The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

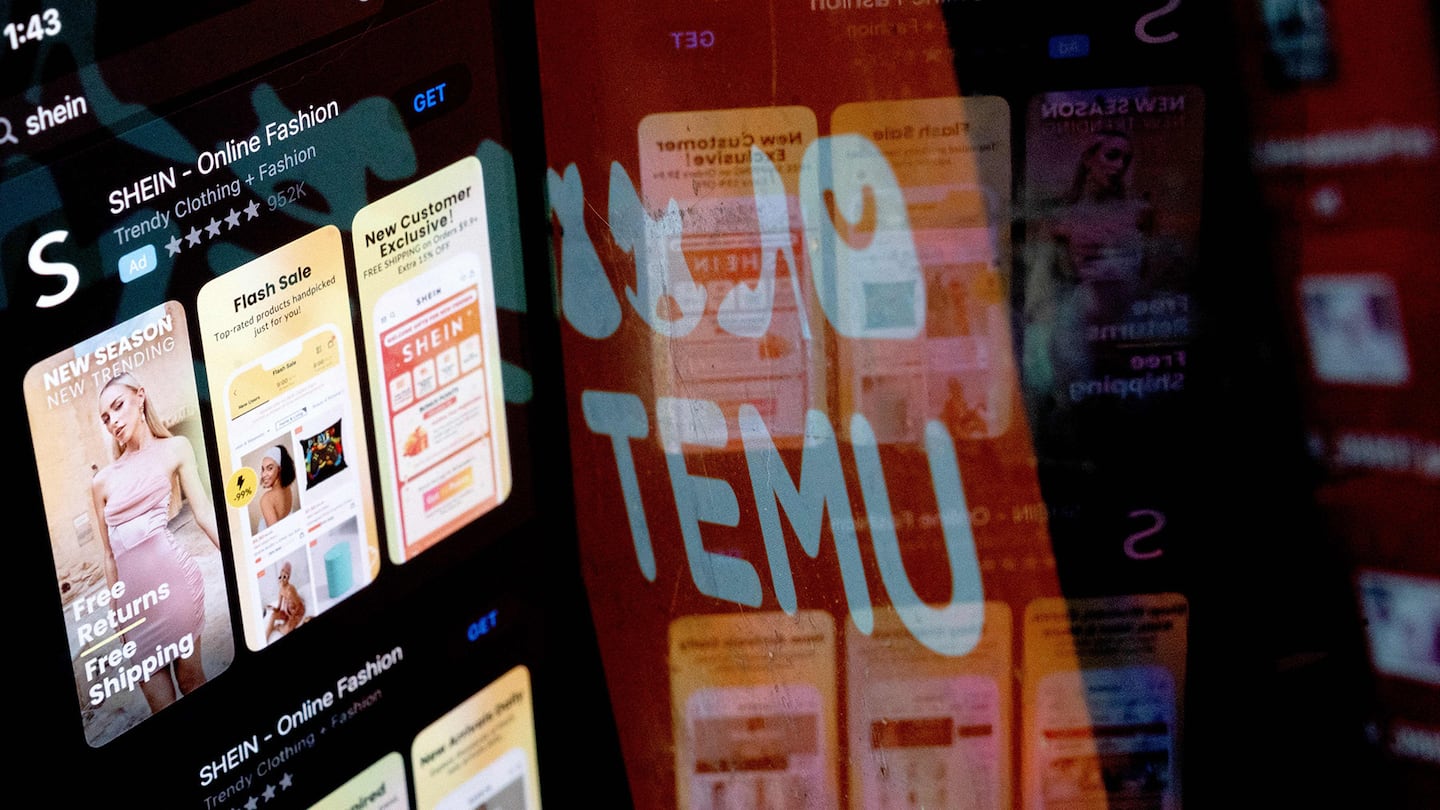

Since its US debut last September, Temu has drawn plenty of comparisons to Shein. Both platforms were launched by Chinese companies (Temu by PDD Holdings, which owns Pinduoduo; Shein has since shifted hits headquarters to Singapore) and seemingly overnight became massively popular with thrifty shoppers drawn to $3 T-shirts and $7 sandals. Like Shein before it, Temu’s low prices and ubiquitous advertising on social media quickly helped its app become the most downloaded in the US. Temu then went a step further, running a Superbowl ad enticing viewers to “Shop Like A Billionaire.”

The rivalry isn’t just in the media’s imagination. Temu has been hiring talent from Shein. And in December, Shein filed a lawsuit in US Federal Court accusing Temu of paying influencers to make negative comments about the retailer. In an emailed statement sent after publication on Tuesday, Temu said it “strongly and categorically rejects all allegations.”

But Temu’s goal is not to win at trendy tops or going out dresses. It wants to become its home country’s first major player in the West’s online shopping space.

Its aspirations are built into its business model: where Shein works directly with a network of suppliers to produce clothing in small batches that it can sell through its site and app, Temu is purely a platform. A factory or merchant in any of 27 categories, from home to personal care and electronics, can reach American consumers through Temu’s interface. Temu is targeting GMV of $3 billion this year and $30 billion by 2027, in other words it’s trying to do in five years what Shein did in seven. In China, Pinduoduo was able to reach $30 billion in GMV about two years after launch. If Shein perfected the fast-fashion supply chain pioneered by Zara and H&M, Temu is looking to do the same with Amazon’s everything store.

ADVERTISEMENT

It has plenty of competition: Alibaba’s Aliexpress operates a similar platform in the US, and in the fashion space both Temu and Shein are fending off an ever-growing number of rivals, including Cider, Chicme, and Bytedance’s If Yooou. Shein’s growth has begun to slow as the novelty wears off, suggesting there may be a cap on how far the fast-and-cheap retail model can go.

“While still very early in its development stage, [Temu] may serve as the next big catalyst to take [PDD Holdings] to the next level and become the only Chinese e-commerce company that has achieved meaningful success in markets outside of China, organically,” said Jiong Shao, Barclays head of China internet research.

Temu, which is headquartered out of Boston, declined to be interviewed for this story. Shein did not respond to a request for comment.

Chinese e-commerce firms’ expansions abroad have yielded mixed results. Five years ago, JD.com inked a deal with the Thai retail conglomerate Central Group to target Southeast Asia, but this past January, shuttered its Indonesia and Thailand sites.

Alibaba acquired Lazada in 2016, an online shopping platform which operates across Southeast Asia, but it’s been edged out the dominant position by local player Shopee.

Companies are redoubling their efforts as growth within China is slowing. The country is still recovering from the damage done to its economy by the zero-Covid lockdown policy. But after two decades of torrid growth, the country’s online shopping market is saturated. After many years of increasing sales by acquiring new customers, e-commerce companies have had to focus on the tougher task of increasing purchase frequency and order size of existing shoppers.

So China’s tech giants have begun looking even further afield. Last fall, Lazada announced plans to expand to Europe. But both Southeast Asia and Europe are markets that require a high degree of local adaptation due to the large number of countries in one relatively small geography. This past week, Temu launched in Australia and New Zealand where the e-commerce landscape is even weaker.

The US on the other hand offers a large market with also a low online shopping penetration of 20 percent —compared with nearly 30 percent in China, according to UBS. It’s conventional wisdom to many Chinese entrepreneurs that competition is not as intense compared to back home.

ADVERTISEMENT

Amazon holds 38 percent of the US ecommerce market share as of June 2022 per HSBC, but other players are much smaller and are mostly traditional retailers or brands, including Walmart, Apple and Target, all in the single digits.

Temu could follow a similar path in the US to Pinduoduo’s rise in China: it was initially known for cheap products, but now hosts stores for Dyson, Adidas, Anta and other well-known brands, taking market share from Alibaba and JD.

Michael Felice, an associate partner at Kearney’s CMT practice, said similar to China, there’s a suburban price-sensitive customer in the US who is “drastically underserved,” particularly online. These customers look for bargains at dollar stores or simply haven’t been able to access products in the past. Chains like Big Lots are stepping up their online efforts, but Temu has the potential to go a step further, he said.

“There is a white space to open up with a less brand-focused disruptor” that can operate on even slimmer margins, and therefore offer the lowest prices, Felice said.

Chinese sellers, who make up a significant portion of Amazon’s GMV, are also looking for alternatives to the platform, frustrated by increasing costs and what they see as confusing and arbitrary rules. Between 2020 and 2022, the contribution of Chinese merchants to Amazon’s GMV dropped to 42 percent down from 48 percent, research firm Marketplace Pulse said.

“Temu could bring new markets to Chinese manufacturers and merchants, or offer those already selling into the US, mainly on Amazon and Shein, an alternative channel,” UBS’ head of China internet research Jerry Liu wrote in a December note.

TikTok, part of China’s Bytedance, meanwhile is attempting to monetise its hugely popular social media platform beyond ads and gift purchases, officially launching e-commerce in the US last November.

China’s government is signalling its support for the country’s tech giants, after a stretch in 2020 when it cracked down on the sector, including halting Ant Financial’s initial public offering.

ADVERTISEMENT

“With the new senior administration selected at the Party Congress in October and focus now back on the economy and jobs, the new order from the top appears to be: support tech and internet companies,” said Barclays’ Shao.

Whether Temu and other Chinese firms will get a similarly warm reception in the US is another question. Relations between China and America are at a low. Economic jockeying has mostly been limited to semiconductors and other strategic technologies, but there are signs fashion may soon be in the crosshairs. Last week, TikTok confirmed to The Wall Street Journal and other media outlets that the Biden administration is pressuring its owner, Bytedance, to sell the social platform or risk a ban.

However, UBS’ Liu said even factoring in the geopolitical risk factor, he believes the company’s prospects are promising given PDD Holdings’ ability to support Temu’s lavish spending on marketing and discounts to gain market share.

“If Temu continues to gain traction, then the ultimate competitors are Amazon and TikTok,” he wrote.

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.

The company has continued to struggle with growing “at scale” and issued a warning in February that revenue may not start increasing again until the fourth quarter.