The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Gorpcore may not be the coolest trend anymore, but the market for premium hiking shoes and water-proof jackets continues to grow, and investors see an opportunity to cash in on the boom.

On Wednesday, Arc’teryx- and Salomon-owner Amer Sports filed for a US IPO that could value the Finnish group at as much as $10 billion, according to a Bloomberg report citing sources familiar with the matter.

The valuation would be more than double the company’s 2018 price tag when it was acquired by a consortium of buyers led by Anta Sports, China’s largest sportswear company, that also includes Chinese tech giant Tencent, private equity firm Fountain Vest Partners and Lululemon founder Chip Wilson.

The IPO will help fund the ambitious growth plans that Amer has set for its three largest brands — Salomon, Arc’teryx and tennis equipment company Wilson — to reach €1 billion ($1.1 billion) in annual sales each, and for Amer Sports to generate €5 billion ($5.5 billion) in total revenue, up from €3.4 billion in 2022.

ADVERTISEMENT

Anta hasn’t specified a timeframe for meeting this goal, but said in its half-year earnings report in August that the group was making “steady progress.” For now, the group has seen persistent, and rapid growth: In the six months ending June 30, Amer Sports’ revenue grew to RMB 13.27 billion ($1.8 billion), up 37.2 percent from the same period in 2022, while EBITDA, a measure of profitability, increased by 149 percent to RMB 1.78 billion ($240 million).

Arc’teryx and Salomon have benefited from the post-pandemic obsession with outdoor gear like shell jackets, technical trousers and trail and hiking sneakers — in other words, gorpcore. But their growth plans aren’t tied to the continuation of that trend. Key strategies include scaling e-commerce for each of the brands, cutting back on wholesale and boosting sales in China. Success will also be rooted in maintaining a balance of offering new, fashion-forward products without compromising on the performance-driven staples true to each of the three brands’ DNA.

Meanwhile, Wilson is in the early days of a radical transformation from a manufacturer of sports equipment like tennis rackets and basketballs to a full-fledged fashion brand, a shift that so far has comprised the launch of activewear (including a pickleball collection), retail expansion and, following in the footsteps of Arc’teryx and Salomon, buzzy collaborations with the likes of Louis Vuitton, Kith, and Canadian rapper Drake’s label, OVO.

Anta will likely see a lucrative exit with Amer’s imminent IPO. Whether the company will one day reach the scale of Nike or Adidas, however, lies in its ability to remain relevant and coveted regardless of trend cycles.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

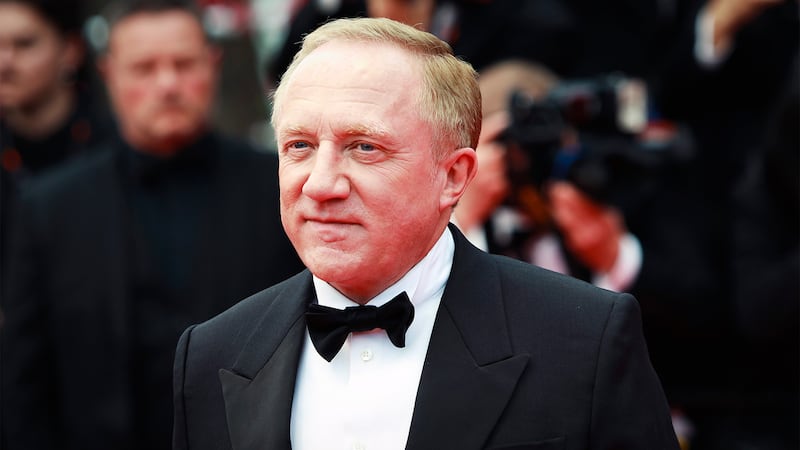

Pinault buys majority stake in talent agency CAA. Pinault family holding company Artémis is acquiring private equity firm TPG’s stake in the Hollywood talent giant in a deal that values the business at $7 billion.

LVMH’s Thelios acquires French eyewear brand Vuarnet. The deal with owner-NEO Investment Partners is the first brand acquisition for Thelios, which designs, produces and distributes sunglasses and optical frames for brands such as Dior, Fendi and Givenchy. Neither company disclosed financial details about the deal.

ADVERTISEMENT

Audemars Piguet CEO expects to exit watchmaker with record sales. Annual sales at the company could climb by a double-digit percentage to 2.4 billion francs ($2.7 billion) this year, outpacing the industry, outgoing chief executive officer Francois-Henry Bennahmias said.

Tod’s operating profit more than tripled in first-half. Sales at the company grew 23 percent in the first six months of the year, driven by a strong performance in Greater China, as shown by preliminary data published in July.

LVMH-backed luxury watch site Hodinkee cuts a fifth of jobs. The company has eliminated about two dozen positions, according to people familiar with the matter. Hodinkee confirmed it’s reducing staff in operations, technology and photography as part of its 2021 acquisition of pre-owned watch seller Crown & Caliber.

Consortium Brand Partners acquires 70 percent majority stake in Draper James. Reese Witherspoon, the brand’s founder, will retain her minority stake in the brand, as well as a board seat and position as partner. Draper James chief executive Erin Moennich, CFO and COO Sarah Foley and head of design Kathryn Sukey will also remain in their respective positions.

Europe luxury stocks slide after Richemont chairman says inflation is denting demand. Richemont, the Swiss owner of Cartier and watchmakers including IWC and Vacheron Constantin, dropped 5.2 percent, and Moncler SpA declined 5 percent. Swatch Group AG, Gucci owner Kering SA and Birkin bag maker Hermès International also slid.

Forever 21 launches a Barneys collection. Forever 21 recently released similar tie-ups with Reebok and Juicy Couture, two brands also under the Authentic Brands Group umbrella. The 32-piece collection is designed to be unisex and includes monochromatic basics such as leggings, blazers and denim, priced between $30 and $130.

New EU sustainability reporting rules are a challenge, says Puma. Companies will have to comply with the directive — which requires them to analyse environmental risks, set targets, and get sustainability reports externally audited — in the 2024 financial year for reports published in 2025.

Director purchases fuel surge in watches of Switzerland shares. Chief financial officer Anders Romberg, chairman Ian Carter and non-executive directors Tea Colaianni and Robert Moorhead spent an aggregate of about £890,000 ($1.1 million) buying more than 150,000 shares on Friday, filings to the London Stock Exchange showed on Monday.

ADVERTISEMENT

Diamond prices are in free fall in one key corner of the market. One of the world’s most popular types of rough diamonds has plunged into a pricing free fall, as an increasing number of Americans choose engagement rings made from lab-grown stones instead.

Major Helmut Newton exhibition to open in Spain. Titled “Fact & Fiction,” the exhibition will explore the life of the late photographer, best known for provocative fashion imagery and sexually charged portraits that earned him the moniker “The King of Kink.”

THE BUSINESS OF BEAUTY

Richemont creates a new beauty division, doubling down on high-end fragrance. The department will be headed up by division chief executive officer Boet Brinkgreve, formerly president of ingredients division and group procurement at fragrance manufacturer DSM-Firmenich.

L Catterton takes a minority stake in Swedish hair care brand Maria Nila. The partnership will help Maria Nila expand its suite of products and global reach, while bolstering L Catterton’s position in the beauty sector. Marcus Wikström, son of Maria Nila founders Ann and Ulf Wikström, will continue to lead the label as chief executive.

L’Occitane halted trading in Hong Kong and shares shed 30 percent after owner shelved a private deal. The company halted trading in Hong Kong ahead of the private deal announcement. L’Occitane’s stock slid to HK$19.70 in early trading after chairman Reinold Geiger’s investment holding company, L’Occitane Groupe SA, decided not to go ahead with a take-private offer it last month said would be worth no less than HK$26.00 a share.

PEOPLE

Prada names new chief people officer Rosa Santamaria, completing executive recast. The executive joins a Prada C-suite that has been almost completely overhauled: Last year, the company named a new group chief executive officer (former Luxottica chief Andrea Guerra) and a brand-level CEO for its flagship label (Gianfranco D’Attis, hired from Dior), as the company’s founding family seeks to ease the transition to its next generation.

H&M taps Heron Preston as creative menswear advisor. The New York-based designer will create his own collection for the retailer, launching in 2024. As part of his long-term role, Preston will also consult on the brand’s overall menswear assortment.

Under Armour appoints John Varvatos chief design officer. The fashion veteran will be charged with overseeing the company’s design direction and blending “performance and style” in its apparel, footwear and accessories.

Aura Blockchain Consortium names new CEO. Romain Carrere, a tech entrepreneur whose background includes advising web3 start-ups and luxury companies, is tasked with driving the group’s “new phase of growth.”

Mansur Gavriel names former Thakoon executive Maria Borromeo CEO. Borromeo, who was a founding member of the apparel brand Thakoon and later served as president of Hudson Jeans, has been at the helm of the brand since May. She replaces Isabelle Fevrier, who was named CEO when the brand sold a majority stake to private equity firm GF Capital Management & Advisors in 2019.

MEDIA AND TECHNOLOGY

Inditex’s Zara to launch its secondhand platform in France. The service, which will be available through Zara’s stores, its website and a mobile app, already exists for its British customers since last October. The company aims to extend the life of the customers’ clothes and contribute to the reduction of waste and the consumption of new raw materials, it said in a statement.

Compiled by Sarah Elson.

The British musician will collaborate with the Swiss brand on a collection of training apparel, and will serve as the face of their first collection to be released in August.

Designer brands including Gucci and Anya Hindmarch have been left millions of pounds out of pocket and some customers will not get refunds after the online fashion site collapsed owing more than £210m last month.

Antitrust enforcers said Tapestry’s acquisition of Capri would raise prices on handbags and accessories in the affordable luxury sector, harming consumers.

As a push to maximise sales of its popular Samba model starts to weigh on its desirability, the German sportswear giant is betting on other retro sneaker styles to tap surging demand for the 1980s ‘Terrace’ look. But fashion cycles come and go, cautions Andrea Felsted.