The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Last week, Richemont chair Johann Rupert for the first time publicly acknowledged a proposal made by French rival Kering “more than a year ago” to join forces but said that the Swiss group he controls was not for sale, according to The Financial Times.

The logic for a Kering-Richemont merger has long made sense.

The two companies are highly complementary, Kering with its strengths in soft luxury and Richemont with its hard-luxury prowess. And though they are both successful, they remain far smaller than French sector leader LVMH, whose chairman Bernard Arnault momentarily surpassed Amazon founder Jeff Bezos to become the world’s richest person earlier this week. Their best shot at building a genuine multi-category rival to the luxury goliath is a merger.

In luxury, scale matters hugely. The heft of its portfolio gives LVMH a significant edge over competitors in distribution and media, where it enjoys leverage with multi-brand retailers, mall owners, real estate developers, magazines, influencers and other key players in the fashion ecosystem. LVMH also has an advantage in attracting and retaining top talent, who it can offer better compensation, more interesting career opportunities and larger budgets.

ADVERTISEMENT

Scale benefits are by no means unique to luxury. Across industries, from cars to technology, the bigger you are the easier it is to stay on top. But in recent years, luxury has become a winner-takes-all business increasingly dominated by the biggest players as the landscape has become more complex, unpredictable and difficult to navigate for smaller companies.

Digital has upended once dependable distribution channels, giving rise to new competitors, but online upstarts face rising customer acquisition costs and rarely have the time and capital it takes to build luxury brands. Meanwhile, the proliferation of digital communications channels has favoured bigger players that can not only master the growing number of platforms but keep pace with consumer expectations for product innovation at the speed of social media. The rise of China, now the world’s largest fashion market, has added further complexity to the equation.

Then came the shock of Covid-19, which not only disrupted supply chains and forced store closures, but also recentred the fashion market from the United States and Europe to Asia and pushed more consumers to blue-chip brands, deepening the divide between the biggest companies and everyone else. The latest round of luxury results saw luxury megabrands like Hermès and LVMH’s Louis Vuitton and Dior far ahead of the pack, while smaller labels have struggled to bounce back from lockdown lows with anything near the same velocity.

“Performance is driven by a few elements that are typically linked to scale,” explained Bernstein analyst Luca Solca. “The need to capture consumers at the four corners of the world (as they are not travelling to Europe as much) favours the biggest brands that have both a global retail network and global digital distribution,” he said. “Then, there is the ability of brands to be compelling to Chinese consumers in terms of traction and innovation, and their ability to connect with customers by using a multitude of different communication and CRM channels.”

Today, even Kering and Richemont could benefit more than ever from greater scale.

Whether they ever tie the knot remains to be seen. Price could be one obstacle, though Rupert’s willingness to relinquish control (his family holds the majority of Richemont voting rights but only 9 percent of its capital) may be the real stumbling block. But 2021 may yet prove a catalyst for a transformative deal for Kering. If not the Richemont megamerger Pinault is said to have proposed, the group could make a move for a smaller but still significant player like Burberry.

The need for scale in a complex world is driving talk of game-changing consolidation in Italy, too. Renzo Rosso — founder and president of Diesel-owner OTB, which recently acquired Jil Sander — told La Repubblica last week that he was seeking a “significant acquisition” in “high-end prêt-à-porter” and seems to be on a mission to unite Italy’s fragmented luxury sector, which has long been populated with smaller, family-run firms and lacks a large-scale leader.

Smaller firms “won’t be able to sustain the costs of digital development, won’t get a deal with big online platforms,” Rosso told Bloomberg this month. “Some fashion companies will need to accept partnerships, and these alliances will give them the visibility they never had before.”

ADVERTISEMENT

After years of fiercely asserting his independence, Giorgio Armani may be ready for a deal. Covid-19 “made us open our eyes a bit” the 86-year-old designer told American Vogue in an interview published in its May issue. “One could think of a liaison with an important Italian company,” he added, prompting speculation of a tie-up with Agnelli family holding Exor, which has the scale to pursue such a deal and may have a growing interest in fashion. (The company is pushing its Ferrari fashion line and recently acquired Shang Xia from Hermès as well as a 24 percent stake in Christian Louboutin).

Soon after the Armani interview was published, Dolce & Gabbana joined the chorus, quashing rumours of a deal with Kering, but leaving the door open to a “broader Italian project.”

And yet Moncler’s Remo Ruffini, who last December acquired Stone Island in a transformative move that signalled the company’s ambitions to build its own group, said Thursday he did not expect to see consolidation in Italy’s fashion sector, citing the culture of its controlling families.

“I do not see consolidation in Italy,” he said. “In Italy everyone wants to hold the majority. Most companies have a long history — four, five generations long — and it’s hard to let go,” he continued, before adding that he himself was not constrained by such thinking.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

Capri Holdings forecasts annual revenue above expectations. The Michael Kors and Versace parent expects revenue of about $5.1 billion for its fiscal 2022, betting on shoppers returning to stores in the United States following speedy vaccinations and pent-up demand for luxury goods in Europe. Analysts were estimating $4.99 billion, according to IBES data from Refinitiv.

Nordstrom beats quarterly revenue estimates. Total revenue rose to $3.01 billion in the first quarter ended May 1 from $2.12 billion a year earlier, beating analysts’ average estimate of $2.90 billion.

ADVERTISEMENT

Kering to reduce Puma stake further with $1 billion sale. The Gucci owner is further reducing its stake in Puma SE, slimming down its investment in the sports shoe maker to focus on higher-end luxury. The French company said it will sell 8.9 million shares in the German brand, a stake representing around 5.9 percent, according to a statement on Wednesday.

Report: Forever 21 owner Authentic Brands plans IPO this year. The company could seek a valuation of about $10 billion when it goes public, according to people with knowledge of the matter, though the size and valuation of the deal is not final. The company was valued at more than $4 billion, including debt, in an $875 million investment by BlackRock in 2019.

Gap raises 2021 forecasts as apparel shopping gains momentum. The San Francisco-based company expects fiscal 2021 net sales to grow in the low-to-mid 20% range from a year ago, compared with its prior projection of mid-to-high teens. Analysts were forecasting sales growth of 17.8%, according to IBES data from Refinitiv. The company stayed mum on the timing for the rollout of Yeezy Gap, its upcoming partnership would with collaborator Kanye West.

Valentino to show haute couture in Venice. Long a staple of the Paris fashion week calendar, Valentino will remain in Italy for one more season, with plans to return to Paris in September, staging its haute couture collection for a small audience in Venice on July 15.

Michael Kors to show during NYFW. The American designer made the announcement on Wednesday, indicating the event will be a live, in-person runway show scheduled for September 10, though it will also include a “multi-layered digital experience” broadcast simultaneously on the brand’s e-commerce site.

Something Navy aims for growth, but Arielle Charnas takes a step back. Though Charnas will retain her title as chief creative officer, going forward, the brand, which took on outside investors in 2019, will rely less on its famous founder to drive sales. Its backers hope to grow beyond the influencer’s fan base, said chief executive Matt Scanlan.

MatchesFashion joins 15 Percent Pledge. The luxury e-commerce player is the first UK-based company to join the commitment, which calls on companies to give Black-owned businesses at least 15 percent of their shelf space (a number that roughly corresponds to the percentage of the US population that is Black).

UK retail sales subdued in May. British retailers said sales fell back to more normal volumes earlier this month after seeing increased demand in April. The Confederation of British Industry said its monthly balance for whether sales were above or below normal for the time of year dropped to -3 in May from +16 in April, indicating roughly normal volumes.

Report: Shein prepares for IPO as valuation nears $47 Billion. Shein, founded in 2008 in China, utilises big data and China’s highly developed garment manufacturing capabilities to pump out products in record time and ship them to 220 countries, with growth fuelled by a community of young female users and thousands of micro-influencers.

THE BUSINESS OF BEAUTY

Chinese transgender star Jin Xing to front campaign for Dior J’Adore. Describing Jin as a woman of courage with a passion for freedom and art, Dior announced through its official Sina Weibo account that Jin is now the face of the luxury brand’s signature fragrance, Dior J’Adore, in a new marketing campaign.

South Korean consumer craze for quirky ‘funsumer’ products continues. The “funsumer” trend for retro product packaging and cross-sector partnerships is generating buzz in Korea, The Korea Herald reports. A milk powder-scented body wash, a collaboration between supermarket Homeplus, LG Household & Health Care and Seoul Dairy Cooperative, is the the latest example.

PEOPLE

GmbH founders named creative directors of Trussardi. Serhat Işık and Benjamin Huseby, the design duo behind menswear label GmbH, will continue on at the Berlin-based brand in addition to their new duties at Trussardi. Their first show for the Italian accessories, jeans and perfume brand will be for the Fall/Winter 2022 season.

Coty names Andrew Stanleick CEO of Kylie Jenner beauty brands. Stanleick was the executive vice president of the Americas region. In his new role, he will also manage Kim Kardashian’s business for the beauty conglomerate. Kris Jenner was formerly the interim chief executive for Kylie’s beauty business and will remain involved as a board member.

Tod’s appoints chief marketing and communications officer. Former KCD Paris managing director Michele Giacalone, has been appointed to the newly created position, Tod’s Group said. He will be based in Milan and report to Tod’s general manager Carlo Alberto Beretta.

Gwyneth Paltrow joins Rent the Runway board. The founder of Goop will take up this position in May as the rental fashion company seeks to redefine itself with customers coming out of the pandemic.

MEDIA AND TECHNOLOGY

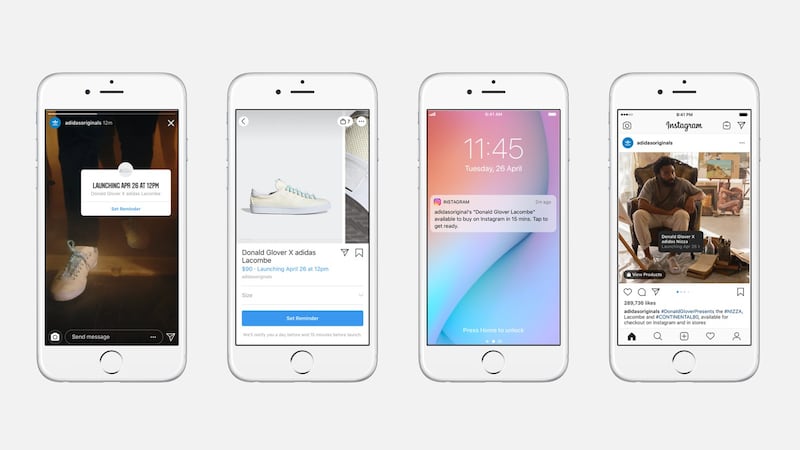

Instagram launches new ‘Drops’ shopping feature. On Wednesday, Instagram announced a new feature to bring the growing e-commerce “drop” trend to the platform. Located inside the Shop tab, the feature will showcase upcoming launches, recent drops and launch reminders.

Port Authority says Condé Nast’s parent Advance owes $9.6 million in Manhattan rent dispute. “The companies responsible for this lease have billions of dollars in assets, yet they have unilaterally withheld rent without any legal justification,” said a representative for the Port Authority.

ByteDance foe Kuaishou drops as livestreaming sinks, costs jump. Kuaishou Technology shares tumbled after it reported a faster decline in its livestreaming business while boosting investments in newer businesses. While revenue climbed 37 percent to 17 billion yuan ($2.65 billion) in the three months ended March, sales from its livestreaming business fell almost three times faster than a year earlier.

Tencent revenues up 25 percent in Q1, short video is future focus. The Chinese tech giant and owner of “everything app” WeChat reported total revenues of 135.3 billion yuan ($20.6 billion) for the first quarter ending March 31, an increase of 25 percent year-on-year. Operating profit was 42.8 billion yuan ($6.5 billion), an increase of 20 percent on the year.

Compiled by Darcey Sergison.

The fashion giant has been working with advisers to study possibilities for the Marc Jacobs brand after being approached by suitors.

A runway show at corporate headquarters underscored how the brand’s nearly decade-long quest to elevate its image — and prices — is finally paying off.

Mining company Anglo American is considering offloading its storied diamond unit. It won’t be an easy sell.

The deal is expected to help tip the company into profit for the first time and has got some speculating whether Beckham may one day eclipse her husband in money-making potential.