. Those locations, which in the past primarily had access to luxury brands through department stores, will play a key role in luxury’s future, which will lean more on direct-to-consumer business.

“People here are dying to spend money,” said Libby Callaway, founder of Nashville-based public relations firm The Callaway. “So many people are moving here, but not with stars in their eyes, thinking about starting their career and making a fortune. They are established, and they want to spend money here.”

But there are also signs that the surge in US spending may prove short-lived. The last of the pandemic stimulus checks were mailed months ago, and while luxury spending was up for lower-income Americans last year compared to 2019, that trend isn’t expected to continue into 2022, according to Bank of America data. Households worried about high gasoline prices may be less inclined to spend at the mall. Retail sales in February increased by only 0.3 percent; in January, they grew 4.9 percent. The Federal Reserve raised interest rates for the first time since 2018 this week, a move to counter inflation that signals higher borrowing costs and potentially slower economic growth.

China, meanwhile, remains a powerful force, even amid the lockdowns. Last year, luxury sales in China rose 36 percent to 471 billion yuan ($73.59 billion), according to consultancy Bain, though that growth is expected to slow in 2022. The country remains a key driver of travel retail sales despite restrictions on international tourism, thanks to explosive growth in Hainan’s duty-free shops.

ADVERTISEMENT

But if the upheaval of the last two years have taught fashion brands anything, it’s not to put all their eggs in one basket. Just as companies are diversifying their supply chains, they should be looking to grow in multiple markets. This minimises the risk that disruption in one country — such as China’s recent Covid outbreak or inflation worries in the US — torpedoes an entire global strategy. In the years to come, more American cities will likely flex their muscle when it comes to their spending power — brands certainly seem to think so.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

Bernard Arnault signals intent to lead LVMH until he is 80. The luxury conglomerate said in a filing it would seek to raise the age limit for the chief executive officer to 80 from its current 75 at next month’s annual general meeting.

Prada confirms targets after ‘strong start’ to 2022. Earnings before interest and taxes (EBIT) in 2021 jumped to €489 million ($535.85 million) from €20 million a year earlier and well above the €307 million posted in 2019 before the Covid outbreak. Though the group did caution that the war in Ukraine made predictions uncertain.

Lockdown conditions return to major Chinese cities as Covid-19 cases reach two-year high. The southern tech hub of Shenzhen and its 17.5 million residents have entered a government-ordered lockdown that is expected to last at least a week, impacting local malls, manufacturing hubs and ports. Some in the industry fear disruptions will cause further strain on global supply chains and fuel more inflation.

UK hits Russia with new sanctions on luxury goods. The UK is banning exports of luxury goods to Russia, the British government announced Tuesday. The ban, which will “come into force shortly,” is part of the new wave of international sanctions designed to dial up economic pressure on Russia and isolate the region following its invasion of Ukraine.

Ralph Lauren unveils collection for HBCUs Morehouse and Spelman. The brand aims to honour the contributions of Black students to American collegiate style by drawing inspiration from fashion worn at historically Black colleges from 1920 to 1950.

ADVERTISEMENT

Vestiaire Collective is buying resale platform Tradesy. The Paris-based resale company’s acquisition of the California-based competitor comes amid a wave of consolidation in the category.

Signet hits diamond trade with refusal to buy Russian gems. Signet is the world’s largest diamond retailer, and Russia is the world’s biggest source of gems. The move will create difficulties throughout the global supply chain.

Report: Hudson’s Bay considers bid for Kohl’s. The Saks Fifth Avenue owner is considering a bid for the department store operator, which has already rejected two separate takeover bids this year.

H&M sales soar but shares slip on wider Ukraine impact concern. H&M reported a 23 percent rise in first quarter sales on Tuesday, which was in line with market expectations, as the world’s second-biggest fashion retailer attempts to build on its recovery from the Covid-19 pandemic.

Russia clouds prospects for Inditex after sales surge. The Zara-owner’s net profit more than doubled in the year ended Jan. 31, to €3.2 billion ($3.51 billion) as it bounced back from the worst effects of the pandemic. The retailer faces challenges in the months ahead after it stopped trading in Russia, a major market.

THE BUSINESS OF BEAUTY

Beauty giant Natura shelves NYSE move as turmoil rattles markets. As the war in Ukraine and prospect of surging rates bring wild swings to global equity markets, the Sao Paulo-based company, which owns Avon Products Inc., said the timing wasn’t right and it would “assess the appropriate moment to resume it.”

PEOPLE

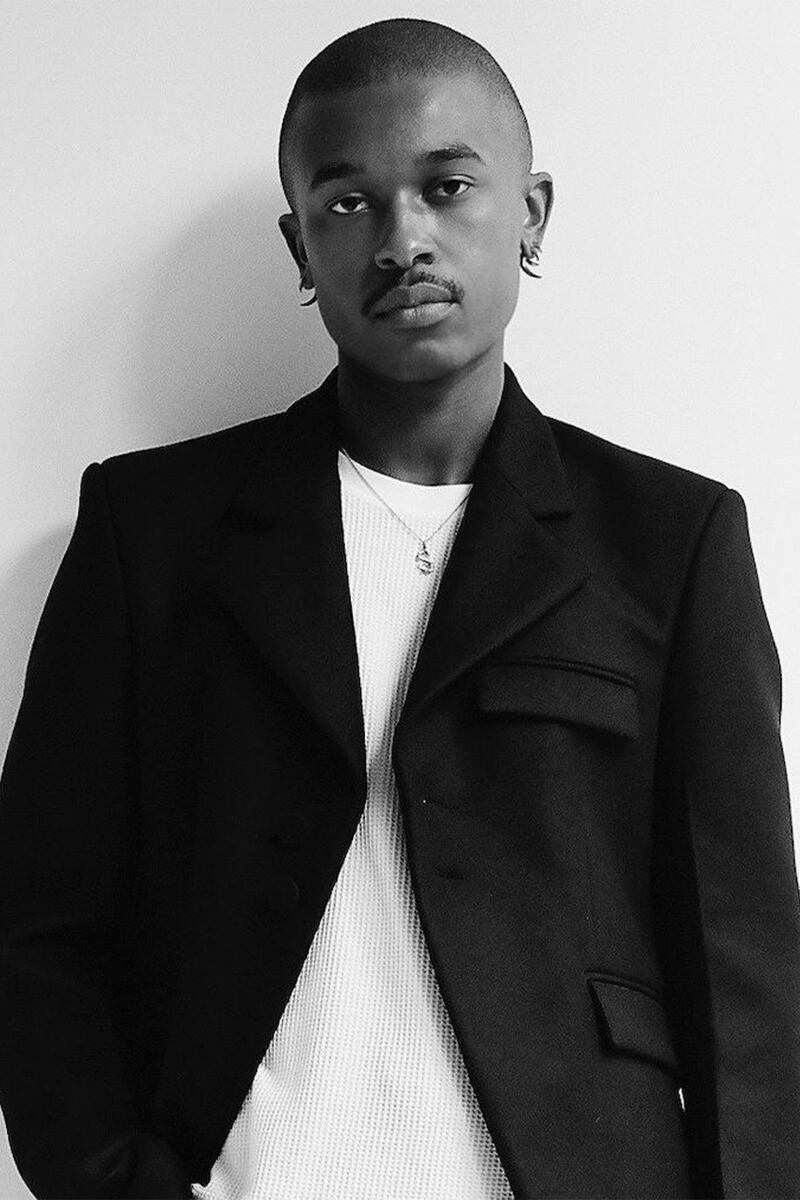

Salvatore Ferragamo hires Maximilian Davis as creative director. The appointment is the first big move by new chief executive Marco Gobbetti, who aims to re-energise the Florentine house. The 26-year-old British-West Indian designer will succeed Paul Andrew, who exited the label last March as part of a major shakeup, which saw board chairman Ferruccio Ferragamo step down.

Hodinkee hires Farfetch’s Jeffery Fowler as chief executive. The executive handoff comes as the online destination for watch superfans looks to expand its e-commerce business, which has surpassed $100 million in annual sales. Fowler succeeds Mr Porter veteran Toby Bateman, the company’s first CEO.

Neiman Marcus Group names new chief financial officer. Katie Anderson, who has worked at companies including Guess Inc. and California Pizza Kitchen, will assume the role of executive vice president, chief financial officer on Apr. 4.

Chinese spokesperson for Bulgari, Bally fined $16.6 million for tax evasion. Actor Deng Lun, 31, was fined 106 million yuan ($16.6 million) for tax evasion following the discovery of irregularities in his reported income in 2019 and 2020. Before this scandal broke, Deng was a favourite spokesperson for brands including Bally, Bulgari, Roger Vivier and L’Oréal.

MEDIA AND TECHNOLOGY

Stefano Tonchi to launch print publications for wealthy American enclaves. Along with his co-founder Michael J. Berman, the former W magazine editor’s first new publication, titled Palmer, will be about Palm Beach, Florida.

Regina King, Blake Lively, Ryan Reynolds and Lin-Manuel Miranda named Met Gala co-chairs. The Metropolitan Museum of Art announced the selection of the co-chairs for this year’s annual Costume Institute Benefit on Thursday. King, Lively, Reynolds and Miranda, will join honorary co-chairs CFDA president Tom Ford, Instagram head Adam Mosseri and Vogue editor Anna Wintour.

Compiled by Joan Kennedy.

Editor’s note: This article was revised on Mar. 28, 2022. A previous version of this story said that the US had surpassed Spain to become Inditex’s largest consumer market. The US is actually now Inditex’s largest consumer market outside of Spain.

The Coach owner’s results will provide another opportunity to stick up for its acquisition of rival Capri. And the Met Gala will do its best to ignore the TikTok ban and labour strife at Conde Nast.

The former CFDA president sat down with BoF founder and editor-in-chief Imran Amed to discuss his remarkable life and career and how big business has changed the fashion industry.

Luxury brands need a broader pricing architecture that delivers meaningful value for all customers, writes Imran Amed.

Brands from Valentino to Prada and start-ups like Pulco Studios are vying to cash in on the racket sport’s aspirational aesthetic and affluent fanbase.