The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Opens in new window

Opens in new windowThe rules of global trade are being rewritten in the final months of 2020, with widespread implications for fashion companies around the world.

This week, 15 Asian countries — including China and other big exporters of apparel and textiles — signed the Regional Comprehensive Economic Partnership (RCEP) agreement, a feat which led upbeat politicians to declare the arrival of a new world order. Though the appraisal is both premature and hyperbolic, the pact does provide a glimmer of hope for business leaders in need of a more stable environment to conduct trade.

In a year which has seen the pandemic crush the profits of many fashion brands, the prospect of a more integrated supply chain within the RCEP trading bloc — hailed as the largest in the world by some measures — is a relatively small but significant positive sign for brands fighting for survival.

Notwithstanding concerns for environmental protections and labour rights, the agreement should make doing business easier and cut tariffs on the growing proportion of textiles exported from China to garment manufacturers in Southeast Asia, where a growing number of fashion brands from the US and Europe do their sourcing. Major players like H&M and Uniqlo might even feel compelled to re-evaluate where they manufacture and reconsider suppliers in non-RCEP countries like India and Bangladesh, which are now at a disadvantage.

ADVERTISEMENT

Though it remains unclear what US president-elect Joe Biden’s views are on RCEP or the CPTPP (the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, which was formed after Donald Trump withdrew from its forerunner bloc a few years ago), Biden’s constructive rules-based stance is clear enough: “I’m not looking for punitive trade,” he said, just days after RCEP was formed. The US is not part of either bloc.

For American brands like Everlane and Levi’s that have been troubled by Trump’s pursuit of increased tariffs in the protracted US-China trade war, and for French luxury giants LVMH and Kering, which will be concerned about higher tariffs imposed by Trump that are due to take effect in January 2021, there is an urgent need for Biden to somehow reboot America’s trading relationships. Executives will be watching closely who he chooses for the US Trade Representative position, which has been occupied by a hawkish figure under Trump.

Biden seems more than willing to re-engage and less adversarial than his predecessor: “America is back. We’re going to be back in the game. It’s not America alone,” he reportedly told European leaders who called to congratulate him on his election win. But it will not be easy for the new president to perform global trade backflips as urgently as they are needed. And more to the point, he may not be inclined to do them at all.

Though there is hope that a more rational negotiating partner in the White House might work to unwind some of the trade hostilities America is embroiled in from Europe to China, when it comes to the latter, there is no evidence that Biden will be motivated to take a soft approach on his country’s most significant economic and technological rival.

For many multinational fashion brands, the biggest threat they face is a further breakdown between the US and China, the latter having sent $451.7 billion worth of goods to the former in 2019. Nike alone earned more than $6 billion in the Greater China market in its last fiscal year and the market accounts for almost 20 percent of the brand’s global sales, as well as a significant proportion of the goods it produces.

Nike and other US brands will be hoping Biden can thread the needle between taking a sufficiently hard line to protect their interests and fostering friendlier negotiations than Trump did in a way that reduces both friction and trade costs.

Elsewhere, global brands with a retail footprint or supply chain straddling the UK and the European Union are watching nervously as the two parties hammer out new trade rules for a post-Brexit world. While there has been much speculation this week about a potential breakthrough in the deadlock, experts say there are several major sticking points left to resolve and predict that negotiations will probably go down to the wire.

Deal or no deal, the Brexit transition period ends with the dawn of 2021, so fashion companies with links across the English Channel are understandably anxious. Those moving inventory to stores across the border will of course be impacted if a deal is not struck but it’s not just the prospect of red tape and delays worrying those who fear the worst.

ADVERTISEMENT

Without a new deal, as of January 1, the two sides will see tariffs introduced on goods that until this point have been tax-free. Based on export figures from 2018 it is estimated that a no-deal default switch to World Trade Organisation (WTO) rules would cost the British fashion industry £850 to 900 million ($1.12 to $1.19 billion).

UK retailers, including Harvey Nichols and Marks & Spencer, have responded by upping their share of bonded warehouse space (storing imports in a bonded facility means they can delay paying customs charges until the goods are sold), but this can only limit financial impact up to a point.

Whatever the outcome of these eleventh-hour negotiations and whatever side Britons were on in the Brexit debate, everyone will be relieved in six weeks’ time when years of uncertainty are finally over. That can’t come soon enough for the UK, which needs to turn its attention to accelerating other international trade deals, and the EU, which has its own priorities to get on with.

For a global industry still in the midst of a pandemic and economic crisis, any ceasefire in the global trade wars that businesses endured in recent years has to be considered progress. Indeed, however fleeting, anything that quells the tensions and volatility that characterised the last decade will be seen as a welcome relief.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

Arcadia denies report that it’s on brink of bankruptcy. The Topshop-owner hit back against a Sunday Times report that it is drawing up plans to enter administration. Sky News previously reported the group was seeking £30 million in loans to help keep the business afloat as England’s second lockdown delivers another blow to the ailing high street retail empire.

International Woolmark Prize announces 2021 finalists. The United Kingdom’s Bethany Williams and Matty Bovan, France’s Casablanca, Nigeria’s Kenneth Ize, Canada’s Lecavalier and South Africa’s Thebe Magugu will compete for AU$200,000 (about $146,000) and an opportunity to be sold at retailers around the world, with the winner of the Karl Lagerfeld Award for Innovation receiving AU$100,000. They beat out more than 380 applicants in 55 countries for the opportunity.

ADVERTISEMENT

Report: Indian factory workers supplying for Ralph Lauren allege exploitation. The factory forced women to stay overnight and work additional hours without notice, the BBC reported, citing anonymous workers who described a “culture of fear” at the plant.

Macy’s reports 20 percent drop in comparable sales. It said it expects that to continue into the fall season, signalling a tough holiday season for the coronavirus-battered department store chain. The retailer’s shares fell three percent in premarket trading. Its stock has lost nearly half its value in a tumultuous year in which it has had to lay off thousands of workers.

L Brands reports better-than-expected quarterly sales. Comparable sales at Bath & Body Works surged 56 percent in the third quarter, while they rose four percent at Victoria’s Secret. The company reported a net income of $330.6 million, or $1.17 per share, compared with a loss of $252 million, or 91 cents per share, a year earlier, when it recorded some impairment charges.

Report: Manish Arora in liquidation. The Indian label has been suffering from financial troubles for years and is now facing legal action from vendors and employees alleging unpaid wages, according to a report by The New York Times.

JD.com announces 29 percent boost in third-quarter revenue. China’s second-largest e-commerce player continues to benefit as shoppers move online in the world’s biggest market for fashion and luxury. Its sales for the quarter ended September 30 reached 174.21 billion yuan ($26.5 billion), beating analysts’ expectations of 170.5 billion yuan. The company’s stock has more than doubled in 2020.

De Beers diamond demand recovers from Covid-19 hit. Sales of rough diamonds at De Beers rose more than 12 percent in the latest sales cycle, its parent Anglo American said on Wednesday, as demand improves on the back of easing Covid-19 restrictions and ahead of the December festive season. Sales of $450 million in the ninth sales cycle, or between November 2 and November 16, were higher than the $400 million a year earlier.

Tomorrow acquires majority stake in London concept store Machine-A. The shop’s founder Stavros Karelis will stay on as buying director, while Tomorrow’s Alessandra Rossi will take over as chief executive to revamp its direct-to-consumer business and long-term growth strategy. Machine-A currently operates its e-commerce business through a partnership with Showstudio, the content agency founded by photographer Nick Knight.

Target’s sales soar ahead of crucial holiday shopping period. Comparable sales including e-commerce, a critical gauge of success for retailers, jumped 20.7 percent from a year earlier, the retailer said Wednesday in a statement. That’s almost double the estimate of 11.6 percent growth from Consensus Metrix, although down from 24.3 percent in the second quarter. Profit and gross margin also exceeded estimates.

China’s retail sales grow, Japan’s GDP bounces back. Retail sales in China rose 4.3 percent year-on-year in October, according to the country’s National Bureau of Statistics. Though this beat the previous month’s rise of 3.3 percent, analysts had been hoping for more of a bump in a month that included the nine-day national ‘Golden Week’ public holiday period.

Global Fashion Group raises $140 million. The fashion e-tailer will invest the new round of financing to accelerate growth and expand its marketplace and fashion services business. It will also invest in technology to streamline its e-commerce business, currently popular in emerging markets, on a global scale.

British retailers Peacocks and Jaeger enter administration. Peacocks, based in Cardiff, Wales, operates 423 stores with 4,369 staff and London-based Jaeger has 76 stores and employs 347, putting 4,716 jobs at risk in total. Their administration followed the failure of efforts by management to secure a solvent sale of both businesses. Both retailers are part of privately-owned EWP Group.

THE BUSINESS OF BEAUTY

C-Beauty Giant Yatsen Raises $617m in IPO. Chinese cosmetics giant Yatsen Holding Ltd rose 75 percent in its trading debut, raising $617 million in a US initial public offering. The company sold 58.75 million American depositary shares at $10.50 each. The shares closed at $18.40 on Thursday in New York, giving the company a market value of $7.82 billion.

Kohl’s wants to expand its beauty business. The retailer sees beauty as a growth driver and plans to triple its sales in the category. Kohl’s is trying out what it calls “Wellness Markets” in 50 stores to help shoppers more easily find personal care products and help it stand out from competitors like Target, which last month struck a deal with Ulta Beauty.

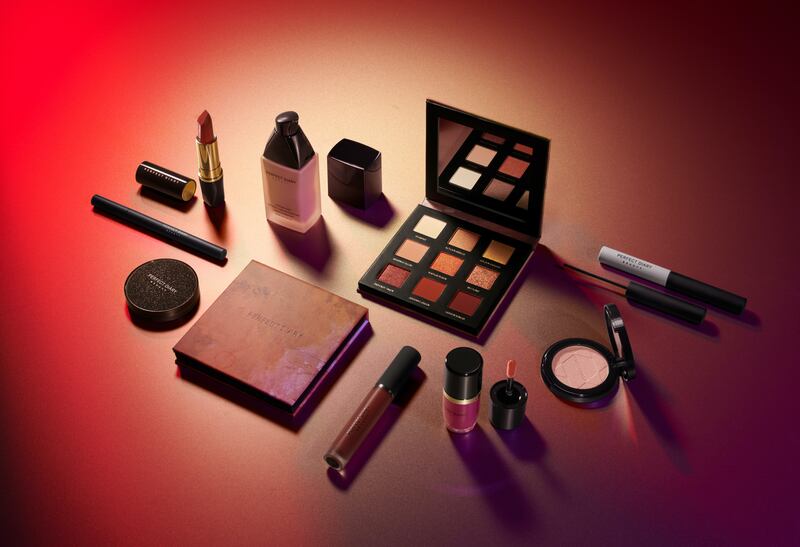

Huda Beauty is the most in-demand beauty line online. According to the Cosmetify Index, Huda Beauty has over 53 million combined social media followers, followed by Kylie Cosmetics and MAC Cosmetics. Next up were beauty brands like Anastasia Beverly Hills, NYX Professional Makeup and Fenty Beauty.

PEOPLE

Vogue China editor Angelica Cheung to step down. After 16 years as editor-in-chief of Vogue China, Angelica Cheung will resign from the post on December 8. A letter was reportedly sent to staff at Condé Nast China to announce the move, which also said there were no replacement candidates ready to be confirmed yet.

GQ’s Nikki Ogunnaike named Harper’s Bazaar digital director. The appointment marks a return for Ogunnaike to Hearst, where she previously worked for Elle’s digital team in multiple positions, rising to the title of style director before leaving for GQ one year ago. In her role, Ogunnaike will work closely with Samira Nasr, Hearst said in a statement, in contrast to the completely separate print and digital operations under Nasr’s predecessor Glenda Bailey.

Alber Elbaz’s AZ factory set to launch in January. The project, a partnership with Swiss conglomerate Richemont, announced its new name and logo today, abandoning the working title AZFashion. It will mark the designer’s return to fashion since his blockbuster tenure at Lanvin ended in 2015.

PVH hires Nike’s Jessica Lomax as Calvin Klein global head of design. The brand began its search for a global head of design in late 2018 after Raf Simons left his role as chief creative officer months before his three-year contract was up. Lomax joins Calvin Klein from Nike, where she is currently senior creative director, women’s sportswear apparel.

MEDIA AND TECHNOLOGY

A new online platform celebrates black creative talent. Blacktag is a new interactive digital platform showcasing work by Black creatives with the aim of uplifting Black voices and connecting emerging talent with brands. Founded by Akin Adebowale, a multidisciplinary artist who has worked with Drake and Kanye West, and Ousman Sahko, a filmmaker and Google Creative Lab alum, Blacktag has already secured a $3.75 million seed round led by venture capital firms Connect Ventures and New Enterprise Associates.

Paris Fashion Week says autumn shows brought in 135 million views on YouTube. The value of press and social media coverage for Paris’s spring-summer ’21 womenswear week declined by roughly one third versus the prior year’s season, according to Launchmetrics estimates released Thursday by Paris fashion chamber FHCM. That’s still a relatively strong performance according to the popular metric, taking into account that most international journalists, influencers, and celebrity spokespeople did not attend due to the pandemic.

BoF Professional is your competitive advantage in a fast-changing fashion industry. Missed some BoF Professional exclusive features? Click here to browse the archive.

BoF’s ANNUAL GATHERING FOR BIG THINKERS

VOICES brings together the movers, shakers and trailblazers of the global fashion industry and unites them with the big thinkers, entrepreneurs and inspiring people who are shaping the wider world, hosted by BoF founder and editor-in-chief, Imran Amed, and led by BoF's expert editors and correspondents.

Register now to reserve your spot.

1. THE WIDER WORLD: Making sense of 2020 and charting a way forward

2. INSIDE THE FASHION SYSTEM: Addressing the industry’s most important challenges and opportunities

3. TECHNOLOGY & INNOVATION: Exploring how new technologies will change consumer behaviour

4. REINVENTING RETAIL: Understanding how forces accelerated by the pandemic are completely reshaping the retail landscape

5. LIVE YOUR BEST LIFE: Finding the balance, insight and inspiration to be the most authentic, healthy version of yourself

JOIN US FOR A GLOBAL CONVERSATION ABOUT THE FUTURE OF THE FASHION INDUSTRY

This year, VOICES will be delivered via a live broadcast adapted to the unique circumstances of the Covid-19 era — and BoF Professional and BoF Professional Student members anywhere in the world can take part in this live global conversation as the industry looks ahead to 2021. If you are not a member, sign up today with our 30 day trial, including access to VOICES 2020.

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.