The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

This article first appeared in the special edition of The State of Fashion: Watches and Jewellery, co-published by The Business of Fashion and McKinsey & Company. To learn more and download a copy of the report, click here.

Historically a stronghold of Swiss brands that have established themselves as household names through decades of watchmaking, the mid-market for watches priced between $180 and $3,600 is facing existential threats from both ends of the spectrum. The most aggressive competition comes from luxury watch brands leveraging their brand power to entice the higher end of the mid-market, and smartwatches at the lower end convincing consumers to swap tradition for technical functionality.

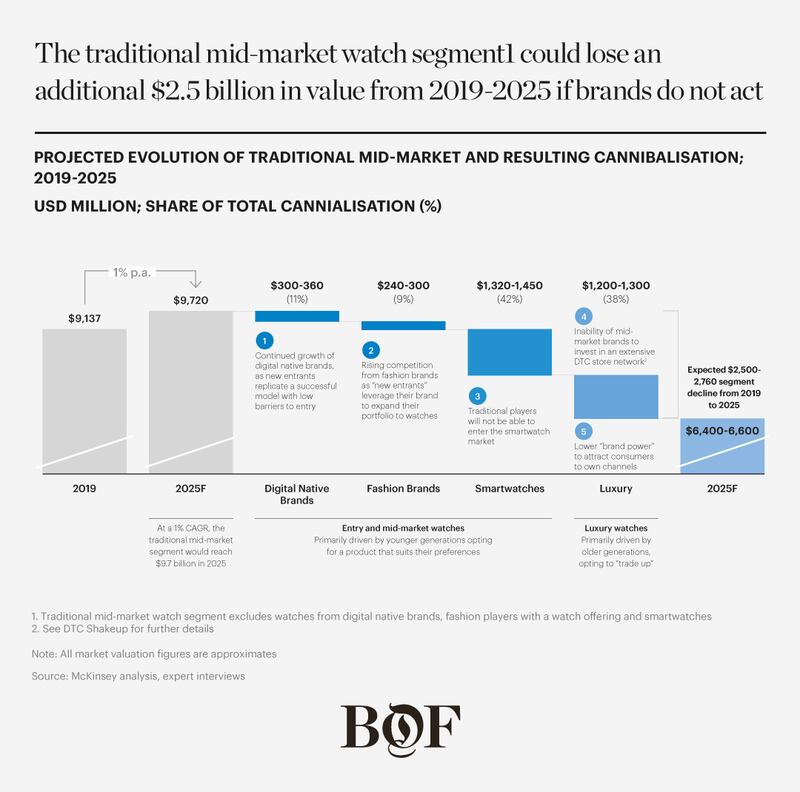

The squeeze from the lower end will be multi-faceted. Numerous mid-market brands are globally recognised as marks of reliability and quality, especially Swiss players who trade off their “made in Switzerland” origins. Primarily sold through third-party retailers, traditional mid-market watch brands accounted for around 18 percent of all watches in value segments spanning premium to ultra-luxury in 2019, making over $9 billion in annual sales according to McKinsey analyses. But while the overall watch market grew in recent years, established mid-market players saw their market share erode, with mid-market brands losing an estimated $1 billion in market share between 2015 and 2019. By 2025, mid-market players could expect to cede a further $2.5 billion compared to projected revenues to new entrants that are better positioned to appeal to a new generation of consumers. These disruptors at the lower end fall into three categories — digital natives, fashion brands and smartwatches.

For digital natives with online-only propositions, such as Christopher Ward, Daniel Wellington and MVMT, the consumer shift to online shopping is a determining success factor in capturing the lower end of the market: “Lower barriers to entry due to a rise in online retailing and digital marketing are favouring the entry segment,” said Silas Walton, chief executive of pre-owned watch platform A Collected Man. As such, since 2015, McKinsey estimates that watch sales from digital natives have almost doubled to around $300 million, with the majority of sales representing a switch from traditional watchmakers. Indeed, some online-only companies such as Daniel Wellington have seen their annual sales as much as double. By 2025, as investments in start-ups continue to climb, digital natives could account for 11 percent of revenue shift from the mid-market, equating to $300 million. These companies will leverage a low-cost base, a streamlined product portfolio and increased consumer appetite for online shopping to gain advantage.

ADVERTISEMENT

At the same time, fashion brands such as Gucci, Hermès and Fendi are also taking a slice of the mid-market, leveraging their substantial brand equity to expand into watches. Gucci has produced fashion watches through its Gucci watch division in Switzerland for decades, but more recently introduced four high watchmaking lines, conceptualised by creative director Alessandro Michele and his eclectic style. Luxury streetwear brands will also look to leverage the trend toward casualisation which can be realised through collaborations, such as that between Tag Heuer and Hiroshi Fujiwara’s streetwear label Fragment. Sales of watches from fashion brands now represent an estimated $1.6 billion, and some of these players will have the financial firepower and creative skill set to offer fierce competition. By 2025, around $240 million could transfer from mid-market players to fashion brands according to McKinsey, as the latter continue to diversify their categories and take advantage of the rise of less formal aesthetics.

Finally, the most substantial dent in the lower end of the traditional mid-market comes from smartwatches, accounting for around 70 percent of its revenue decline since 2015 — equating to roughly $780 million. The fast-growing segment is dominated by tech players such as Apple, Garmin and Samsung, who have added entirely new functionality to the equation which give consumers tangible benefits, such as health and sports tracking. On standalone terms, growth has been spectacular: Apple alone now sells more watches than the entire Swiss entry-luxury segment, outselling the segment by nearly 10 million units in 2019. In the highly technical and specialised smartwatch market, traditional mid-market players are unlikely to be able to compete with tech companies’ increasingly advanced wearable devices.

“Demographically, it’s difficult to see what the difference is [between those buying smartwatches and those buying similarly priced traditional watches] but it’s a different need, use case and frame of mind,” said Suparna Mitra, chief executive of Titan Company Limited’s watches and wearables division. The Indian jewellery and watch conglomerate’s portfolio includes traditional premium and entry-level watch brands Titan and Sonata and “a range at the lower end smart band space, as well as in the mid segment of smartwatches.”

While smartwatches and traditional watches, over time, will no longer be an either/or purchase for consumers, younger buyers who have historically been the main consumers of mid-market brands are increasingly opting for smartwatches as their first buy instead of a traditional watch. By 2025, smartwatches will capture another $1.3 billion in revenue lost by the mid-market.

Meanwhile, the squeeze from the higher end is likely to be felt across the board but will impact some mid-market brands harder than others. Luxury watch brands are increasingly seeing traditional mid-market customers — particularly aspirational older consumers — trading up to luxury watches typically priced above $3,600. Three factors are accelerating this shift and were apparent even before the pandemic: the rise of direct-to-consumer (DTC) retailing for luxury brands, reduced footfall in multi-brand retail (and subsequently the decline of exposure for mid-market brands which do not carry the same brand equity for shoppers) and the downward repositioning of some luxury brands.

Luxury players will benefit from consumer expectations of value and quality, which are rising, alongside willingness-to-pay — 60 percent of US consumers say they are willing to pay full price or a premium to get exactly what they want from a watch purchase. Consequently, mid-market brands will struggle to match these expectations, given their limited differentiation across aesthetics and brand messaging to date. They may also find it more difficult to commit to a DTC strategy than their more upmarket competitors due to the high investments required to operate their own stores and challenges in attracting sufficient footfall. On top of this, many mid-market players do not have the breadth of product to justify the switch from multi-brand retail to operating their own stores, presenting challenges in creating a compelling in-store experience. As such, the traditional mid-market could continue to be eroded by luxury brands, which are poised to capture an incremental $1.2 billion in revenue by 2025 according to McKinsey analysis.

However, some market territories will feel the squeeze more than others. “In the context of India, the mid-market is not shrinking, and it’s not likely to shrink. The aspiring class segment is just so big [that] no matter how many people are [trading] up, there are large numbers of people who are… coming into branded consumption [or] coming into higher and higher price points,” said Titan Company Limited’s Mitra. “If you leave aside the [global pandemic period] where, of course, it’s been hit, the long-term secular trend is of huge adoption of lifestyle goods, brands, discretionary products and categories, like watches.”

The greatest impact of these shifts will likely be felt in Switzerland, where the majority of mid-market brands are headquartered. Between 2015 and 2019, Swiss mid-market brands experienced nearly the entirety of the drop in overall watch exports from the country, which fell by more than 25 percent. If this trend continues as projected, additional pressure will be placed on the Swiss industry’s cost structure, and the “made in Switzerland” label could risk losing its value in the mid-market.

ADVERTISEMENT

Traditional mid-market watchmakers should consider five business levers to guard against these pressures from both the lower and higher ends of the market:

Differentiate Beyond ‘Made in Switzerland’

Mid-market brands have historically relied on a claim of “building quality Swiss watches” which, today, offers little in terms of differentiation and brand image given the similarity of claims across brands. Mid-market brands must therefore make bold decisions to develop distinct propositions. This may mean focusing initially on research and development to spearhead greater innovation and technological capabilities. To further differentiate, they should strengthen the brand proposition with cutting-edge designs and consider using alternative materials. Geneva-based Frederique Constant is among the companies to have invested in advanced computer-aided design software to help in the design and development of new watches, while Swatch has focused on creating innovative, provocative and fun time pieces as a key differentiator.

Target Consumers Online

To engage with the shift to DTC, mid-market brands should invest in a targeted online offering. Where it may prove difficult for mid-market players to operate their own physical stores, a strong digital presence will enable them to target the right customer at the right time and respond quickly to shifting needs from both the business and consumer. Mid-market businesses may also consider launching e-commerce pop-up stores, which are marketed through social media. Brands should look to lessons from start-ups such as BA111OD, which has developed what it calls an “afluendor” strategy, within which it leverages its network of customers to create content for the brand and generate new sales in exchange for “tokens” to buy new watches.

Leverage Product Customisation

Across luxury categories, over 80 percent of customers want some form of product personalisation. In luxury watches, this could mean personalisation of the watch dial colour, hands shape, clasp or bezel, and more. This reflects broader trends seen in the fashion industry, in which companies such as Adidas and Nike offer customers the ability to “build their own” products. If the economics work, mid-market brands could command a higher price for distinct, customised products and protect the higher end of the market from the risk of consumers trading up.

Aim for Exclusivity

ADVERTISEMENT

The luxury segment has formerly taken the lead in producing special editions, such as celebrity-endorsed timepieces, in small production runs that emphasise individuality and exclusivity. These watches tend to command higher prices and see higher levels of demand due to their rarity. This same opportunity exists in the mid-market, where brands such as Casio are having success with exclusive collections: Casio’s rainbow G-Shock collaboration with retailer Kith, priced at $400, sold out almost instantly at its launch in March 2021.

Get Distribution Right

While moving to DTC, especially online, mid-market brands should continue to leverage their retail partners as much as they can. As luxury brands go DTC, there is an opportunity for mid-market brands to take more space in retail stores, working with independent retailers to ensure they gain visibility in stores and lock out competing fashion brands trying to gain a foothold. In addition, watchmakers could leverage independent retailers’ online platforms and third-party platforms to increase their visibility online and gain exposure to customers not specifically looking for their brand.

By acting decisively with these five levers, mid-market businesses may stem the flow of demand towards competitors and find new ways to excite and engage new and existing customers. While incumbents are unlikely to be able to compete against the smartwatch segment, they can make real gains by improving their digital presence, finding the right partnerships to enhance their brand, competing more aggressively in the retail space and in leveraging creativity to take on luxury players.

“[Mid-market] brands should strive to develop a strong brand identity and house codes that are easily recognisable, while tapping into the cultural zeitgeist,” said Jennifer Obayuwana, executive director of Polo Luxury Group, which sells watch brands through its network of multi-brand and mono-brand boutiques across the Nigerian market. “This will help them to stand out from the masses and make the consumer feel that they have captured a piece of ‘accessible luxury.’”

If they are successful, mid-market players are likely to stem at least half of the potential $2.5 billion in revenue loss and breathe life into a segment that remains a key driver of industry profit.

The inaugural edition of The State of Fashion: Watches and Jewellery report co-published by The Business of Fashion and McKinsey & Company forecasts a shake-up in priorities for hard luxury as well as different recovery scenarios across geographies and consumer segments. To learn more and download a copy of the report, click here.

BoF Professionals are invited to join us on July 13, 2021 for a special live event in which we'll unpack findings from the report. Register now to reserve your spot. If you are not a member, you can take advantage of our 30-day trial to experience all of the benefits of a BoF Professional membership.

Explore the six seismic shifts from the report:

The Future of Watches:

The Future of Jewellery:

Click here to explore more from this special edition report, including executive interviews.

The fashion giant has been working with advisers to study possibilities for the Marc Jacobs brand after being approached by suitors.

A runway show at corporate headquarters underscored how the brand’s nearly decade-long quest to elevate its image — and prices — is finally paying off.

Mining company Anglo American is considering offloading its storied diamond unit. It won’t be an easy sell.

The deal is expected to help tip the company into profit for the first time and has got some speculating whether Beckham may one day eclipse her husband in money-making potential.