The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Opens in new window

Opens in new windowMore than any other cohort, Gen-Z is deeply connected to beauty. And why wouldn’t they be? These digitally savvy teens and twentysomethings, born 1996 to 2010, have been engaged in the category from a young age, thanks to technology at their fingertips connecting them with influencer- and celebrity-founded product lines, and “Get Ready with Me” videos on TikTok and YouTube. They are more willing than older cohorts to experiment with makeup, skin care and hair products, perhaps because of how quickly beauty’s viral trends spread on social media. According to McKinsey’s 2023 global consumer survey, 45 percent of Gen-Z respondents said they try new brands every two to three months. For brands that hit the mark, though, Gen-Z shoppers show high levels of loyalty, with close to 60 percent willing to stick with their favourites, compared to around 50 percent of older generations, making the generation worth investing in.

Gen-Z has outsize potential to drive the beauty market’s growth. By 2030, when they will represent a quarter of the world’s population, their income will reach $33 trillion. This will exceed that of Millennials, born 1980 to 1995, by 2031. Gen-Z individuals are also opinion leaders — much more so than the generations that preceded them. Studies by the National Retail Federation, as well as First Insight and the University of Pennsylvania’s Wharton School, show that Gen-Z exert substantial influence over the purchasing behaviour of older cohorts, with close to 90 percent of parents stating that their children influence their buying decisions.

Yet Gen-Z is not a monolith: the youngest Gen-Z individuals are just in their teens, while the oldest have jobs, rent and bills to pay. Largely because of both their age and the fast-evolving digital world that they are so firmly part of, Gen-Z’s preferences are in flux as they figure out exactly who they are.

So how can beauty brands get ready? Knowing who Gen-Z is today — and how quickly their preferences can change — is critical for consumer industries like beauty. That starts with interpreting the hallmarks already evident across this generation while questioning widely accepted attributes.

ADVERTISEMENT

Unlike their predecessors, Gen-Zers do not want to make compromises. Millennials initially drove much of the mainstream interest in diversity in the beauty industry. Yet, as the most diverse generation to date when it comes to gender, ethnicity, sexual orientation and more, Gen-Z is more adamant that brands, products and marketing stand for something and reflect their values relating to topics ranging from mental health to climate change, while also acknowledging their diversity.

Young shoppers, for example, seem to connect to Selena Gomez’s Rare Beauty brand in a way that extends beyond its products. The American singer and actor’s outspokenness about her own mental health issues has helped to portray the brand as a safe space for Gen-Z. The brand launched the Rare Impact Fund to give people access to mental health resources and held workshops during the pandemic for consumers to connect with one another.

Meanwhile, Gen-Z brands like Topicals and Eadem are addressing skin issues typically found among consumers of colour, such as hyperpigmentation and dark spots, deepening the beauty industry conversation around skin tones that was started by brands like Rihanna’s Fenty Beauty.

McKinsey’s survey shows that close to 40 percent of Gen-Z consumers — compared with about 30 percent of older generations — prefer gender-neutral beauty products. Bigger brands have adjusted their playbooks to keep pace with this shift. YSL Beauté, for example, launched Nu Collection, a genderless skin care and makeup line, in 2021 and tapped American rapper and singer Lil Nas X as one of its ambassadors in 2022. Armani Beauty, meanwhile, created Gen A, a collective of next-gen international actors including Maude Apatow, Jonathan Daviss and Lili Reinhart to appeal to a younger clientele.

At the same time, brands are more frequently working with male, transgender or non-binary models for traditionally female-orientated product ranges such as makeup. One example is Shiseido’s partnership with brand ambassador and transgender actress Hunter Schafer. McKinsey research shows that Gen-Z men in Asia already embrace makeup products, with around one third using makeup regularly, while in the US and key European markets, between 5 percent and 10 percent of male respondents use makeup.

To cement Gen-Z loyalty, companies must therefore develop and communicate authentic brands that connect with Gen-Z on an emotional level.

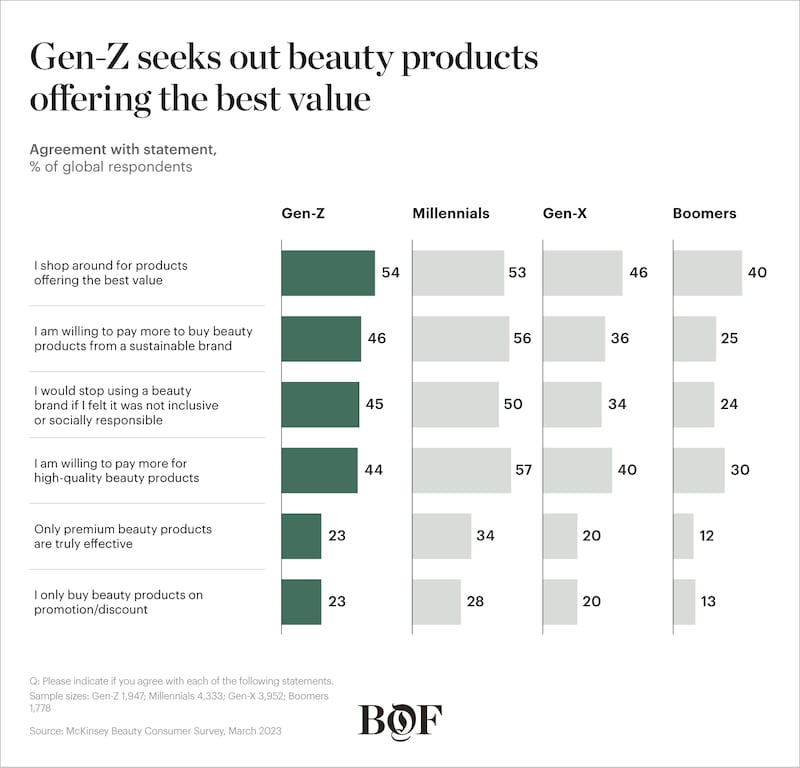

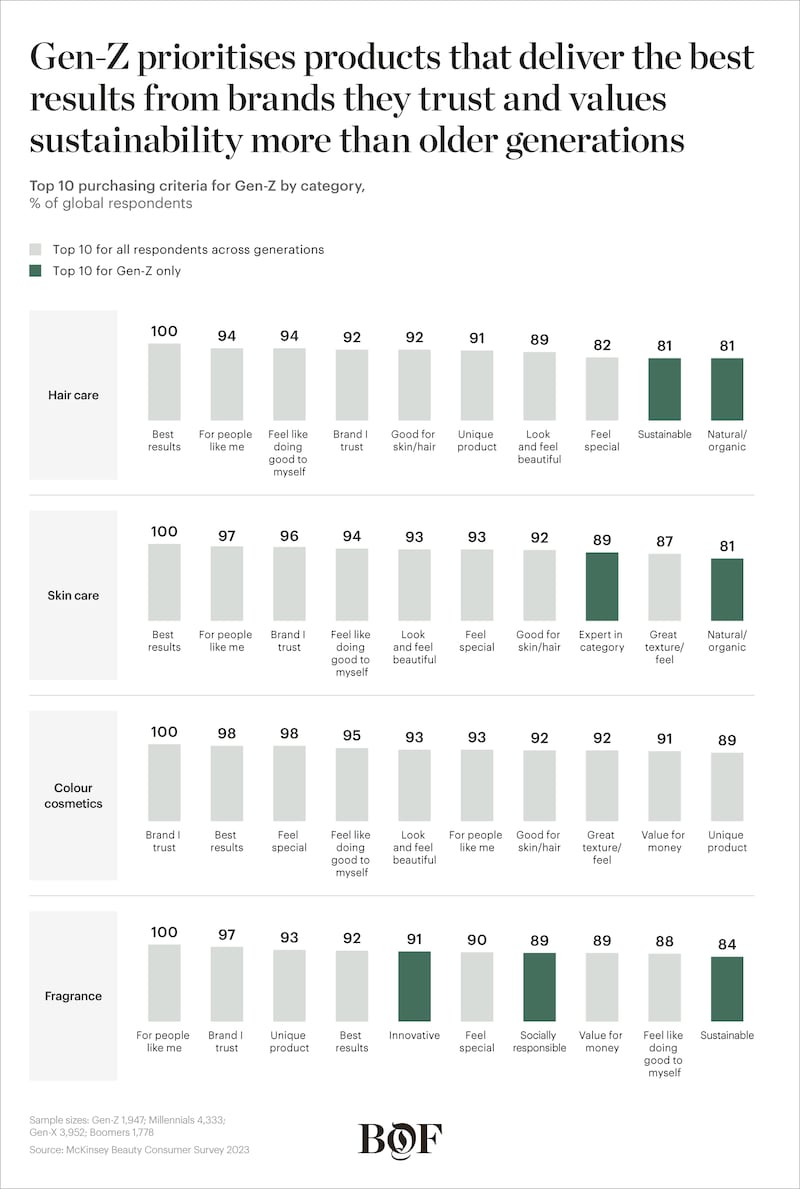

Similarly to Millennials, close to half of Gen-Z report checking product ingredients and doing extensive research on their benefits before purchasing, compared with one-third of Gen-X (born 1965 to 1979) and one-fifth of Boomers (born 1945 to 1964). However, Gen-Z does not equate higher price points with quality like their older counterparts: one in two Gen-Z consumers report shopping for the best value for money and fewer than one in five consider products from premium beauty brands to be effective, compared with about one in three Millennials.

The Ordinary is a favourite among younger shoppers, in part because of its transparent strategy for product and price. The brand makes clear to consumers that its products have the same ingredients as other, more expensive lines. Even when the skin care brand raised prices in 2022, it explained why, citing the rising cost of raw ingredients, packaging and shipping, as well as cost-of-living increases for employees.

ADVERTISEMENT

Brands should not shy away from their mass or masstige positioning. For example, marketing for Bubble Skincare, a Gen-Z line launched in 2020, underscores the products’ affordability. Yet, while Gen-Z is driving growth in the mass and masstige segments, beauty brands can also find success with premium products if they can justify higher prices and do not rely on premium positioning alone by demonstrating additional value. Nearly half of Gen-Z respondents report being willing to pay a premium for products if they are higher quality. On top of this, 46 percent are willing to pay a premium if they consider a brand to be sustainable. These figures may increase along with Gen-Z’s spending power.

Gen-Z generally prefer unfiltered aesthetics which speak to their demand for authenticity. Unlike Gen-X and Millennials when they were in their teens and twenties, who prioritised brand reputation and experiences respectively, younger shoppers today want realness and relatability. Indeed, while Millennials generally aspired to a singular ideal of beauty — coining the term “Instagram face” — Gen-Z values authentic self-expression and want to be part of a brand’s story. In essence, the term “community” has higher stakes for Gen-Z than any other generation.

E.l.f. has been quick to involve younger shoppers in its brand story, so much so they were the inspiration for the US brand’s first television advert promoting its primer, which aired during the Super Bowl in 2023. E.l.f. chief marketing officer Kory Marchisotto said fan interest in the product — generated on TikTok and other social media platforms where Gen-Z congregates — drove the TV strategy: E.l.f. fans called the primer “sticky jam,” “sticky slime” and “space glue,” among other monikers, which was why actress Jennifer Coolidge, the star of the ad, found herself in “sticky situations” in the slapstick commercial directed by “White Lotus” creator Mike White.

Indeed, Gen-Z is the first digitally native generation. Its use of social media has propelled brands such as skin care label CeraVe, which did not necessarily set out to target the generation but found success on TikTok as users and influencers highlighted the brand’s lower-cost but effective products.

Yet Gen-Z is not as digitally fixated as some believe. While 50 percent of Gen-Z respondents said they are most likely to learn about new products from social media personalities, particularly on TikTok, 41 percent also cited brick-and-mortar stores as an important channel — roughly the same percentage as older survey respondents.

When Gen-Z individuals shop in stores, they have a clear sense of what the experience should be, with more than 85 percent citing high levels of service — such as customised skin and hair diagnostics — and pleasant store environments as very important purchasing factors.

Retailers are adjusting the brands they stock accordingly. Ulta Beauty was the most popular destination for beauty purchases for US Gen-Z in 2022 largely due to its stock of Gen-Z favourites, according to a survey by Piper Sandler. Meanwhile, Sephora dedicates shelf space to popular Gen-Z brands with in-store categories like “Hot on Social Media,” showcasing products that have gone viral among the online beauty community, which the retailer nurtures through partnerships with influencers and key opinion leaders.

For both brands and retailers, staying attuned to Gen-Z — even while targeting other generations — will be a critical piece of any growth puzzle. Building a meaningful, authentic and collaborative connection with this cohort can help inform where and how to best direct a business’s focus, from pricing strategies to product lines to marketing. This will require brands to ensure their products encapsulate meaning beyond their material value. Above all, beauty leaders must ensure their brands grow and mature alongside Gen-Z, while also being seen as a positive force for change and innovation in how Gen-Z experiences beauty.

This article first appeared in The State of Fashion: Beauty report, co-published by BoF and McKinsey & Company.

Opens in new window

Opens in new windowThe State of Fashion: Beauty finds that brands have a growing opportunity to tap into emerging wellness subcategories — from sleep to sexual intimacy to ingestible beauty — by upgrading existing products or expanding portfolios, provided they do so with credibility and authenticity.

Going public is usually a pivotal moment in a company’s history, cementing its heavyweight status and setting it up for expansion. In L’Occitane’s case, delisting might be a bigger conduit for growth.

Brands say they’re barreling ahead with marketing and commerce on the app, even as the clock starts ticking for owner ByteDance to sell it or shut it down.

The Spanish beauty and fashion conglomerate’s smart acquisitions and diverse portfolio could be a big draw for investors. Plus, Adidas is set to confirm its stellar first quarter.

How not to look tired? Make money.