The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

This article first appeared in the special edition of The State of Fashion: Watches and Jewellery, co-published by The Business of Fashion and McKinsey & Company. To learn more and download a copy of the report, click here.

The watch industry has historically been slow — and in some cases reluctant — to embrace change of any kind. The industry’s distribution model is no exception, which still relies heavily on offline channels and a network of retailers who are trusted to build the customer relationship. But consumers are beginning to demand more direct interactions with brands. In fact, globally, the majority of affluent consumers now prefer buying watches from mono-brand stores, according to a consumer survey by Agility. This shift in expectations is enabling brands to take over the reins of the customer relationship by expanding their DTC channels.

A parallel trend can be observed in consumer preferences for shopping online, where online sales of watches continue to gain traction. In China, 30 percent of consumers reported to have made a premium to ultra-luxury watch purchase online in the last 6 months, while a significant 53 percent of US consumers reported the same. Indeed, McKinsey research projects that by 2025, online sales of watches will more than double to $6 billion, amounting to 10 to 15 percent of all watch sales spanning the premium to ultra-luxury segments and representing a steep increase from 5 percent today.

Another signal that the shift to DTC is here for the long haul is the changing face of established B2B watch fairs such as Baselworld, which were once an industry mainstay. “In 2018, we knew a lot of things were not right and that we had to transform the show,” said Michel Loris-Melikoff, managing director of HourUniverse, which replaced the now-defunct 103-year-old Baselworld in 2021. Going forward, trade shows, such as HourUniverse, will be increasingly focused on engaging consumers directly, with other consumer-facing forums, such as the Dubai Watch Week and Geneva Watch Days, taking a prominent position on the annual calendar of both consumers and watchmakers.

ADVERTISEMENT

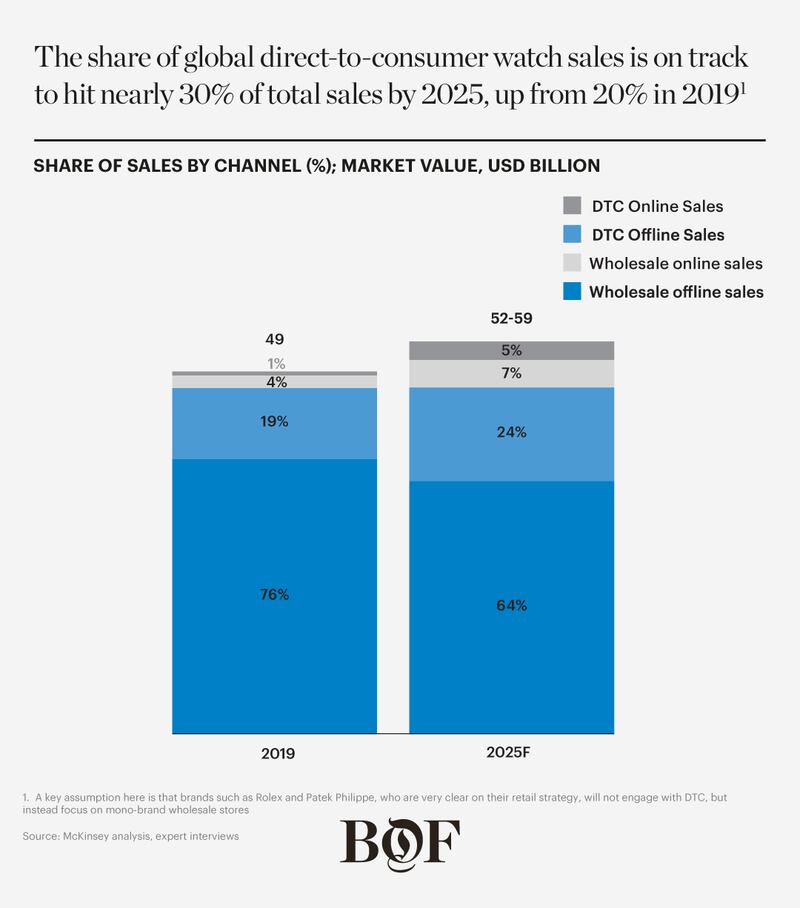

Together, these factors will contribute to a fundamental shift in market dynamics as brands actively turn to DTC channels to increase margins and better connect with customers, to the extent that watchmakers in the premium to ultra-luxury segments could expand their share of DTC sales from 20 percent in 2019 to 27 to 30 percent by 2025. While some brands such as Rolex and Patek Philippe remain outliers to the DTC wave and are not expected to change that position, the industry as a whole could still see $2.4 billion in annual revenue transfer from retailers to watchmakers if the market is to follow the trajectory of adjacent industries like fashion.

“We are seeing more and more that brands want to cut out their channel partners to gain more margin and get closer to the customer,” says Jennifer Obayuwana, executive director of Polo Luxury Group, which sells brands such as Rolex and Piaget through its network of Polo multi-brand and mono-brand boutiques across the Nigerian market. “[But] not every brand will be able to make the switch to direct-to-consumer successfully. They would lose the edge of a deepened market penetration where channel partners have proven that understanding of local nuances [and local market know-how] can give significant advantage.” Mid-market brands in particular will face challenges in implementing a DTC strategy, owing to their narrower product assortments and their limited brand differentiation to date.

While the drive towards DTC will demand fundamental changes in the industry’s distribution model, the shift offers a wide range of advantages for both consumers and brands. For consumers, a direct relationship increases the sense of brand trust and enables direct interaction with service staff who have deep, rather than broad, product expertise. For brands, DTC sales enable greater control of the customer experience and brand image through consistent messaging, while generating higher margins by cutting out intermediaries.

At the same time, the model gives brands access to a wealth of data which can be used to create more personalised, time-sensitive and connected customer journeys across multiple channels — both online and off — with brands able to react speedily to changing preferences and needs. Zenith is one such company that has focused its strategy on creating an engaging online experience and seamless customer journey: through these efforts, the company made half of its sales though DTC channels in 2020. But not all watchmakers are ready or willing to move away from multi-brand distribution channels.

“When we launch a product, I give all my [communications] assets to [UK-based multi-brand retailer] Watches of Switzerland too. Ultimately, I don’t care who sells the watch,” says Georges Kern, chief executive of Breitling. “Yes, direct e-commerce is great because the margin is much higher and it’s great for cash flow because you get the payments immediately and you also get the consumer data. But we are not at that stage yet. We can’t channel 100 percent of our custom through our own channels.”

Online will be the fastest-growing DTC channel, rapidly expanding from just 5 percent of DTC sales in 2019 to 15 to 20 percent by 2025. However, the shift to DTC will be as much about physical retail as digital, where in-store brand experiences will continue to play a fundamental role in cementing the customer-brand relationship. Some 90 percent of Chinese consumers say that brands’ stores are one of the most important factors influencing their purchase, compared to 45 percent who cite e-commerce, according to a survey by McKinsey & Company.

However, the comparatively slow uptake of DTC sales by watchmakers to date has left the field open for new digital entrants. While brands hesitated, third-party platforms and those operating in the grey market have picked up the slack by offering consumers some of the elements they lack in the traditional retail model: online pure play platforms — which accounted for roughly 5 percent of the market for all value segments from premium to ultra-luxury in 2020 — offer an increasingly convenient and safe way to buy online, while grey market sites and retailers (accounting for around 4 percent) are able to offer greater price transparency.

The industry will witness several lasting impacts of these changing dynamics. Fundamentally, the switch to DTC will cause a shakeup of multi-brand independent retailers, with up to a third facing closure or consolidation as they struggle to offer brands a distinct value proposition or make the investments required to set up powerful online platforms. Meanwhile, mid-market brands will face additional pressure to redefine themselves as lower foot traffic in some multi-brand retailers renders it increasingly difficult to retain customer visibility and engagement. They will also find it more challenging to set up their own DTC channels, owing to less-compelling store economics and lower brand recognition.

ADVERTISEMENT

Lastly, DTC-native brands will win market share as lower barriers to entry will enable smaller brands to talk directly to consumers and establish a distinct point of view. “We are much closer to [our customers] than most of the watch brands in the world. We’re able to have a relationship from day one, even before the purchase,” says DTC watch brand Christopher Ward’s chief executive and co-founder Mike France. The British brand has an online forum set up by Christopher Ward fans that the company leverages for research and to help make design decisions. “That’s one of the great advantages of being an online business,” he says.

Given these changes, how should brand decision-makers move forward? The bottom line is that they need to commit more firmly to developing DTC — leveraging both physical and digital to foster closer customer relationships. In making this happen, they also have an opportunity to take more control of the stories they tell, adjusting to individual customer preferences.

However, maximising the potential of DTC will not come easy for most brands, who will need to adopt radically new ways of working. “DTC will be a challenge for a lot of companies,” said Thomas Baillot, founder and chief executive of B2B watch database Watch Distributor Directory. “They are not store operators and, perhaps more importantly, they have not historically been consumer-facing, and so need a very different set of skills to manage those direct conversations.”

Brands will need to overcome three challenges:

The first challenge is to find the right balance across channels. Winners will find the right mix of both DTC and wholesale channels and will create an engaging and coherent customer experience across them. However, building a seamless omnichannel DTC offering can demand high investment costs, with stores alone generating overheads of as much as $3 to $4 million a year in prime real estate locations. Additionally, it may be difficult for brands to develop a DTC offering addressing all geographies or customer segments, and they will therefore need to be clear-eyed in strategically identifying areas where DTC will make the most economic sense.

An omnichannel presence has inherent complexities, too, such as maintaining consistency in prices and product availability. Decision-makers should therefore establish a clear channel strategy and risk assessment. Where a DTC strategy for particular geographies or customer segments does not make sense for a brand to pursue on its own, there may be opportunities to share risk with retailers or online platforms, as can be seen in the growing number of mono-brand stores opened in partnership with independent retailers.

Secondly, watch brands will need to define engaging store concepts. Given the mono-product nature of watch stores, their low foot traffic and the technical nature of the product that demands highly trained staff, the experience can be underwhelming if brands do not give consumers a distinct reason to visit. Decision-makers must therefore develop stores as a space for a holistic brand experience using both creativity and technology. This may mean highlighting the brand’s heritage or creating experiences that capture vital brand characteristics. For example, Audemars Piguet has launched a series of global “AP Houses,” which are concept stores designed to look more like a five-star hotel lounge or a private salon than a retail space, which offer an immersive brand experience in which customers are engaged in cultural events such as musical performances and masterclasses. In 2020, the company made 72 percent of its sales through DTC channels.

Lastly, translating the tactile experience of trying on a product in-store before buying, on which watch sales have depended for so many years, to the more sterile online environment will present challenges. Business leaders should focus on integrating human interactions at every stage of the customer journey — from considering a possible purchase, to buying and shipment. Online represents a unique opportunity for brands to connect with customers anytime, anywhere and expand their global audience. At the same time, they will need to develop the right technical and human capabilities to ensure the consumer journey remains seamless across channels. Deploying e-commerce infrastructure will entail executional challenges, including logistics, customer relationship management and data use, which itself will require significant investment in advanced analytics and artificial intelligence to get ahead.

ADVERTISEMENT

As brand strategies evolve, multi-brand retailers must also adapt, adjusting their gatekeeper mentality to one of participation in a broader ecosystem. Those that already have an established footprint and market recognition in a given region could opt to consolidate to benefit from economies of scale. Alternatively, they could double down on customer insights and specific brand expertise, offering their retail know-how to brands as a strong value proposition, for example by opening mono-brand stores in partnership with brands. Finally, they might specialise, deepening access to a niche consumer group or demographic. Regardless of which route they choose, multi-brand retailers will also need to develop digital capabilities in line with watchmakers’ investments in order to provide a value-add across all channels and to stay relevant.

Over the next five years, the push for DTC will reshape the industry’s distribution model and will force all players within it to rethink their role. While there will be winners and losers in the DTC shakeup, the outcome will be a better understanding of customers for both brands and retailers and ultimately a more rewarding experience for consumers.

The inaugural edition of The State of Fashion: Watches and Jewellery report co-published by The Business of Fashion and McKinsey & Company forecasts a shake-up in priorities for hard luxury as well as different recovery scenarios across geographies and consumer segments. To learn more and download a copy of the report, click here.

BoF Professionals are invited to join us on July 13, 2021 for a special live event in which we'll unpack findings from the report. Register now to reserve your spot. If you are not a member, you can take advantage of our 30-day trial to experience all of the benefits of a BoF Professional membership.

Explore the six seismic shifts from the report:

The Future of Watches:

The Future of Jewellery:

Click here to explore more from this special edition report, including executive interviews.

The LVMH-linked firm is betting its $545 million stake in the Italian shoemaker will yield the double-digit returns private equity typically seeks.

The Coach owner’s results will provide another opportunity to stick up for its acquisition of rival Capri. And the Met Gala will do its best to ignore the TikTok ban and labour strife at Conde Nast.

The former CFDA president sat down with BoF founder and editor-in-chief Imran Amed to discuss his remarkable life and career and how big business has changed the fashion industry.

Luxury brands need a broader pricing architecture that delivers meaningful value for all customers, writes Imran Amed.